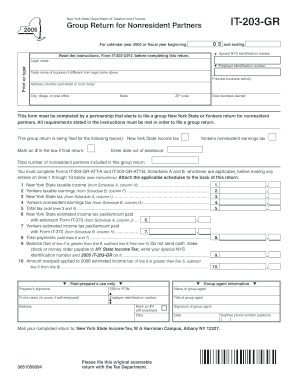

This Form Must Be Completed by a Partnership that Elects to File a Group New York State or Yonkers Return for Nonresident Partne

What is the form for nonresident partners' tax in New York?

This form must be completed by a partnership that elects to file a group New York State or Yonkers return for nonresident partners. It is specifically designed for partnerships that have nonresident partners and need to report income earned within New York State or Yonkers. The form facilitates the proper calculation of tax obligations for nonresident partners based on their share of income from the partnership, ensuring compliance with state tax regulations.

Steps to complete the nonresident partners' tax form

Completing the form involves several key steps. First, gather all necessary financial documentation related to the partnership's income and the individual contributions of each nonresident partner. Next, accurately fill out the form by providing details such as the partnership's name, address, and identification number, along with the specific income amounts allocated to each nonresident partner. Ensure that all calculations are correct to avoid discrepancies. Finally, review the completed form for accuracy before submission.

Eligibility criteria for filing the nonresident partners' tax form

To be eligible to file this form, the partnership must consist of partners who are not residents of New York State or Yonkers but have income sourced from these areas. The partnership must have made the election to file a group return, which allows for the aggregation of income and tax responsibilities for all nonresident partners. It is essential to confirm that the partnership meets all state requirements before proceeding with the filing.

Required documents for the nonresident partners' tax form

When preparing to file the form, several documents are necessary to ensure compliance and accuracy. These include the partnership's federal tax return, individual income statements for each nonresident partner, and any supporting documentation that outlines the income earned within New York State or Yonkers. Additionally, any previous correspondence with the New York State Department of Taxation and Finance regarding the partnership's tax status may be useful.

Filing deadlines for the nonresident partners' tax form

It is crucial to adhere to the filing deadlines set by the New York State Department of Taxation and Finance. Typically, the form must be submitted by the fifteenth day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is usually March 15. Late submissions may incur penalties, so timely filing is essential.

Form submission methods for the nonresident partners' tax form

The completed form can be submitted through various methods. Partnerships have the option to file electronically, which is often the most efficient way to ensure timely processing. Alternatively, the form can be mailed to the appropriate address designated by the New York State Department of Taxation and Finance. In-person submissions may also be possible at designated offices, though this option may vary based on location and current regulations.

Quick guide on how to complete this form must be completed by a partnership that elects to file a group new york state or yonkers return for nonresident

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to This Form Must Be Completed By A Partnership That Elects To File A Group New York State Or Yonkers Return For Nonresident Partne

Create this form in 5 minutes!

How to create an eSignature for the this form must be completed by a partnership that elects to file a group new york state or yonkers return for nonresident

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 201 NYS tax form?

Enhanced paper filing with a fill-in form Electronic filing is the fastest, safest way to file—but if you must file a paper Resident Income Tax Return, use our enhanced fill-in Form IT-201 with 2D barcodes. Benefits include: no more handwriting—type your entries directly into our form.

-

Do I need to file a NY partnership return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

-

Do I need to fill out it-203 A?

Specific instructions If you carried on more than one business for which an allocation is required, prepare a separate Form IT-203-A for each business. two or three Forms IT-203-A if you carry on business between both zones, in and out of Zone 1 or Zone 2, and in and out of New York State.

-

What is IT203C?

(8/15) Purpose of form. Married nonresidents and part-year residents who are required to file a joint New York State return must use the combined income of both spouses to determine the base tax subject to the income percentage allocation, even if only one spouse has New York source income.

-

What is an IT-203 B form?

ProWeb: New York Form IT-203-B Nonresident and Part-Year Resident Income Allocation. New York Form IT-203-B is used to allocate income to the state during the period of the taxpayer's (and spouse's) period of nonresidency and to indicate where in the state the taxpayer and/or spouse maintained living quarters, if any.

-

Do I have to file a NY state tax return for nonresident?

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

-

What is the difference between NYS IT 201 and 203?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

-

Is it-203 or 201 for NY state tax return?

New York State Modifications. If filed before the due date, will allow a taxpayer an automatic extension of six months to file Form IT-201, Resident Income Tax Return, or Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

Get more for This Form Must Be Completed By A Partnership That Elects To File A Group New York State Or Yonkers Return For Nonresident Partne

Find out other This Form Must Be Completed By A Partnership That Elects To File A Group New York State Or Yonkers Return For Nonresident Partne

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed