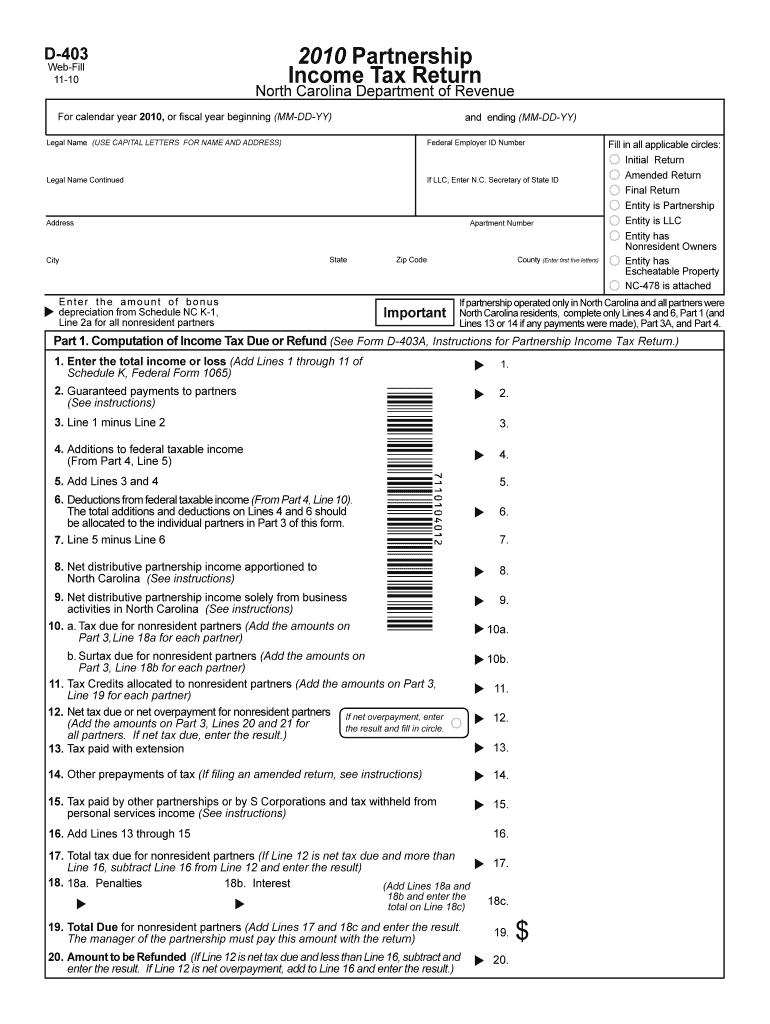

Computation of Income Tax Due or Refund See Form D 403A, Instructions for

What is the Computation of Income Tax Due or Refund See Form D 403A

The Computation of Income Tax Due or Refund, as detailed in Form D 403A, is a crucial document for taxpayers in the United States. This form is designed to help individuals accurately calculate their income tax obligations or determine if they are eligible for a refund. It provides a structured approach to reporting income, deductions, and credits, ensuring compliance with federal tax regulations. Understanding this form is essential for anyone looking to manage their tax responsibilities effectively.

Steps to Complete the Computation of Income Tax Due or Refund See Form D 403A

Completing Form D 403A involves several important steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions or credits. Next, fill out the personal information section accurately, ensuring that names and Social Security numbers are correct. Then, proceed to report all sources of income, followed by applicable deductions. After calculating the total tax due or refund, review the form for accuracy before submission. This thorough process helps prevent errors that could lead to delays or penalties.

Key Elements of the Computation of Income Tax Due or Refund See Form D 403A

Form D 403A includes several key elements that are vital for accurate tax computation. These elements consist of personal identification information, income sources, allowable deductions, and tax credits. Additionally, the form outlines specific calculations for determining the total tax liability or refund due. Understanding these components enables taxpayers to navigate the form efficiently and ensures that all relevant financial information is considered in the tax computation process.

Required Documents for the Computation of Income Tax Due or Refund See Form D 403A

To complete Form D 403A accurately, certain documents are required. Taxpayers should have their W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any other income sources. Additionally, records of deductible expenses, such as mortgage interest, medical expenses, and charitable contributions, should be collected. Having these documents on hand facilitates a smoother completion of the form and helps ensure that all income and deductions are reported correctly.

Filing Deadlines for the Computation of Income Tax Due or Refund See Form D 403A

Filing deadlines for Form D 403A are critical to avoid penalties and interest. Typically, individual tax returns are due on April 15 each year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It is advisable to check for any specific state deadlines that may apply. Timely submission of the form ensures that taxpayers can meet their obligations and potentially receive any refunds they are owed without unnecessary delays.

IRS Guidelines for the Computation of Income Tax Due or Refund See Form D 403A

The IRS provides specific guidelines that govern the completion and submission of Form D 403A. These guidelines include instructions on how to report income, claim deductions, and calculate taxes owed or refunds due. It is important for taxpayers to familiarize themselves with these guidelines to ensure compliance and avoid common mistakes. The IRS also offers resources and assistance for individuals who may have questions about the form or their tax situation.

Quick guide on how to complete computation of income tax due or refund see form d 403a instructions for

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize key sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to finalize your modifications.

- Select your preferred method of sending your form, whether via email, SMS, invitation link, or by downloading it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate new printed document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Computation Of Income Tax Due Or Refund See Form D 403A, Instructions For

Create this form in 5 minutes!

How to create an eSignature for the computation of income tax due or refund see form d 403a instructions for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax form given to me by my employer each tax year to show my earnings and taxes withheld?

The Form W-2 contains all wages and tax information for an employee regardless of the number of state agencies/campuses for which he or she worked during the tax year.

-

Does North Carolina require partnership extension?

For Partnership/Fiduciary Businesses operating (as Partnership/fiduciary) in North Carolina need to file Form D-410P with the state to obtain a 6-month extension of time to file their business income tax return with the state.

-

Who needs to file a partnership tax return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. ... Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

-

Who needs to file a North Carolina tax return?

A Return is Required if Federal Gross Income Exceeds: Single, $12,750. Married Filing Jointly, $25,500. Married Filing Separately (if spouse does not itemize), $12,750. Married Filing Separately (if spouse claims itemized deductions), $0.

-

Do you have to register a partnership in North Carolina?

How to start a General Partnership in North Carolina. You don't have to file any formation paperwork with the state to start a General Partnership. Only formal business structures (like LLCs or Corporations) have to file formation documents with the state.

-

Who must file a North Carolina partnership tax return?

Who must file Form D-403. - Every partnership doing business in North Carolina must file a partnership income tax return, Form D-403, for the taxable year if a federal partnership return was required to be filed.

-

What is the penalty under section 234F of Income Tax Act?

Under Section 234F of the Income Tax Act, taxpayers are required to pay a penalty for late filing of their income tax returns (ITR). Simply put, if you miss the current year's deadline, you could face a penalty of up to Rs. 5,000. Previously, the Assessing Officer had discretion in determining the penalty amount.

-

What is the federal income tax form that is to be filled out and submitted to the IRS?

Form 1040. Annual income tax return filed by citizens or residents of the United States.

Get more for Computation Of Income Tax Due Or Refund See Form D 403A, Instructions For

- Blank eob form

- How to document a ct scan form

- Guardian research comprovider interest formprovider interest form guardian research

- Electronic claims payment for providers form

- When youre extra sensitive to sunlight what you need to know form

- Piedmont psychiatric clinic parents form

- Cgr form for dtc docx

- Contact us higher education insurance program form

Find out other Computation Of Income Tax Due Or Refund See Form D 403A, Instructions For

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free