IDAHO SUPPLEMENTAL SCHEDULE Form

What is the IDAHO SUPPLEMENTAL SCHEDULE

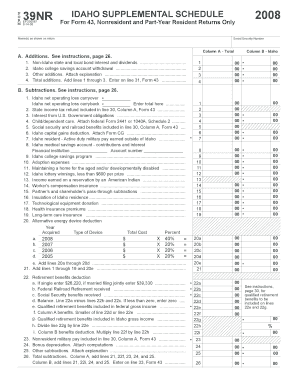

The Idaho Supplemental Schedule is a tax form used by residents of Idaho to report additional income, deductions, and credits that are not included on the standard state tax return. This form is essential for accurately calculating state tax liabilities and ensuring compliance with Idaho tax laws. It is particularly relevant for individuals with specific types of income, such as self-employment income, rental income, or other sources that require detailed reporting.

How to use the IDAHO SUPPLEMENTAL SCHEDULE

To effectively use the Idaho Supplemental Schedule, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering the required information about additional income and applicable deductions. It is crucial to follow the instructions provided with the form to ensure all entries are accurate. Once completed, the schedule should be submitted alongside the main Idaho tax return.

Steps to complete the IDAHO SUPPLEMENTAL SCHEDULE

Completing the Idaho Supplemental Schedule involves several key steps:

- Collect all relevant financial documents, including income statements and receipts for deductions.

- Obtain the latest version of the Idaho Supplemental Schedule from the Idaho State Tax Commission website.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring all additional income and deductions are accurately reported.

- Review the completed schedule for any errors or omissions.

- Submit the schedule with your Idaho tax return by the designated filing deadline.

Key elements of the IDAHO SUPPLEMENTAL SCHEDULE

The Idaho Supplemental Schedule includes several key elements that taxpayers must address:

- Income Reporting: Detailed sections for reporting various types of income, including self-employment and rental income.

- Deductions: Areas to claim deductions that may not be included in the primary tax return.

- Credits: Information on any applicable tax credits that can reduce overall tax liability.

- Signature: A section for the taxpayer's signature, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Idaho Supplemental Schedule. Typically, the deadline for submitting the Idaho tax return, including the Supplemental Schedule, is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply if they require additional time to file.

Required Documents

To complete the Idaho Supplemental Schedule, taxpayers need to gather several important documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of rental income, if applicable.

- Receipts for deductible expenses.

- Any other relevant financial statements that support income and deductions reported.

Quick guide on how to complete idaho supplemental schedule

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents rapidly and without any hassles. Manage [SKS] across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Edit and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent parts of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IDAHO SUPPLEMENTAL SCHEDULE

Create this form in 5 minutes!

How to create an eSignature for the idaho supplemental schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the tax brackets for 2024?

Tax RateFor Single FilersFor Married Individuals Filing Joint Returns 10% $0 to $11,600 $0 to $23,200 12% $11,600 to $47,150 $23,200 to $94,300 22% $47,150 to $100,525 $94,300 to $201,050 24% $100,525 to $191,950 $201,050 to $383,9003 more rows

-

What is the tax on bonuses in Idaho?

Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security.

-

What drugs are Schedule 2 in Idaho?

Examples of schedule II stimulants include: amphetamine (Dexedrine®, Adderall®), methamphetamine (Desoxyn®) and methylphenidate (Ritalin®). Other schedule II substances include: cocaine, amobarbital, glutethimide, and pentobarbital.

-

What is the supplemental tax rate for 2024?

Key takeaways While the federal supplemental tax rate is a flat 22%, states have different approaches, with some imposing specific rates, others applying regular income tax rates, and some having no provisions for supplemental wages at all.

-

What is the IRS supplemental tax rate?

If your supplemental wages are identified separately from your salary (as a bonus, for example), your employer must withhold taxes using one of the following two methods: Withhold at the supplemental rate of 22 percent.

-

How much do bonuses get taxed in Idaho?

Your bonus will be taxed the same as your regular pay, including income taxes, Medicare, and Social Security.

-

What is a supplemental levy in Idaho?

The Supplemental Levy is a renewable, voter-approved levy that generates funds Idaho school districts can use to maintain their local operating costs. For the 2023-2024 school year, the Supplemental Levy funded approximately 7 percent of PCSD 25's operating costs.

-

What is the supplemental tax rate in Idaho 2024?

Supplemental Wage Tax Rate Lowered Retroactive to January 1, 2024, the supplemental wage tax rate has been reduced to 5.695% from 5.8%.

Get more for IDAHO SUPPLEMENTAL SCHEDULE

- Articles of revival form

- Request for copy of record b150 form

- Notice of business closure docx form

- Sba small business subcontracting plan form

- Virginia application permit form

- Herd share agreement elimspringsfarm form

- Application for a certificate of cancellation to cancel form

- Jack fonts order form bows and beaus gifts

Find out other IDAHO SUPPLEMENTAL SCHEDULE

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement