NON RESIDENT AMENDED DELAWARE Division of Revenue Revenue Delaware Form

What is the NON RESIDENT AMENDED DELAWARE Division Of Revenue Revenue Delaware

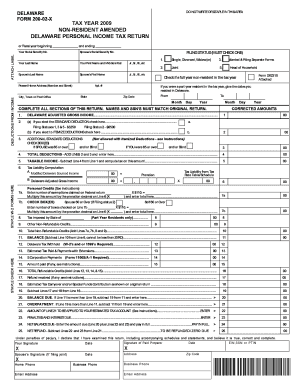

The NON RESIDENT AMENDED DELAWARE form is a tax document specifically designed for non-resident individuals and entities who need to amend their tax filings with the Delaware Division of Revenue. This form allows taxpayers to correct previously submitted information, ensuring compliance with state tax laws. It is essential for maintaining accurate records and fulfilling legal obligations regarding income earned in Delaware.

How to use the NON RESIDENT AMENDED DELAWARE Division Of Revenue Revenue Delaware

To effectively use the NON RESIDENT AMENDED DELAWARE form, taxpayers should first gather all relevant documentation, including previous tax returns and any supporting materials that justify the amendments. The form requires specific details about the changes being made, such as adjustments to income or deductions. After completing the form, it must be submitted to the Delaware Division of Revenue for processing.

Steps to complete the NON RESIDENT AMENDED DELAWARE Division Of Revenue Revenue Delaware

Completing the NON RESIDENT AMENDED DELAWARE form involves several key steps:

- Review the original tax return to identify errors or necessary changes.

- Obtain the NON RESIDENT AMENDED DELAWARE form from the Delaware Division of Revenue website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documents that substantiate the changes.

- Submit the completed form to the appropriate address as indicated in the instructions.

Required Documents

When submitting the NON RESIDENT AMENDED DELAWARE form, certain documents may be required to support the amendments. These can include:

- Copies of the original tax return.

- Documentation for any income adjustments, such as W-2s or 1099s.

- Receipts or records for any deductions claimed.

- Any correspondence from the Delaware Division of Revenue regarding the original filing.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the NON RESIDENT AMENDED DELAWARE form. Generally, amended returns should be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Missing these deadlines may result in penalties or the inability to claim refunds.

Penalties for Non-Compliance

Failure to file the NON RESIDENT AMENDED DELAWARE form when necessary can lead to various penalties. These may include:

- Interest on any unpaid taxes due.

- Fines for late filing or underpayment of taxes.

- Potential legal action for continued non-compliance.

Quick guide on how to complete non resident amended delaware division of revenue revenue delaware

Complete [SKS] effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NON RESIDENT AMENDED DELAWARE Division Of Revenue Revenue Delaware

Create this form in 5 minutes!

How to create an eSignature for the non resident amended delaware division of revenue revenue delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does Delaware have state income tax for retirees?

Delaware income tax Delaware tax on retirement benefits: Delaware does not tax Social Security benefits or Railroad Retirement benefits. Retirees age 60 and older may exclude up to $12,500 of pension or retirement income from a qualified retirement plan in Delaware.

-

What is the filing threshold for non residents in Delaware?

Delaware does not have a filing threshold for nonresidents. A Delaware personal income tax return must be a nonresident if the taxpayer has gross income attributable to state sources. Part-residents that elect to file Delaware personal incomes as a resident are subject to a filing threshold.

-

Who is subject to Delaware gross receipts tax?

Delaware's Gross Receipts Tax is a tax on the total gross revenues of a business, regardless of their source. This tax is levied on the seller of goods or services, rather than on the consumer. Gross receipts tax rates currently range from . 0945% to .

-

What is the purpose of Delaware's real estate tax return declaration of estimated income tax form 5403?

A Delaware licensee's seller clients will complete tax form 5403 as part of the transaction. Why? To receive a tax credit for any loss on the transaction if it qualifies as an investment. To receive a tax rebate for the amount of the real estate agent's commission.

-

Do you have to pay capital gains when you sell your house in Delaware?

It's called a capital gain because the seller is literally gaining more capital for having sold the property than they had when they purchased it. In Delaware, capital gains on real estate investments are considered to be income and therefore subject to taxation at Delaware's capital gains rate.

-

Who is exempt from transfer tax in Delaware?

In general, the following are excluded from the tax: leasehold interests; mortgage foreclosure sales; conveyances between husband and wife; conveyances between parent and child; conveyances to a religious organization; conveyances without consideration; conveyances between a parent corporation and a wholly owned ...

-

How to file an amended Delaware tax return?

Description:Option 1: Sign in to your eFile.com account, modify your Return and download/print the DE PIT-RES (resident) or DE PIT-NON (nonresident) under My Account. Mark the check box "Amended Return" sign the form and mail it to one of the addresses listed below.

-

What is form 5403 Delaware?

Real Estate Tax Return. Declaration of Estimated Income Tax.

Get more for NON RESIDENT AMENDED DELAWARE Division Of Revenue Revenue Delaware

- Fpd009 occupancy certificate springdale springdalear form

- Insurance arkansas govpagesindustry regulationlicensingarkansas insurance department form

- Mortgage pre qualification form pdf 204675411

- City of mulberry edamame festivaldo south magazine form

- Form 8 k granite point mortgage trust inc

- August 7 11 is national farmers market week form

- Application for new shop form

- State of alabama county of bill of sale form

Find out other NON RESIDENT AMENDED DELAWARE Division Of Revenue Revenue Delaware

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement