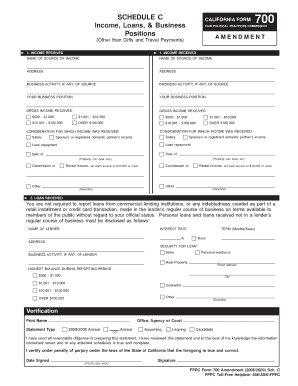

SCHEDULE C Income, Loans, & Business Positions Fair Political Form

What is the SCHEDULE C Income, Loans, & Business Positions Fair Political

The SCHEDULE C Income, Loans, & Business Positions Fair Political is a specific form used to disclose income, loans, and business positions held by individuals involved in political activities. This form is essential for ensuring transparency in financial dealings and potential conflicts of interest for public officials and candidates. It provides a detailed account of all sources of income, any loans received, and positions held in businesses, which is crucial for maintaining public trust in the political system.

Steps to complete the SCHEDULE C Income, Loans, & Business Positions Fair Political

Completing the SCHEDULE C form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect all relevant financial documents, including income statements, loan agreements, and business ownership records.

- Fill out personal details: Enter your name, address, and position you are reporting for, ensuring accuracy to avoid any discrepancies.

- Report income sources: List all sources of income, including wages, dividends, and any other earnings. Be specific about the amounts and sources.

- Disclose loans: Provide details on any loans received, including the lender's name, amount, and terms of repayment.

- Detail business positions: Include information about any businesses you own or have a stake in, specifying the nature of your involvement.

- Review and verify: Double-check all entries for accuracy and completeness before submission.

Legal use of the SCHEDULE C Income, Loans, & Business Positions Fair Political

The legal use of the SCHEDULE C form is governed by federal and state laws that mandate transparency in political financing. This form is required for candidates and public officials to disclose their financial interests, which helps to prevent corruption and conflicts of interest. Failing to complete or submit this form can lead to legal repercussions, including fines and disqualification from holding office. Understanding the legal implications is crucial for compliance and maintaining ethical standards in political activities.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the SCHEDULE C form. These guidelines outline the necessary information to include, the format for reporting income and loans, and the deadlines for submission. It is important to adhere to these guidelines to ensure that all financial disclosures are accurate and compliant with federal regulations. Familiarizing oneself with IRS requirements can help avoid mistakes that could lead to penalties.

Required Documents

To complete the SCHEDULE C Income, Loans, & Business Positions Fair Political, several documents are required:

- Income statements: Documentation of all income sources, such as W-2s, 1099s, or other relevant records.

- Loan agreements: Copies of any loan contracts or agreements that detail the terms and conditions.

- Business ownership records: Proof of ownership or interest in businesses, including partnership agreements or corporate documents.

Disclosure Requirements

Disclosure requirements for the SCHEDULE C form include providing comprehensive information about all financial interests that could influence political decisions. This includes not only direct income but also any indirect benefits, such as loans or investments in businesses. The goal is to create a transparent record that allows the public to assess potential conflicts of interest. Ensuring full disclosure is essential for maintaining integrity in public service.

Quick guide on how to complete schedule c income loans amp business positions fair political

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important parts of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE C Income, Loans, & Business Positions Fair Political

Create this form in 5 minutes!

How to create an eSignature for the schedule c income loans amp business positions fair political

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SCHEDULE C Income, Loans, & Business Positions Fair Political?

SCHEDULE C Income, Loans, & Business Positions Fair Political refers to the financial disclosures required for individuals involved in political activities. This includes reporting income, loans, and business positions that may influence political decisions. Understanding these requirements is crucial for compliance and transparency in political finance.

-

How can airSlate SignNow help with SCHEDULE C Income, Loans, & Business Positions Fair Political?

airSlate SignNow provides an efficient platform for managing documents related to SCHEDULE C Income, Loans, & Business Positions Fair Political. With our eSigning capabilities, you can easily prepare, send, and sign necessary documents, ensuring compliance and timely submissions. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those dealing with SCHEDULE C Income, Loans, & Business Positions Fair Political. Our plans are designed to be cost-effective, providing essential features without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing political finance documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all essential for managing SCHEDULE C Income, Loans, & Business Positions Fair Political. These tools help ensure that your documents are completed accurately and efficiently, facilitating compliance with political finance regulations.

-

Is airSlate SignNow compliant with legal standards for political documents?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management, making it suitable for SCHEDULE C Income, Loans, & Business Positions Fair Political. Our platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other software for managing political finance?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help manage SCHEDULE C Income, Loans, & Business Positions Fair Political. This allows you to streamline your workflow by connecting with tools you already use, enhancing efficiency and data management.

-

What benefits does airSlate SignNow provide for political organizations?

For political organizations, airSlate SignNow offers signNow benefits, including improved document management and faster processing times for SCHEDULE C Income, Loans, & Business Positions Fair Political. Our user-friendly interface and robust features help organizations maintain compliance while saving time and resources.

Get more for SCHEDULE C Income, Loans, & Business Positions Fair Political

- Expanded definitions for who may apply united states citizen form

- Modifier59 website article 11 doc the icd 10 transition an introduction cms form

- Inpatient prospective payment system hospital and long term form

- Ambulances services centercmsambulance services coverage medicarehomeamerican ambulance associationhomeamerican ambulance form

- Medicare provider supplier enrollment form

- State operations manual exhibit 82 cms gov form

- In the traditional medicare form

- Form 891402311000 rev 1123reset formmississipp

Find out other SCHEDULE C Income, Loans, & Business Positions Fair Political

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document