The Payment Had a Reportable to the Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI of More Than $500000 for Form

Understanding the Payment Reportable to the IRS

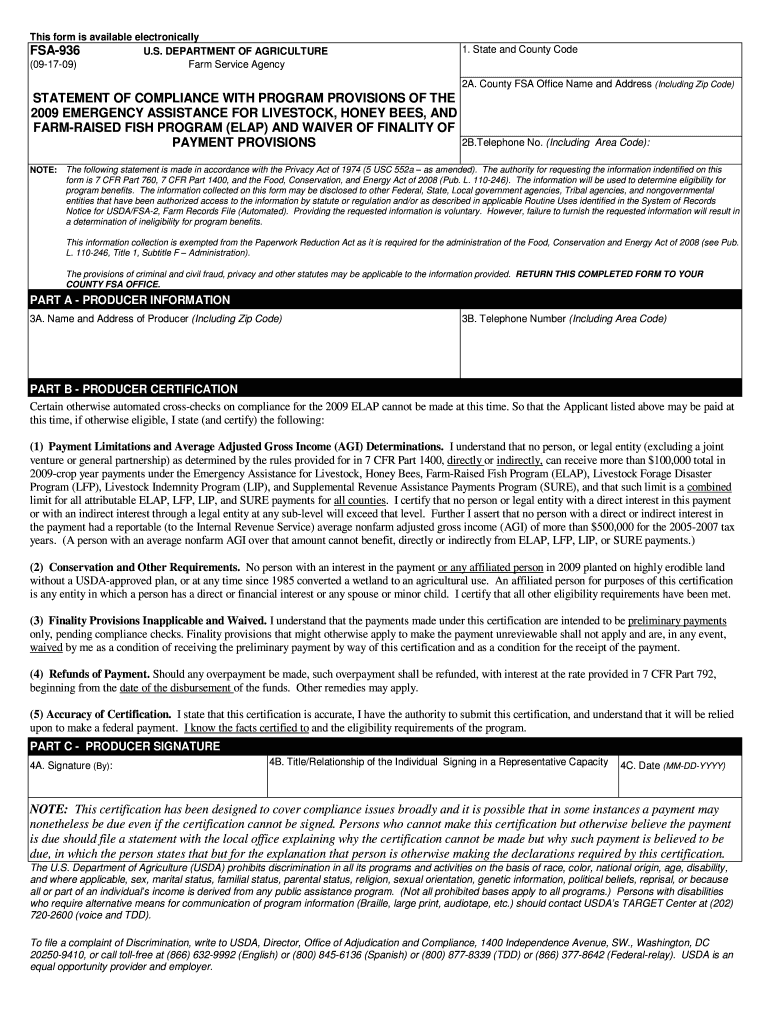

The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income (AGI) Of More Than $500,000 For The Tax Forms SC Egov USDA is a specific tax form used to report significant income levels. This form is crucial for individuals or businesses that have an AGI exceeding this threshold, as it ensures compliance with federal tax regulations. The IRS requires accurate reporting of income to maintain transparency and accountability in tax filings.

How to Use the Payment Reportable to the IRS

To effectively use the Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500,000 For The Tax Forms SC Egov USDA, individuals should gather all necessary financial documentation. This includes income statements, expense reports, and any other relevant financial records. Once collected, users can fill out the form accurately, ensuring that all figures are correct and reflect the actual income earned during the tax year.

Steps to Complete the Payment Reportable to the IRS

Completing the Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500,000 For The Tax Forms SC Egov USDA involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and other income statements.

- Calculate your total income to determine if it exceeds the $500,000 AGI threshold.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

Key Elements of the Payment Reportable to the IRS

Several key elements are essential when dealing with the Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500,000 For The Tax Forms SC Egov USDA:

- Income Reporting: Accurate reporting of all sources of income is vital.

- Documentation: Supporting documents must be attached to validate the reported income.

- Filing Status: Your filing status can affect the overall tax obligations.

- Compliance: Adhering to IRS guidelines is crucial to avoid penalties.

IRS Guidelines for Reporting High Income

The IRS has specific guidelines for reporting income that exceeds the $500,000 AGI threshold. It is important to familiarize yourself with these guidelines to ensure compliance. This includes understanding the types of income that must be reported, allowable deductions, and any credits that may apply. Regularly checking the IRS website for updates can help stay informed about any changes in regulations or reporting requirements.

Filing Deadlines for the Payment Reportable to the IRS

Filing deadlines for the Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500,000 For The Tax Forms SC Egov USDA typically align with the standard tax filing deadlines. Generally, individual tax returns are due on April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is important to stay aware of these dates to avoid late penalties.

Quick guide on how to complete the payment had a reportable to the internal revenue service average nonfarm adjusted gross income agi of more than 500000 for

Finish [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to get going.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant parts of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the payment had a reportable to the internal revenue service average nonfarm adjusted gross income agi of more than 500000 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda?

The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda is crucial for understanding tax obligations. It indicates that individuals or businesses with an AGI over $500,000 may have specific reporting requirements. This can affect how you manage your documents and eSignatures through airSlate SignNow.

-

How does airSlate SignNow help with tax document management?

airSlate SignNow streamlines the process of managing tax documents, including those related to The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda. Our platform allows you to easily send, sign, and store important tax documents securely. This ensures compliance and simplifies your tax preparation process.

-

What features does airSlate SignNow offer for eSigning tax forms?

airSlate SignNow offers a range of features for eSigning tax forms, including customizable templates and secure cloud storage. These features are particularly beneficial for documents related to The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda. You can also track the status of your documents in real-time.

-

Is airSlate SignNow cost-effective for businesses with high AGI?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses, including those with a high AGI like The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda. Our pricing plans are flexible and cater to various business sizes, ensuring you get the best value for your investment.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage documents related to The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda. This integration helps streamline your workflow and ensures that all your financial documents are in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and compliance with regulations. For those dealing with The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda, our platform ensures that your documents are handled efficiently and securely.

-

How secure is airSlate SignNow for sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents. This is especially important for documents related to The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For The Tax Forms Sc Egov Usda. You can trust that your information is safe with us.

Get more for The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For

Find out other The Payment Had A Reportable to The Internal Revenue Service Average Nonfarm Adjusted Gross Income AGI Of More Than $500000 For

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure