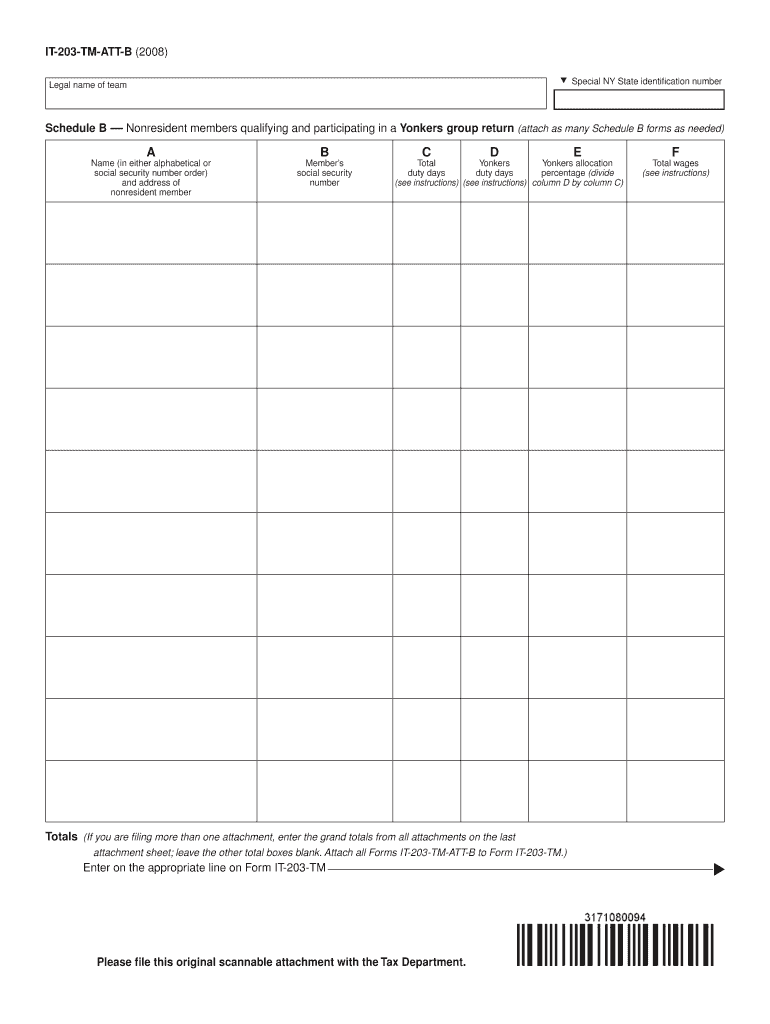

Special NY State Identification Number Legal Name of Team Schedule B Nonresident Members Qualifying and Participating in a Yonke Form

Understanding the Special NY State Identification Number

The Special NY State Identification Number is essential for nonresident members participating in a Yonkers group return. This number helps identify the legal name of the team and is crucial for accurate tax reporting. It ensures compliance with state tax laws and facilitates the proper allocation of tax responsibilities among group members. Each member qualifying for the group return must be listed accurately to avoid any issues with tax filings.

Obtaining the Special NY State Identification Number

To obtain the Special NY State Identification Number, nonresident members must complete the necessary application forms provided by the New York State Department of Taxation and Finance. This process typically involves submitting identification documents and relevant tax information. It is advisable to check for any updates or changes in the application process to ensure compliance with current regulations.

Steps to Complete the Schedule B Form

Filling out the Schedule B form requires careful attention to detail. Start by gathering all necessary information about each member of the team, including their legal names and identification numbers. Next, ensure that each member's participation status is accurately recorded. Attach additional Schedule B forms as needed, labeling them clearly as A, B, C, D, or E, depending on the number of members. Finally, review the completed forms for accuracy before submission.

Legal Use of the Special NY State Identification Number

The Special NY State Identification Number is used legally to ensure that tax obligations are met for nonresident members of a Yonkers group return. This number is crucial for maintaining compliance with state tax laws and avoiding penalties. Misuse or failure to provide accurate information can lead to legal repercussions, including fines or audits by tax authorities.

State-Specific Rules for Nonresident Members

Each state has specific rules regarding the taxation of nonresident members participating in group returns. In New York, it is important to follow the guidelines set forth by the New York State Department of Taxation and Finance. These rules dictate how income is reported, what deductions can be claimed, and the deadlines for filing. Familiarity with these regulations is essential for ensuring proper compliance and avoiding unnecessary complications.

Examples of Using the Special NY State Identification Number

When completing tax filings, the Special NY State Identification Number is used to accurately report income and allocate tax responsibilities among nonresident members. For example, if a team consists of five members, each must have their identification number listed on the Schedule B form. This ensures that each member's income is reported correctly and that they receive the appropriate credits or deductions based on their participation.

Filing Deadlines and Important Dates

Filing deadlines for the Special NY State Identification Number and associated forms are critical for compliance. Typically, the group return must be filed by the due date specified by the New York State Department of Taxation and Finance. It is advisable to mark these dates on your calendar to ensure timely submission and avoid penalties. Additionally, keeping track of any changes in deadlines due to legislative updates is important for accurate compliance.

Quick guide on how to complete special ny state identification number legal name of team schedule b nonresident members qualifying and participating in a

Complete [SKS] effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without wait. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just moments and holds the same legal force as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing out new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the special ny state identification number legal name of team schedule b nonresident members qualifying and participating in a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How many days can I work in New York before paying taxes?

NY state has a threshold of 14days. An employer is required to withhold taxes on all NY state wages paid after the 14th day.

-

Can you settle NYS tax debt?

New York City's Offer-in-Compromise program allows qualifying financially distressed taxpayers to settle their non-property tax debt for less than the full amount owed.

-

Does New York allow composite tax returns?

Such composite return shall consist of a form or forms prescribed by the commissioner and an attachment or attachments of magnetic tape or other approved media. Notwithstanding any provision in this Subchapter to the contrary, a single form and attachment may comprise the returns of more than one such person.

-

What is the 183 day rule in New York State?

Any part of any day spent physically in New York, including days in transit, counts as a day of presence in New York. N.Y.C.R.R. 105.20(c). Because residency is determined in part by day count (183-day rule), generally a part-year resident is a person whose domicile changes to or from New York State during a tax year.

-

Does NYS have a tax forgiveness program?

Does NYS Forgive Tax Debt or Offer Tax Forgiveness? As we mention in our NYS Tax Warrant article, NYS does not do a straight-out forgiveness program. They do have a statute of limitations, which is 20 years as opposed to the IRS' 10 years.

-

Are you a nonresident of New York State?

A Nonresident of New York is an individual that was not domiciled nor maintained a permanent place of abode in New York during the tax year. A Part-Year Resident is an individual that meets the definition of resident or nonresident for only part of the year.

-

How long can NYS collect a tax debt?

New York or the DTF has 20 years to collect tax liabilities. It is 20 years from the date the DTF could file a warrant. While the IRS has ten years to legally collect the taxes, NY State has 20 years.

-

What happens if you owe New York state taxes?

If you have unpaid taxes in New York, the DTF can seize your real or personal property. If you are a business taxpayer, the DTF agents can lock your place of business and deny you entry. They can also remove all of your merchandise. The DTF will notify you of the auction time and place if your property has been seized.

Get more for Special NY State Identification Number Legal Name Of Team Schedule B Nonresident Members Qualifying And Participating In A Yonke

- Usc credit union direct deposit authorization form usccreditunion

- Certificate surrender request form foresters financial

- Insperity 401k rollover form

- Beneficiary questionnaire fhlbc pdf form

- Isuzu finance of america form

- Homeownercontractor agreement afrwholesalecom form

- Referencewhat is the difference between a joint owner vs adding a pod designation to a joint accountnolohow to add a new owner form

- Credit card charge authorization form

Find out other Special NY State Identification Number Legal Name Of Team Schedule B Nonresident Members Qualifying And Participating In A Yonke

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form