Irs 8848 Form 2017-2026

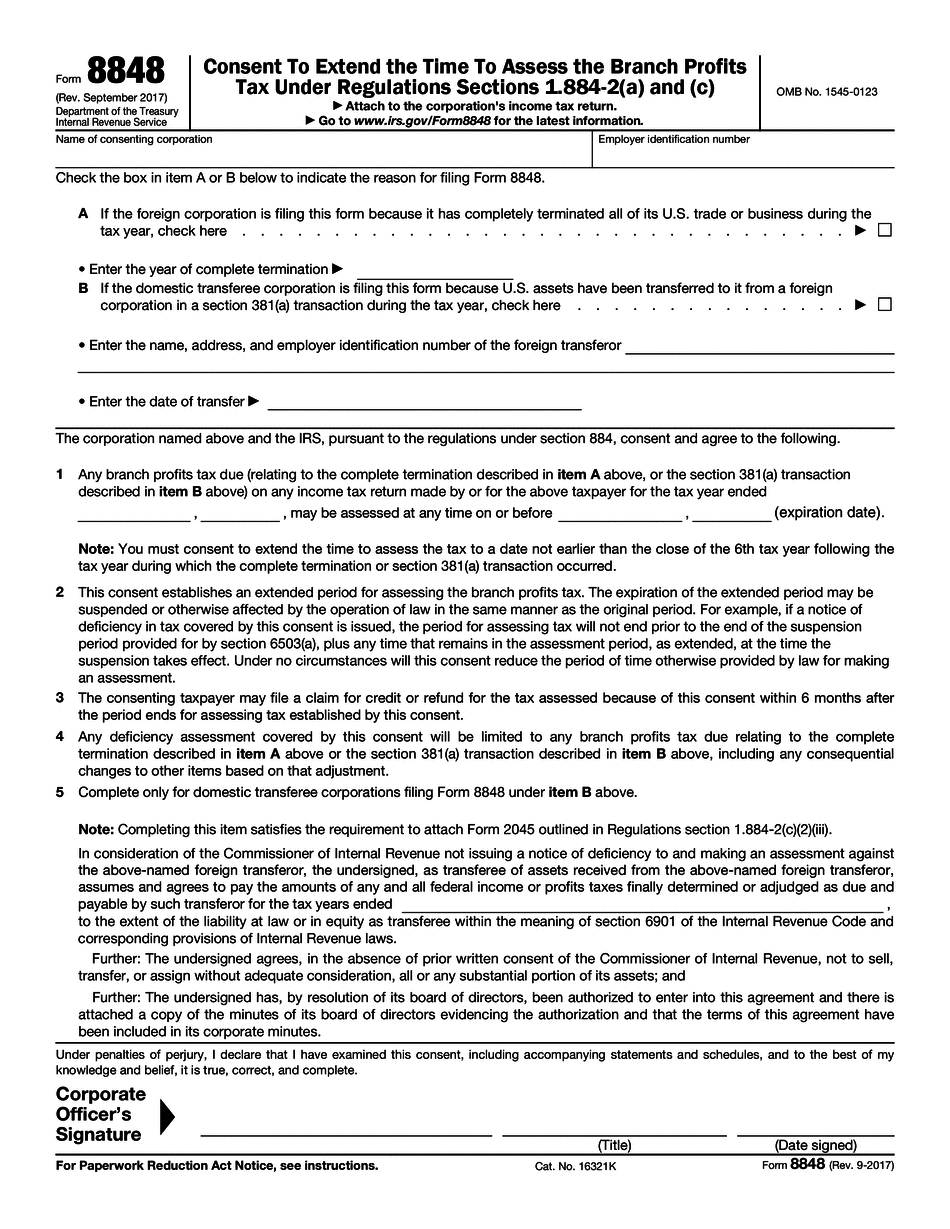

What is the IRS 8848 Form

The IRS 8848 form is a tax form used by certain U.S. taxpayers to report specific information about their foreign financial accounts. This form is particularly relevant for individuals or entities that have foreign accounts exceeding certain thresholds. It is essential for compliance with U.S. tax laws and helps the IRS track international financial activities, ensuring that taxpayers meet their reporting obligations.

How to Obtain the IRS 8848 Form

To obtain the IRS 8848 form, taxpayers can visit the official IRS website, where they can download the form directly. It is available in PDF format, making it easy to print and complete. Additionally, taxpayers can request a physical copy by contacting the IRS directly, though downloading it online is typically faster and more convenient.

Steps to Complete the IRS 8848 Form

Completing the IRS 8848 form involves several key steps:

- Gather necessary information, including personal identification details and specifics about foreign accounts.

- Carefully fill out each section of the form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Sign and date the form, confirming that the information provided is true and complete.

Legal Use of the IRS 8848 Form

The IRS 8848 form must be used in accordance with U.S. tax regulations. It is crucial for taxpayers to ensure that they are using the most current version of the form and that they are aware of any legal implications associated with its submission. Failure to use the form correctly can lead to penalties or legal issues, making it vital to understand the requirements and guidelines set forth by the IRS.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the IRS 8848 form. Generally, the form is due on the same date as the taxpayer's annual income tax return. It is important to check the IRS calendar for any updates or changes to deadlines, as timely submission is essential to avoid penalties.

Form Submission Methods

The IRS 8848 form can be submitted through various methods:

- Online: If allowed, taxpayers can e-file the form using approved electronic systems.

- Mail: The completed form can be mailed to the appropriate IRS address, which varies based on the taxpayer's location.

- In-Person: Taxpayers may also have the option to submit the form in person at designated IRS offices.

Quick guide on how to complete 2017 extend form

Explore the simplest method to complete and endorse your Irs 8848 Form

Are you still investing time preparing your official paperwork on paper instead of online? airSlate SignNow offers a superior way to complete and endorse your Irs 8848 Form and associated forms for public services. Our advanced eSignature platform provides you with all the tools required to handle documentation swiftly and in accordance with official standards - powerful PDF modifying, managing, securing, signing, and sharing features all available within an intuitive interface.

There are just a few steps needed to finish filling out and signing your Irs 8848 Form:

- Upload the editable template to the editor using the Get Form button.

- Review what information you must enter in your Irs 8848 Form.

- Swing between the fields using the Next option to ensure you don’t overlook anything.

- Employ Text, Check, and Cross tools to complete the sections with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Conceal fields that are no longer relevant.

- Press on Sign to generate a legally enforceable eSignature using any method you prefer.

- Include the Date beside your signature and conclude your task with the Done button.

Store your finalized Irs 8848 Form in the Documents section of your profile, download it, or transfer it to your preferred cloud service. Our platform also offers adaptable file sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - do it using email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 extend form

Create this form in 5 minutes!

How to create an eSignature for the 2017 extend form

How to generate an electronic signature for your 2017 Extend Form in the online mode

How to generate an eSignature for the 2017 Extend Form in Chrome

How to make an eSignature for signing the 2017 Extend Form in Gmail

How to create an electronic signature for the 2017 Extend Form right from your smart phone

How to create an eSignature for the 2017 Extend Form on iOS devices

How to make an electronic signature for the 2017 Extend Form on Android devices

People also ask

-

What is the IRS 8848 Form and why is it important?

The IRS 8848 Form is a crucial document that nonprofits use to report their activities to the IRS. It is essential for maintaining compliance with federal regulations and ensuring that your organization remains in good standing. Properly completing the IRS 8848 Form can help avoid potential penalties and ensure transparency.

-

How can airSlate SignNow help with the IRS 8848 Form?

airSlate SignNow simplifies the process of completing the IRS 8848 Form by allowing you to eSign and send documents securely. With our intuitive platform, you can easily gather signatures from multiple parties, streamlining the process and reducing paperwork. This makes managing your IRS 8848 Form more efficient and organized.

-

What features does airSlate SignNow offer for managing the IRS 8848 Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the IRS 8848 Form. These tools help ensure that your document is completed accurately and efficiently, minimizing the risk of errors. Additionally, you can store all your documents securely in one place.

-

Is there a cost associated with using airSlate SignNow for the IRS 8848 Form?

Yes, there is a cost to use airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans are flexible and cater to different needs, allowing you to choose the one that best fits your usage for managing documents like the IRS 8848 Form. We also offer a free trial so you can explore the features before committing.

-

Can I integrate airSlate SignNow with other software for the IRS 8848 Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the IRS 8848 Form alongside your existing tools. Whether you use CRM systems, document management software, or cloud storage, our platform can enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the IRS 8848 Form?

Using airSlate SignNow for the IRS 8848 Form brings numerous benefits, including increased efficiency, reduced paper clutter, and enhanced security. Our platform enables quick eSigning and document sharing, which speeds up the entire process. Additionally, you can track the status of your documents in real-time, ensuring that everything is completed on time.

-

How secure is airSlate SignNow for handling the IRS 8848 Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the IRS 8848 Form. Our platform utilizes advanced encryption protocols and complies with industry standards to ensure that your data is protected. You can rest assured that your documents are safe and secure throughout the signing process.

Get more for Irs 8848 Form

- Louisiana resale certificate timepayment 0463182 001 1600 form

- Service bureau request form

- Substitute form w9ohio reporting form stark county government

- Bus driver unit albany ny form

- Professionaladministrative employee evaluation bb wetherhaven tamiu form

- Form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

- Pr 78ssta streamlined sales ampamp use tax agreement certificate of form

- Stock repurchase agreement template form

Find out other Irs 8848 Form

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed