Massachusetts Form 2

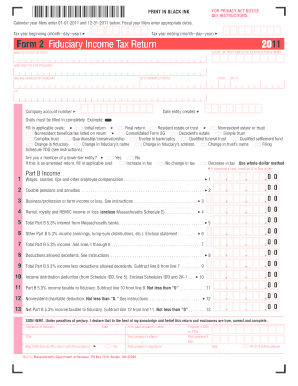

What is the Massachusetts Form 2

The Massachusetts Form 2 is a state tax return form specifically designed for residents of Massachusetts who are filing their personal income taxes. This form is used to report income, calculate tax liability, and determine any refunds or payments due. It is essential for individuals who earn income in the state, as it ensures compliance with Massachusetts tax laws. The form must be filled out accurately to avoid penalties and ensure that taxpayers receive any eligible refunds.

Steps to complete the Massachusetts Form 2

Completing the Massachusetts Form 2 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, Social Security number, and filing status at the top of the form.

- Report income: Input your total income from all sources, including wages, interest, and dividends.

- Calculate deductions: Identify and enter any deductions you qualify for, such as standard deductions or itemized deductions.

- Determine tax liability: Use the provided tax tables to calculate your total tax owed based on your taxable income.

- Review and sign: Double-check all entries for accuracy, sign the form, and date it before submission.

Legal use of the Massachusetts Form 2

The Massachusetts Form 2 is legally binding when completed and submitted according to state regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may result in penalties or legal action. The form must be signed by the taxpayer, affirming that the information is correct to the best of their knowledge. Compliance with Massachusetts tax laws is essential for maintaining good standing with the state.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Form 2 are typically aligned with federal tax deadlines. Generally, the form must be filed by April 15 of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can allow for additional time to file without incurring penalties.

Form Submission Methods

The Massachusetts Form 2 can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved e-filing services, which may offer faster processing and confirmation.

- Mail: Completed forms can be mailed to the appropriate state tax office. Ensure to use the correct address based on the type of return and whether a payment is included.

- In-Person: Some taxpayers may choose to submit their forms in person at designated state tax offices, where assistance may be available.

Required Documents

To complete the Massachusetts Form 2, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as interest or dividends

- Documentation for any deductions or credits claimed

- Previous year’s tax return for reference

Quick guide on how to complete massachusetts form 2

Complete Massachusetts Form 2 effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It presents an ideal sustainable alternative to traditional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Massachusetts Form 2 across any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Massachusetts Form 2 effortlessly

- Locate Massachusetts Form 2 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign Massachusetts Form 2 and ensure outstanding communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts form 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ma form 2 and how can airSlate SignNow help?

ma form 2 is a vital document that many businesses need for compliance and communication. airSlate SignNow makes it easy to create, send, and eSign ma form 2 quickly and securely. Our platform allows you to manage these documents efficiently, improving your workflow and ensuring compliance.

-

What are the pricing options for using airSlate SignNow to manage ma form 2?

airSlate SignNow offers various pricing plans to suit different needs, starting with a free trial to explore features. Our plans provide excellent value for managing ma form 2, with tiered options based on your business size and document usage. This flexibility ensures you only pay for what you need.

-

What key features does airSlate SignNow offer for ma form 2?

airSlate SignNow provides essential features for handling ma form 2, including templates, customizable workflows, and secure cloud storage. Additionally, our eSignature capabilities streamline the signing process, making it faster and easier for all parties involved. These features enhance productivity and ensure document accuracy.

-

How does airSlate SignNow improve the efficiency of processing ma form 2?

By utilizing airSlate SignNow, businesses can automate the entire process of handling ma form 2, reducing manual effort and the risk of errors. Our intuitive interface allows users to quickly create and send documents, track their status, and obtain eSignatures seamlessly. This efficiency saves time and increases overall productivity.

-

Is airSlate SignNow compliant with legal standards for managing ma form 2?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring the validity of your ma form 2. We adhere to regulations such as the ESIGN Act and UETA, providing peace of mind that your documents are legally binding. This compliance is critical for businesses looking to maintain trust and legality.

-

Can I integrate airSlate SignNow with other applications for handling ma form 2?

Absolutely! airSlate SignNow supports numerous integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office. These integrations allow you to streamline your workflows for ma form 2, ensuring a seamless document management experience across your existing tools.

-

What benefits do I gain by using airSlate SignNow for ma form 2?

Using airSlate SignNow to manage ma form 2 provides several benefits, such as reduced turnaround time for document approval, enhanced security, and improved collaboration among your team. Additionally, our platform's user-friendly design helps everyone, even those who are not tech-savvy, navigate the eSigning process easily and effectively.

Get more for Massachusetts Form 2

Find out other Massachusetts Form 2

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe