Requested Coverages Form

What is the Requested Coverages

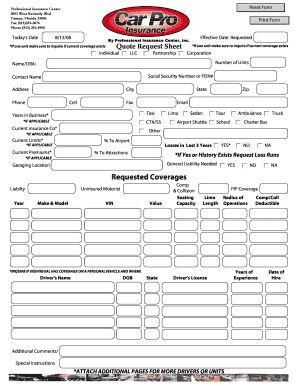

The Requested Coverages form is a document used to specify the types and amounts of insurance coverage a policyholder desires. This form is crucial for ensuring that individuals and businesses receive the appropriate protection tailored to their specific needs. It typically includes various coverage options, such as liability, property, and health insurance, allowing users to select the most relevant options for their circumstances.

How to use the Requested Coverages

To effectively use the Requested Coverages form, begin by reviewing the available coverage options. Carefully assess your needs, considering factors such as the nature of your business or personal circumstances. Fill out the form by indicating your preferences for each type of coverage. Ensure that all information is accurate and complete to avoid delays in processing. Once completed, submit the form to your insurance provider for evaluation.

Steps to complete the Requested Coverages

Completing the Requested Coverages form involves several key steps:

- Review the coverage options listed on the form.

- Identify the types of coverage that are relevant to your situation.

- Fill in your personal or business information accurately.

- Specify the desired coverage limits and any additional options.

- Double-check the form for completeness and accuracy.

- Submit the form to your insurance provider via the preferred method.

Legal use of the Requested Coverages

The Requested Coverages form must be completed in accordance with applicable state and federal regulations. It serves as a legal document that outlines the coverage preferences of the policyholder. Ensuring compliance with these regulations is essential to avoid potential disputes or issues with coverage claims in the future. It is advisable to consult with a legal expert or insurance professional if there are any uncertainties regarding the legal implications of the form.

Key elements of the Requested Coverages

Several key elements are important to understand when working with the Requested Coverages form:

- Coverage Types: Different categories of coverage, such as general liability, property, and workers' compensation.

- Limits: The maximum amount the insurer will pay for a covered loss.

- Exclusions: Specific situations or conditions that are not covered by the insurance policy.

- Premiums: The cost associated with the selected coverage options.

Examples of using the Requested Coverages

Examples of using the Requested Coverages form can vary widely based on individual needs:

- A small business owner may use the form to request liability coverage to protect against potential lawsuits.

- A homeowner might specify coverage for property damage due to natural disasters.

- A freelancer may seek health insurance options to ensure access to medical care.

Quick guide on how to complete requested coverages

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Requested Coverages

Create this form in 5 minutes!

How to create an eSignature for the requested coverages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insurance request?

A request for benefits for a loss made against you or your insurance company.

-

What does a coverage mean in insurance?

Insurance coverage is the amount of risk, liability, or potential loss that is protected by insurance. It helps individuals recover from financial losses as a result of incidents, such as car accidents, damaged property, or unexpected health issues.

-

What is a coverage request?

Posted by admin. This is a required written statement by a potential policyholder, which provides that information that an insurance company relies upon to decide whether to reject or accept the risk of coverage (often an application).

-

What is an insurance request?

A request for benefits for a loss made against you or your insurance company.

-

What are coverages?

Insurance coverage is the amount of risk, liability, or potential loss that is protected by insurance. It helps individuals recover from financial losses as a result of incidents, such as car accidents, damaged property, or unexpected health issues.

-

What is a coverage letter in insurance?

Coverage Letter means the letter and its updated versions attached to these Terms and Conditions setting forth the Plan(s) You have selected, the monthly (or yearly) charge for each Plan, the specific coverages, exclusions and limitations for the Plan(s) you selected, and other important details about the Plan(s). .

-

What do car insurance coverages mean?

Physical Damage Coverage pays the cost of repairs or replacement of your car, minus your deductible. Collision covers damage to your car from an accident with another car or a physical object. Comprehensive covers damage to your car from events other than a collision, such as theft, fire, or vandalism.

-

What is a coverage determination request?

A coverage determination/organization determination is a decision we make about your benefits. This can be a decision about how we cover a drug or how much you pay for the drug. A coverage determination/organization determination is also referred to as an "initial determination".

Get more for Requested Coverages

- Commonspot winter upgrade guide site selection online form

- Download form 67 worksafebc com

- Student personnel data form

- Save pw 2 form print wisconsin nonresident partner member shareholder or beneficiary withholding exemption affidavit clear note

- Application for hearing loss resulting from exposure to long term occupational noise form 4 hearing loss claim application

- Merit badge counselor form golden spread council

- Family fee determination form instructions baby watch early utahbabywatch

- Protocol for an integrated data request from the labs of pathological anatomy for registration of cancer diagnoses and lab form

Find out other Requested Coverages

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter