E595 Web Fill 2018

What is the E595 Web Fill

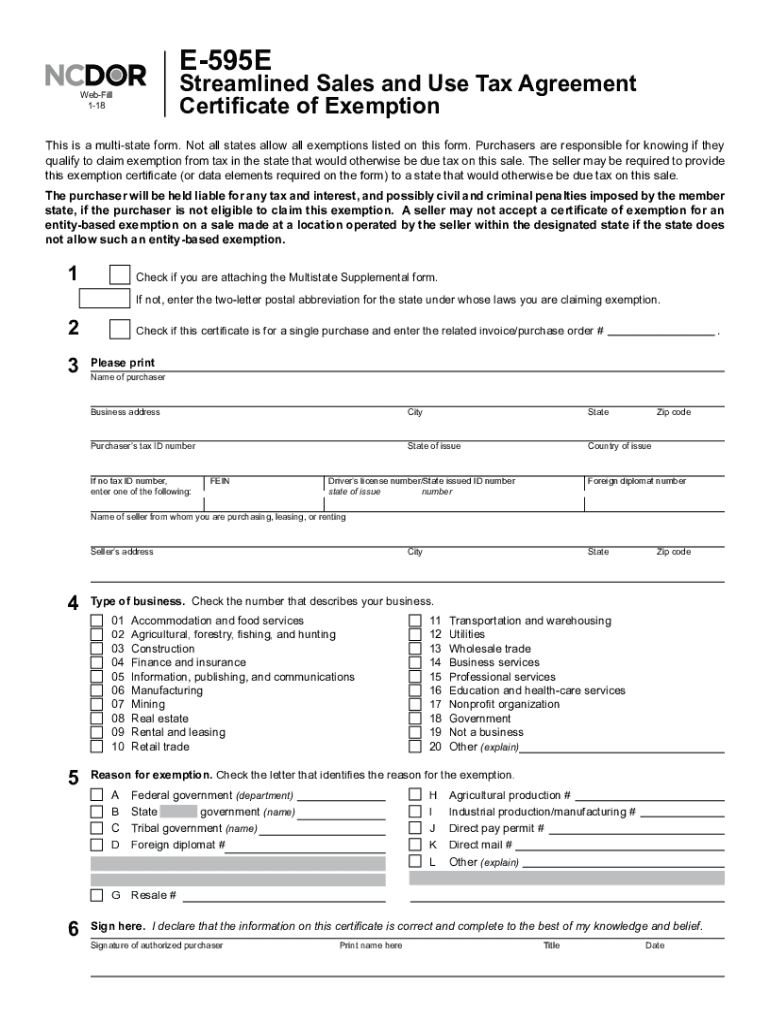

The E595 Web Fill is a digital version of the North Carolina tax exemption certificate, specifically designed for businesses and individuals to claim sales tax exemptions. This form allows users to provide necessary information electronically, streamlining the process of obtaining tax-exempt status for eligible purchases. By utilizing the E595 Web Fill, users can complete and submit the form online, reducing the need for physical paperwork and enhancing efficiency.

How to use the E595 Web Fill

Using the E595 Web Fill is straightforward. First, access the form through a compatible web browser. Once opened, users can fill in the required fields, including details such as the purchaser's name, address, and the nature of the exemption. After completing the form, it can be electronically signed using a secure eSignature solution. This ensures that the submission is legally binding and compliant with state regulations.

Steps to complete the E595 Web Fill

To successfully complete the E595 Web Fill, follow these steps:

- Open the E595 Web Fill form on your device.

- Enter your personal or business information in the designated fields.

- Specify the type of exemption being claimed.

- Review the information for accuracy.

- Sign the form electronically using a trusted eSignature solution.

- Submit the completed form through the online portal.

Legal use of the E595 Web Fill

The E595 Web Fill is legally recognized in North Carolina, provided it is completed and submitted according to state guidelines. The form must be filled out accurately, and the electronic signature must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the form is valid for tax exemption purposes and can be used in audits or tax-related inquiries.

Key elements of the E595 Web Fill

Several key elements must be included in the E595 Web Fill to ensure its validity:

- Purchaser Information: Name and address of the individual or business claiming the exemption.

- Type of Exemption: Clear indication of the reason for the tax exemption.

- Signature: An electronic signature that verifies the authenticity of the submission.

- Date: The date on which the form is completed and submitted.

Form Submission Methods

The E595 Web Fill can be submitted electronically, which is the preferred method for efficiency and speed. Users can also choose to print the completed form and submit it via mail if necessary. However, electronic submission is recommended to ensure timely processing and to minimize delays associated with postal services.

Quick guide on how to complete e 595e 2018 2019 form

Your assistance manual on how to prepare your E595 Web Fill

If you’re interested in understanding how to finalize and submit your E595 Web Fill, here are several straightforward recommendations to streamline tax processing.

To get started, you simply need to create your airSlate SignNow profile to transform the way you manage documentation online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and finalize your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify information as necessary. Simplify your tax administration with sophisticated PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your E595 Web Fill in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your E595 Web Fill in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes digitally using airSlate SignNow. Please keep in mind that filing on paper can lead to return errors and delay reimbursements. Naturally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct e 595e 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the e 595e 2018 2019 form

How to generate an electronic signature for the E 595e 2018 2019 Form online

How to create an electronic signature for your E 595e 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the E 595e 2018 2019 Form in Gmail

How to create an eSignature for the E 595e 2018 2019 Form right from your smartphone

How to create an eSignature for the E 595e 2018 2019 Form on iOS

How to generate an electronic signature for the E 595e 2018 2019 Form on Android devices

People also ask

-

What is the E595 Web Fill feature in airSlate SignNow?

The E595 Web Fill feature in airSlate SignNow allows users to easily fill out forms online before signing them electronically. This powerful tool simplifies the document completion process, ensuring that all necessary fields are completed accurately and efficiently, helping to streamline your workflow.

-

How does airSlate SignNow's E595 Web Fill compare to other e-signature solutions?

airSlate SignNow's E595 Web Fill stands out due to its user-friendly interface and robust functionality. Unlike many other e-signature solutions, it combines web form filling with e-signing, making it a comprehensive choice for businesses looking to enhance their document management processes.

-

What are the pricing options for using the E595 Web Fill feature?

Pricing for the E595 Web Fill feature in airSlate SignNow is competitive and varies based on the subscription plan you choose. Each plan includes access to the E595 Web Fill along with other essential features, ensuring you get great value for your investment.

-

Can I integrate the E595 Web Fill feature with other software tools?

Yes, airSlate SignNow allows for seamless integration of the E595 Web Fill feature with various software tools and applications. This integration helps enhance your existing workflows and ensures that you can manage documents efficiently across different platforms.

-

What benefits does E595 Web Fill provide for businesses?

The E595 Web Fill feature provides businesses with a streamlined document process, reducing errors and saving time. By enabling users to fill out forms online before signing, it enhances accuracy and facilitates faster approvals, ultimately improving productivity.

-

Is the E595 Web Fill feature secure?

Absolutely! The E595 Web Fill feature in airSlate SignNow is designed with security in mind. It utilizes advanced encryption and security protocols to protect your data and ensure that all documents are handled safely throughout the signing process.

-

How can I get started with E595 Web Fill in airSlate SignNow?

Getting started with the E595 Web Fill feature is easy! Simply sign up for an account with airSlate SignNow, choose your subscription plan, and explore the user-friendly interface that guides you through the process of filling and signing documents.

Get more for E595 Web Fill

- Patient report form

- Beneficiary recontact report instructions for reginfogov reginfo form

- Cc 1355 rule to show cause page 1 using this form 1

- Wework membership agreement form

- Ocps calendar form

- Turo checklist form

- Hcl healthcare timesheet form

- Baggage inventory and claim form passenger information swiss

Find out other E595 Web Fill

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney