Form 8848 Rev June Internal Revenue Service 2002

What is the Form 8848 Rev June Internal Revenue Service

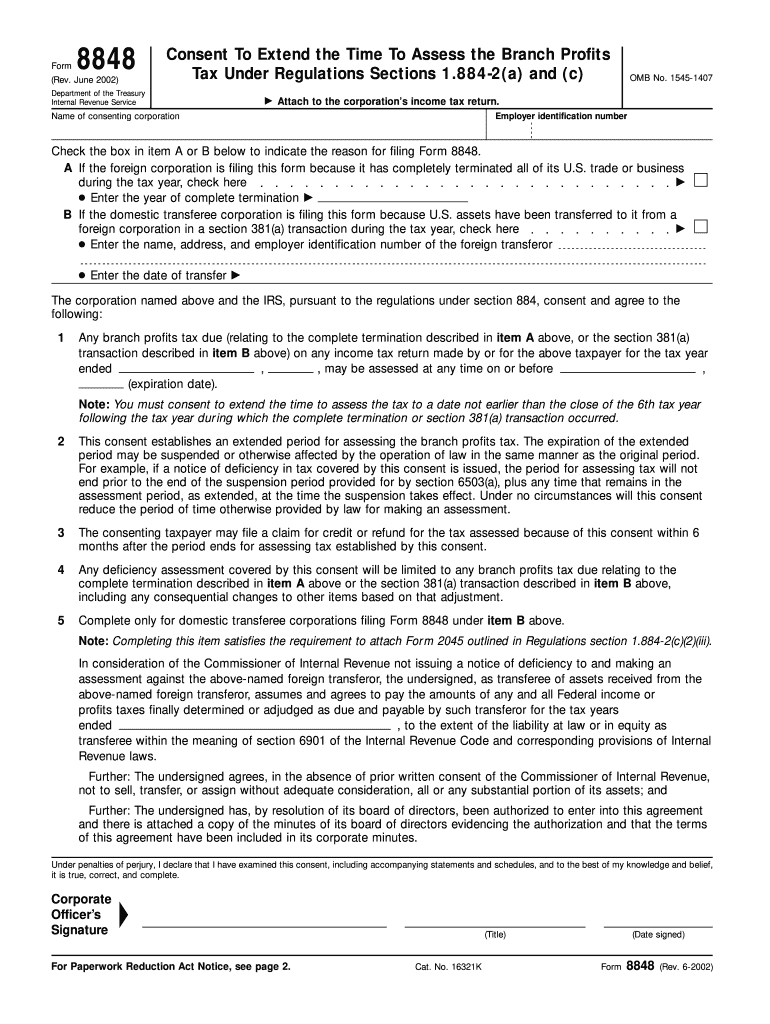

The Form 8848 Rev June is a document issued by the Internal Revenue Service (IRS) that allows certain individuals to request a refund of overpaid taxes. This form is specifically designed for U.S. citizens and residents who have made payments that exceed their tax liabilities. It is important to use the most current version of this form to ensure compliance with IRS regulations. The form must be filled out accurately, as any discrepancies can lead to delays in processing or potential penalties.

How to use the Form 8848 Rev June Internal Revenue Service

Using the Form 8848 Rev June requires careful attention to detail. First, gather all necessary financial documents, including your previous tax returns and any relevant payment records. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Make sure to indicate the tax year for which you are requesting a refund. After completing the form, review it thoroughly to ensure all information is correct before submitting it to the IRS.

Steps to complete the Form 8848 Rev June Internal Revenue Service

Completing the Form 8848 Rev June involves several key steps:

- Download the latest version of Form 8848 from the IRS website.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Provide details about the tax payments made, including the amounts and dates.

- Indicate the tax year for which you are claiming the refund.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS via the designated submission method.

Legal use of the Form 8848 Rev June Internal Revenue Service

The legal use of the Form 8848 Rev June is crucial for ensuring that taxpayers comply with IRS regulations. This form is legally binding once submitted, and it is essential to provide accurate information to avoid legal repercussions. Misrepresentation or errors on the form can result in penalties, including fines or delays in processing. Taxpayers should retain copies of the submitted form and any supporting documents for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8848 Rev June are critical for taxpayers seeking refunds. Generally, the form must be submitted within three years from the original due date of the tax return for which the refund is requested. It is advisable to check the IRS website for any updates or changes to filing deadlines, as these can vary from year to year. Staying informed about these dates helps ensure timely processing of refund requests.

Form Submission Methods (Online / Mail / In-Person)

The Form 8848 Rev June can be submitted through various methods, depending on the preferences of the taxpayer. Options include:

- Online: If eligible, taxpayers can use IRS e-file services to submit the form electronically.

- Mail: The completed form can be mailed to the appropriate IRS address, which can be found in the form instructions.

- In-Person: Taxpayers may also visit local IRS offices to submit the form directly, although this option may require an appointment.

Quick guide on how to complete form 8848 rev june 2002 internal revenue service

Discover the simplest method to complete and endorse your Form 8848 Rev June Internal Revenue Service

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to finish and sign your Form 8848 Rev June Internal Revenue Service and other forms for public services. Our intelligent electronic signature solution provides you with all the tools you need to handle documents swiftly and in line with formal standards - comprehensive PDF editing, management, protection, signing, and sharing capabilities all available within an intuitive interface.

Only a few steps are necessary to complete and endorse your Form 8848 Rev June Internal Revenue Service:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Form 8848 Rev June Internal Revenue Service.

- Move through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Conceal areas that are irrelevant.

- Click on Sign to generate a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your task with the Done button.

Store your finished Form 8848 Rev June Internal Revenue Service in the Documents folder of your profile, download it, or send it to your preferred cloud storage. Our solution also provides versatile file sharing. There’s no requirement to print your forms when you need to deliver them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 8848 rev june 2002 internal revenue service

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

Internal Revenue Service (IRS): I want to file my own taxes this year and am new to America. How and which forms would I need to use to file (I live in columbus, Ohio)?

I suggest you spend some time with a competent tax advisor in Columbus before filing. Also take a look at Publication 519 (2011), U.S. Tax Guide for Aliens if you are not yet a US citizen. Whether and what you have to file depends primarily on your status (citizen/resident alien/nonresident alien), the source of your income, and the amount of your income. If you are a US citizen, or if you qualify as a resident alien, you will be taxed on your worldwide income and will normally file Form 1040. If you do not qualify as a resident alien and you are not a US citizen, but you had US source income (basically anything you earned while living and working in the US), you will file Form 1040NR. You will normally have to file an Ohio state tax return (IT 1040) if you had income while living and working in the state of Ohio - see Ohio Department of Taxation > Forms.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

Create this form in 5 minutes!

How to create an eSignature for the form 8848 rev june 2002 internal revenue service

How to make an eSignature for your Form 8848 Rev June 2002 Internal Revenue Service in the online mode

How to generate an eSignature for your Form 8848 Rev June 2002 Internal Revenue Service in Google Chrome

How to generate an electronic signature for putting it on the Form 8848 Rev June 2002 Internal Revenue Service in Gmail

How to generate an eSignature for the Form 8848 Rev June 2002 Internal Revenue Service from your smart phone

How to create an eSignature for the Form 8848 Rev June 2002 Internal Revenue Service on iOS

How to make an eSignature for the Form 8848 Rev June 2002 Internal Revenue Service on Android OS

People also ask

-

What is Form 8848 Rev June Internal Revenue Service?

Form 8848 Rev June Internal Revenue Service is a tax form used by certain tax-exempt organizations to apply for extension of time to file Form 990 or 990-EZ. This form helps organizations ensure compliance with tax regulations while allowing them more time to prepare their returns. Understanding how to complete this form correctly is crucial for maintaining tax-exempt status.

-

How can airSlate SignNow help with Form 8848 Rev June Internal Revenue Service?

airSlate SignNow simplifies the process of sending and eSigning Form 8848 Rev June Internal Revenue Service. Users can easily upload the form, send it for signatures, and manage documents in a secure environment. This streamlines the compliance process and saves valuable time for organizations.

-

What are the pricing options for airSlate SignNow when dealing with Form 8848 Rev June Internal Revenue Service?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including features specifically designed for managing Form 8848 Rev June Internal Revenue Service. Our competitive pricing ensures that businesses can access an easy-to-use solution without breaking the bank. You can choose a plan based on how frequently you need to eSign documents.

-

Are there integrations available for airSlate SignNow that assist with Form 8848 Rev June Internal Revenue Service?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage Form 8848 Rev June Internal Revenue Service efficiently. Whether it's cloud storage, project management tools, or CRM systems, these integrations ensure that your document workflow is cohesive and organized. This interoperability is key for organizations aiming to streamline their operations.

-

What benefits does airSlate SignNow offer for handling Form 8848 Rev June Internal Revenue Service?

Using airSlate SignNow for Form 8848 Rev June Internal Revenue Service provides numerous benefits, including increased efficiency and reduced turnaround time for document signing. Our platform ensures that all your documents are securely stored and easily accessible. This can signNowly decrease the likelihood of compliance issues arising from delays or improper filings.

-

Can I track the status of my Form 8848 Rev June Internal Revenue Service using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for documents, allowing users to see the status of their Form 8848 Rev June Internal Revenue Service at any time. This feature enhances transparency and ensures that nothing is overlooked during the signing process. Knowing where your documents stand can alleviate concerns about compliance deadlines.

-

Is airSlate SignNow user-friendly for completing Form 8848 Rev June Internal Revenue Service?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete Form 8848 Rev June Internal Revenue Service without extensive training. The intuitive interface allows users to upload, edit, and eSign documents quickly and efficiently. This means you can focus more on your content and less on the paperwork.

Get more for Form 8848 Rev June Internal Revenue Service

- Locker agreement form

- Sample internship forms

- Josef silny evaluation report form

- Registration form june 1 3 2007 what s left of modernism usask

- Where to submit devry academic dismissal appeal form

- Fiu dcf form

- Writing a personal spiritual reference letter form

- Cooper middle school 7 grade summer non fiction book form

Find out other Form 8848 Rev June Internal Revenue Service

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure