Form N 884, Rev Credit for Employment of Hawaii Gov 2012

What is the Form N 884, Rev Credit For Employment Of Hawaii gov

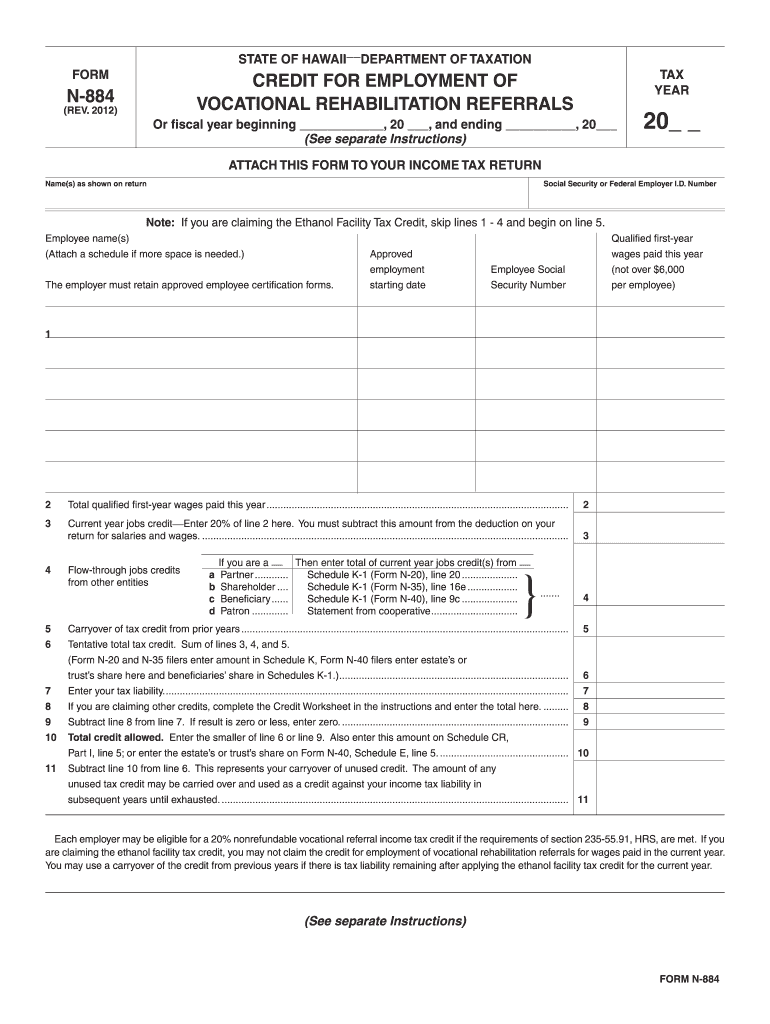

The Form N 884, Rev Credit For Employment Of Hawaii gov is a tax form used by employers in Hawaii to claim a credit for employment. This form allows businesses to report eligible employees and the corresponding credits they can receive, thereby reducing their overall tax liability. It is important for employers to understand the specific requirements and eligibility criteria associated with this form to ensure compliance and maximize potential benefits.

How to use the Form N 884, Rev Credit For Employment Of Hawaii gov

Using the Form N 884 involves several steps. Employers must first gather the necessary information about their employees, including Social Security numbers and employment dates. Once the required information is collected, the form can be filled out online or printed for manual completion. After filling out the form, employers must ensure that all information is accurate before submitting it to the appropriate state authority. This form can be submitted electronically or by mail, depending on the employer's preference.

Steps to complete the Form N 884, Rev Credit For Employment Of Hawaii gov

Completing the Form N 884 requires careful attention to detail. Here are the steps involved:

- Gather employee information, including names, Social Security numbers, and employment dates.

- Access the Form N 884 online or download it for manual completion.

- Fill in the required fields accurately, ensuring that all data is correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail to the designated state office.

Key elements of the Form N 884, Rev Credit For Employment Of Hawaii gov

Key elements of the Form N 884 include the identification of the employer, details of eligible employees, and the calculation of the credit amount. Employers must provide their Employer Identification Number (EIN) and specify the number of employees for whom they are claiming the credit. Additionally, the form requires a declaration of the credit amount being claimed, which is based on the wages paid to eligible employees during the tax year.

Eligibility Criteria

To qualify for the credit claimed on the Form N 884, employers must meet specific eligibility criteria. Generally, the credit is available to businesses that hire eligible employees, which may include those from certain targeted groups or those who meet specific employment requirements. Employers should review the guidelines provided by the Hawaii Department of Taxation to ensure they meet all necessary conditions before submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form N 884 are crucial for compliance. Employers should be aware of the specific dates by which the form must be submitted to avoid penalties. Typically, the form should be filed along with the employer's annual tax return. It is advisable to check the Hawaii Department of Taxation's website for the most current deadlines and any changes that may occur from year to year.

Quick guide on how to complete form n 884 rev 2012 credit for employment of hawaiigov

Your instructional manual on preparing your Form N 884, Rev Credit For Employment Of Hawaii gov

If you’re wondering how to complete and submit your Form N 884, Rev Credit For Employment Of Hawaii gov, here are some quick tips to simplify your tax filing process.

To begin, simply create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is an intuitive and powerful document solution that enables you to edit, draft, and finalize your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to revise any answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form N 884, Rev Credit For Employment Of Hawaii gov in no time:

- Set up your account and begin working on PDFs in just a few minutes.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form N 884, Rev Credit For Employment Of Hawaii gov within our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting paper forms can lead to errors and slow down refunds. Before e-filing your taxes, make sure to check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 884 rev 2012 credit for employment of hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 884 rev 2012 credit for employment of hawaiigov

How to make an electronic signature for the Form N 884 Rev 2012 Credit For Employment Of Hawaiigov in the online mode

How to create an eSignature for your Form N 884 Rev 2012 Credit For Employment Of Hawaiigov in Google Chrome

How to create an eSignature for signing the Form N 884 Rev 2012 Credit For Employment Of Hawaiigov in Gmail

How to make an electronic signature for the Form N 884 Rev 2012 Credit For Employment Of Hawaiigov straight from your smartphone

How to create an eSignature for the Form N 884 Rev 2012 Credit For Employment Of Hawaiigov on iOS devices

How to create an eSignature for the Form N 884 Rev 2012 Credit For Employment Of Hawaiigov on Android

People also ask

-

What is Form N 884, Rev Credit For Employment Of Hawaii gov?

Form N 884, Rev Credit For Employment Of Hawaii gov is a tax form that businesses in Hawaii can use to claim a credit for eligible employees. This form is crucial for employers seeking to maximize their tax benefits related to employee costs. Utilizing airSlate SignNow simplifies the signing and submission process for this important document.

-

How can airSlate SignNow help with Form N 884, Rev Credit For Employment Of Hawaii gov?

With airSlate SignNow, you can easily create, send, and eSign Form N 884, Rev Credit For Employment Of Hawaii gov. The platform provides a streamlined process that ensures your documents are signed quickly and efficiently. This saves time and helps you stay compliant with state requirements.

-

Is there a cost associated with using airSlate SignNow for Form N 884, Rev Credit For Employment Of Hawaii gov?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is typically based on the features you require and the number of users. Investing in SignNow facilitates easy management of forms like Form N 884, Rev Credit For Employment Of Hawaii gov, leading to potential savings in the long run.

-

What features does airSlate SignNow offer that are relevant for Form N 884, Rev Credit For Employment Of Hawaii gov?

airSlate SignNow includes features like customizable templates, team collaboration, and automated reminders, which are beneficial when handling Form N 884, Rev Credit For Employment Of Hawaii gov. These features streamline the process from document preparation to signing and filing, ensuring efficiency and accuracy.

-

Can I integrate airSlate SignNow with other tools when working on Form N 884, Rev Credit For Employment Of Hawaii gov?

Absolutely! airSlate SignNow offers several integrations with popular software tools, making it easy to manage Form N 884, Rev Credit For Employment Of Hawaii gov alongside your existing systems. This interoperability enhances workflow efficiency and ensures seamless document management.

-

How do I get started with airSlate SignNow for Form N 884, Rev Credit For Employment Of Hawaii gov?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account, choose your pricing plan, and start creating or uploading Form N 884, Rev Credit For Employment Of Hawaii gov. The user-friendly interface allows for quick navigation, so you can focus on your business needs.

-

What are the benefits of using airSlate SignNow for tax forms like Form N 884, Rev Credit For Employment Of Hawaii gov?

Using airSlate SignNow for forms like Form N 884, Rev Credit For Employment Of Hawaii gov offers numerous benefits, including enhanced security, faster turnaround times, and reduced paperwork. The electronic signing process ensures that your documents are always accessible and can be processed more swiftly compared to traditional methods.

Get more for Form N 884, Rev Credit For Employment Of Hawaii gov

Find out other Form N 884, Rev Credit For Employment Of Hawaii gov

- Add eSignature Document iOS

- How To Add eSignature Document

- Add eSignature Document iPad

- Remove eSignature PDF Mac

- How Do I Remove eSignature Word

- How To Remove eSignature PDF

- Remove eSignature Word Fast

- Remove eSignature Document Easy

- How Do I Remove eSignature Document

- How Can I Remove eSignature Document

- Can I Remove eSignature PPT

- Certify eSignature Word Online

- Certify eSignature PDF Free

- How Can I Certify eSignature PDF

- How To Certify eSignature Document

- Certify eSignature PPT iPad

- How Do I Validate eSignature Word

- Validate eSignature Document Online

- Validate eSignature Form Online

- Validate eSignature Document Now