How Do I Apply for a Resident Insurance License Form

Understanding the Resident Insurance License Application

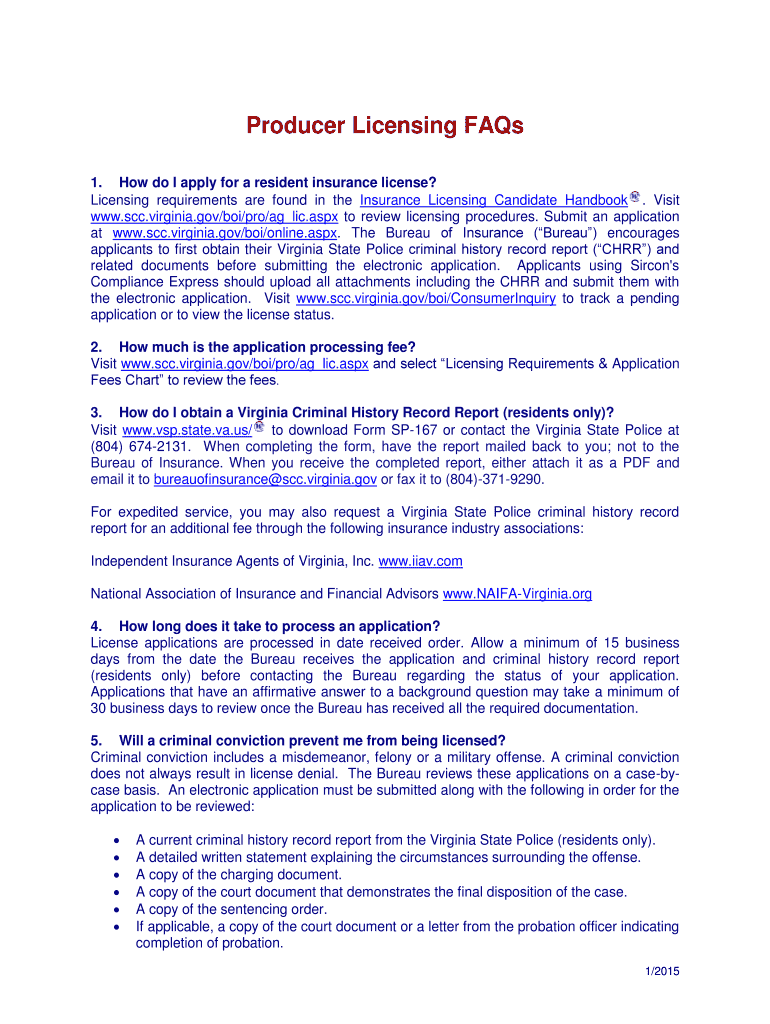

The resident insurance license is a certification that allows individuals to sell insurance products in their state of residence. This license is crucial for anyone looking to pursue a career in insurance sales, as it ensures that agents are knowledgeable about state regulations and insurance policies. To apply for this license, applicants must meet specific eligibility criteria, including age, residency, and background checks. The process typically involves completing pre-licensing education, passing a state examination, and submitting an application to the appropriate regulatory body.

Eligibility Requirements for the Resident Insurance License

To qualify for a resident insurance license, applicants must meet several key criteria, which may vary slightly by state. Generally, the following requirements apply:

- Be at least eighteen years old.

- Be a resident of the state where the application is submitted.

- Complete any required pre-licensing education courses.

- Pass the state licensing examination.

- Submit fingerprints for a background check.

It is essential to verify specific state requirements, as some states may have additional criteria or exemptions.

Steps to Apply for a Resident Insurance License

The application process for a resident insurance license typically involves several steps:

- Complete Pre-Licensing Education: Most states require candidates to complete a specified number of hours in pre-licensing education. This education covers essential topics, including state laws, insurance policies, and ethics.

- Pass the State Examination: After completing the education requirement, candidates must pass a state-administered exam that tests their knowledge of insurance concepts and regulations.

- Submit an Application: Candidates must fill out and submit an application to the state insurance department, along with any required fees.

- Background Check: Applicants typically need to undergo a background check, which may include fingerprinting.

- Receive License: Once the application is approved, the state will issue the resident insurance license, allowing the individual to sell insurance products.

Required Documents for the Application

When applying for a resident insurance license, applicants should prepare the following documents:

- Proof of completed pre-licensing education.

- Examination results from the state licensing exam.

- A completed application form, which can usually be obtained from the state insurance department's website.

- Payment for application fees.

- Fingerprint submission for the background check.

Having these documents ready can help streamline the application process and ensure compliance with state requirements.

Form Submission Methods for the Resident Insurance License

Applicants can submit their resident insurance license applications through various methods, depending on state regulations:

- Online Submission: Many states offer an online portal for submitting applications, which can expedite the process.

- Mail Submission: Applicants may also have the option to send their applications via postal mail. This method may take longer due to processing times.

- In-Person Submission: Some states allow applicants to submit their applications in person at designated offices, which may provide immediate feedback on the application status.

It is advisable to check the specific submission methods available in your state to choose the most convenient option.

Quick guide on how to complete how do i apply for a resident insurance license

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

The Easiest Way to Edit and Electronically Sign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure superior communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to How Do I Apply For A Resident Insurance License

Create this form in 5 minutes!

How to create an eSignature for the how do i apply for a resident insurance license

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Which insurance license is the hardest?

Each insurance licensing exam presents its own challenge. Between Life and Health, students say that the Health insurance exam is the more difficult. Health insurance policies are simply more complicated than life insurance policies. The Property insurance exam is easier than the Casualty insurance exam.

-

Is it easy to make money as an insurance agent?

Successful life insurance agents can make very high incomes. It's not unusual for the successful ones to make $1000000 or more per year. What you probably haven't been told yet is that about 80% of agents fail during the first few years and about 80% of the remaining group don't make much money at all.

-

What type of insurance is most profitable?

Life insurance is the most profitable—and the hardest—type of insurance to sell.

-

What is the best type of insurance license to have?

Property & Casualty is the best license to start with and to get your foot in the door with an insurance carrier. Life, Accident and Health or Commercial is where the real money is at though.

-

What is the best insurance license to have?

Property & Casualty is the best license to start with and to get your foot in the door with an insurance carrier. Life, Accident and Health or Commercial is where the real money is at though.

-

Which insurance license makes the most money?

While there are many kinds of insurance (ranging from auto insurance to health insurance), the most lucrative career in the insurance field is for those selling life insurance.

-

How much does it cost to become an insurance agent in Ontario?

The fee to apply for a new general licence is $150. This fee will cover the first two years of your licence. Depending on the arrangement you have with your sponsoring insurer, the insurer may pay the fee OR you may be responsible for paying this fee.

-

How do I get my level 1 insurance license in Alberta?

General Insurance General Level 1 licence applicants must: Complete a General Licensing Qualification Program (GLQP) course from an approved educator. Pass a General Level 1 exam or complete an approved course equivalency within 12 months before applying.

Get more for How Do I Apply For A Resident Insurance License

- Notice of pay ratedepartment of labor new york state form

- Form c 159 bwc 159 download printable pdf or fill

- Injured worker information

- Reference release authorization post employment form

- Request to addchange or terminate permanent ohio bwc form

- Oklahoma new hire reporting form please fill out c

- Business consumer services and housing agency gavin form

- Oklahoma employment security commission form oes 3 fillable

Find out other How Do I Apply For A Resident Insurance License

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien