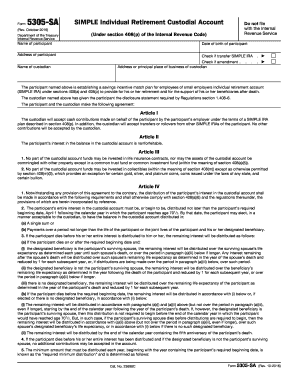

Form 5305 C Rev October IRS Gov 2016

What is the Form 5305 C Rev October IRS gov

The Form 5305 C Rev October is an official document provided by the IRS, primarily used for establishing a simplified employee pension (SEP) plan. This form serves as a written agreement between an employer and eligible employees, outlining the terms and conditions of the SEP. The form is crucial for employers looking to provide retirement benefits to their employees while maintaining compliance with IRS regulations. It is important to use the most current version of the form to ensure legal validity and adherence to IRS guidelines.

How to use the Form 5305 C Rev October IRS gov

Using the Form 5305 C Rev October involves several key steps. First, employers must fill out the form accurately, providing all necessary details about the SEP plan. This includes information about the employer, eligible employees, and contribution limits. After completing the form, it must be signed by the employer and distributed to all eligible employees. Employees should retain a copy for their records. It is also advisable to keep a copy of the signed form in the employer's records to demonstrate compliance with IRS requirements.

Steps to complete the Form 5305 C Rev October IRS gov

Completing the Form 5305 C Rev October requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website.

- Fill in the employer's information, including name, address, and taxpayer identification number.

- List all eligible employees who will participate in the SEP plan.

- Specify the contribution limits and any other relevant plan details.

- Sign and date the form to validate it.

- Distribute copies to all eligible employees and retain a copy for your records.

Legal use of the Form 5305 C Rev October IRS gov

The legal use of the Form 5305 C Rev October is essential for ensuring that the SEP plan complies with IRS regulations. This form must be completed accurately and retained as part of the employer's records. It is important to note that failure to use the correct version of the form or to follow the established guidelines may result in penalties or disqualification of the SEP plan. Employers should regularly review their compliance with IRS requirements to maintain the legal standing of their retirement plans.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 5305 C Rev October is crucial for compliance. Employers must establish their SEP plan by the tax filing deadline for the year in which contributions will be made. Typically, this deadline is April fifteenth for most businesses, but it may vary based on the employer's tax situation. It is advisable to file the form well in advance of this deadline to ensure all necessary documentation is in order.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 5305 C Rev October can be done through various methods. Employers may choose to file the form electronically if the IRS allows for online submissions. Alternatively, the completed form can be mailed to the appropriate IRS address, which can be found on the IRS website. In-person submission is generally not an option for this form, as it is primarily handled through mail or electronic means. Ensure that all submissions are sent well before the filing deadline to avoid any complications.

Quick guide on how to complete form 5305 c rev october 2016 irsgov

Discover the easiest method to complete and endorse your Form 5305 C Rev October IRS gov

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior approach to finalize and endorse your Form 5305 C Rev October IRS gov and similar forms for public services. Our advanced eSignature solution provides you with all the necessary tools to manage paperwork efficiently and comply with legal standards - powerful PDF editing, organization, protection, signing, and sharing features all available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Form 5305 C Rev October IRS gov:

- Insert the editable template into the editor using the Get Form button.

- Review the information you need to fill in your Form 5305 C Rev October IRS gov.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is essential or Obscure sections that are no longer relevant.

- Select Sign to create a legally binding eSignature using your preferred method.

- Add the Date beside your signature and complete your task by clicking the Done button.

Store your completed Form 5305 C Rev October IRS gov in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our platform also offers versatile form sharing options. There’s no requirement to print your documents when submitting them to the appropriate public office - accomplish this through email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 5305 c rev october 2016 irsgov

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I am a repeater. I will be appearing for the JEE Mains 2016. I will also appear for the Maharashtra HSC improvement exam in October of 2015. Will my October board exam result be accepted for the Mains rankings? If so, then how would I have to fill the form?

If you are reappearing for all the subjects then JEE will consider your new results. However if you're reappearing for selected subjects then your pervious results will be considered by JEE.

Create this form in 5 minutes!

How to create an eSignature for the form 5305 c rev october 2016 irsgov

How to create an eSignature for your Form 5305 C Rev October 2016 Irsgov in the online mode

How to make an eSignature for your Form 5305 C Rev October 2016 Irsgov in Chrome

How to create an eSignature for putting it on the Form 5305 C Rev October 2016 Irsgov in Gmail

How to create an electronic signature for the Form 5305 C Rev October 2016 Irsgov straight from your smartphone

How to make an eSignature for the Form 5305 C Rev October 2016 Irsgov on iOS

How to create an electronic signature for the Form 5305 C Rev October 2016 Irsgov on Android devices

People also ask

-

What is Form 5305 C Rev October IRS gov?

Form 5305 C Rev October IRS gov is a document used to establish a streamlined process for certain tax-related transactions. It serves as a vital tool for businesses to simplify their tax obligations with the IRS. Understanding this form can signNowly benefit your financial management strategies.

-

How can airSlate SignNow help with Form 5305 C Rev October IRS gov?

airSlate SignNow provides an efficient solution for electronically signing and sending Form 5305 C Rev October IRS gov. Our platform ensures you can complete and submit the document securely and quickly, saving you time and reducing paper use. By utilizing our e-signature technology, your workflow becomes more effective and streamlined.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit your needs, whether you're an individual or a business. Our plans start at an affordable rate, ensuring you have access to features that include the ability to manage documents like Form 5305 C Rev October IRS gov. Each plan is designed to provide excellent value for the functionalities you receive.

-

Are there any features specifically for tax forms like Form 5305 C Rev October IRS gov?

Yes, airSlate SignNow includes features tailored for handling tax documents such as Form 5305 C Rev October IRS gov. Our solutions support secure e-signatures, document templates, and automated workflows designed to expedite form completion and submission. This allows for better compliance and helps ensure that you minimize errors in your tax filings.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enabling you to enhance your experience when dealing with documents like Form 5305 C Rev October IRS gov. This feature allows you to connect with CRM systems, cloud storage services, and other business tools, ensuring a smooth document management process.

-

What benefits does airSlate SignNow provide for eSigning Forms?

Using airSlate SignNow for eSigning forms, including Form 5305 C Rev October IRS gov, offers multiple benefits, such as increased efficiency and improved security. Our platform simplifies the signature process, allowing multiple signers to sign simultaneously from any device. This not only expedites your transactions but also enhances compliance with IRS regulations.

-

Is airSlate SignNow secure for signing important documents?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 5305 C Rev October IRS gov. Our platform utilizes industry-standard encryption and security protocols to protect your data from unauthorized access. You can confidently sign and share sensitive information knowing it's secure at all times.

Get more for Form 5305 C Rev October IRS gov

- Trauma medical record review form

- K12claimshsricom form

- Hipaa request for amendment of the medical record form doc colorado state university evaluation of administrative professionals

- Massachusetts form 2

- Brokeragelink application union form

- Sehr geehrter dienstgeber dem acrobat reader nicht mglich ist und smtliche form

- Stock option startup agreement template form

- Stock options agreement template form

Find out other Form 5305 C Rev October IRS gov

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document