Form 990 PF Return of Private Foundation or Section 4947a1 Trust Treated as Private Foundation 2022

Understanding the Form 990 PF for Private Foundations

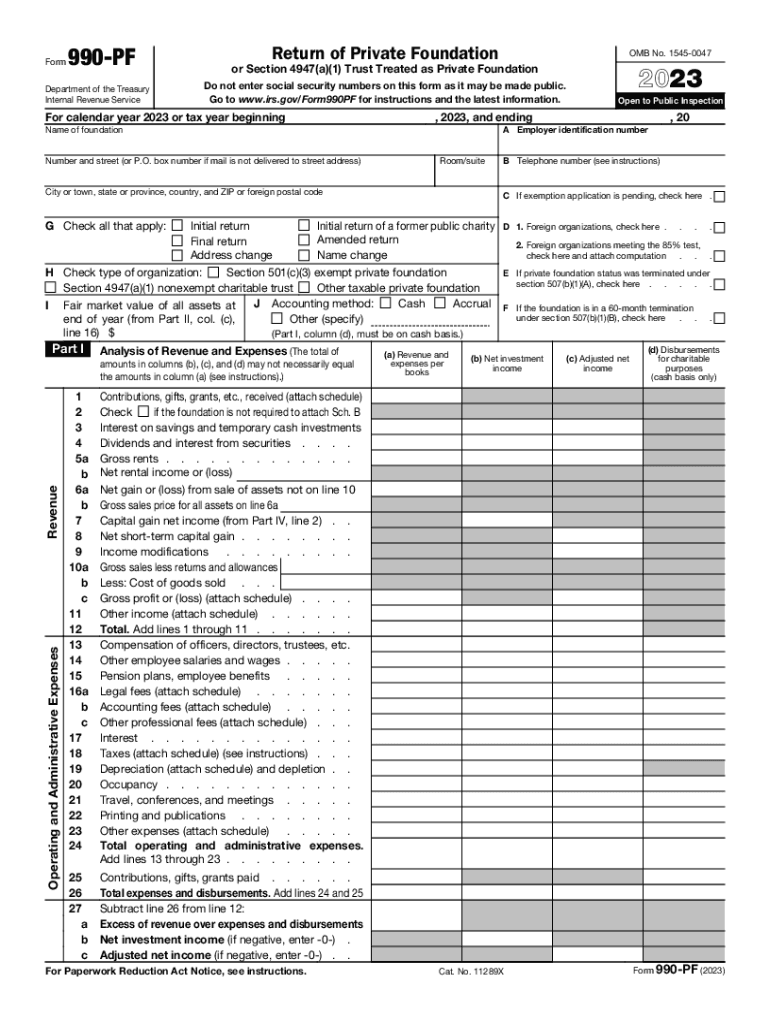

The Form 990 PF is a tax return specifically designed for private foundations and certain trusts that are treated as private foundations under Section 4947(a)(1) of the Internal Revenue Code. This form provides the IRS with essential information about the foundation's financial activities, including income, expenses, and distributions to charitable organizations. It is crucial for maintaining tax-exempt status and ensuring compliance with federal regulations.

Steps to Complete the Form 990 PF

Completing the Form 990 PF involves several important steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Complete the identification section, providing details about the foundation's name, address, and employer identification number (EIN).

- Fill out the financial sections, detailing revenue, expenses, and assets.

- Report on charitable distributions, ensuring that the foundation meets its minimum distribution requirements.

- Review the form for accuracy and completeness before submission.

Key Elements of the Form 990 PF

The Form 990 PF includes several key components that foundations must address:

- Part I: Summary of the foundation's financial activities.

- Part II: Balance sheet detailing assets, liabilities, and net assets.

- Part III: Statement of revenue and expenses.

- Part IV: Information on charitable distributions.

- Part V: Governance and management information.

Filing Deadlines for Form 990 PF

The Form 990 PF must be filed annually, with the due date typically falling on the fifteenth day of the fifth month after the end of the foundation's tax year. For foundations operating on a calendar year, this means the form is due by May fifteenth. If additional time is needed, foundations can file for an extension, allowing them to submit the form by November fifteenth.

IRS Guidelines for Form 990 PF

The IRS provides specific guidelines for completing and filing the Form 990 PF. It is essential for foundations to adhere to these guidelines to avoid penalties and maintain compliance. Key points include:

- Ensuring all financial information is accurate and complete.

- Meeting the minimum distribution requirements to maintain tax-exempt status.

- Providing detailed information on governance and management practices.

Penalties for Non-Compliance with Form 990 PF

Failure to file the Form 990 PF or filing it inaccurately can result in significant penalties. The IRS may impose fines based on the foundation's size and the duration of non-compliance. Additionally, continued failure to meet filing requirements may jeopardize the foundation's tax-exempt status, leading to further financial and legal consequences.

Quick guide on how to complete form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

Complete Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation effortlessly on any device

Online document administration has become increasingly prevalent among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely preserve it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation without hassle

- Locate Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

No more worrying about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in a few clicks from any device you choose. Modify and eSign Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

Create this form in 5 minutes!

How to create an eSignature for the form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 990 pf form and how can airSlate SignNow help?

The 990 pf form is an essential document for private foundations, detailing financial information and compliance status. airSlate SignNow streamlines the signing process for the 990 pf form, allowing you to collect electronic signatures quickly and securely, ensuring timely submissions.

-

What features does airSlate SignNow offer for managing the 990 pf form?

airSlate SignNow includes key features for managing the 990 pf form such as customizable templates, automated workflows, and real-time tracking of document status. These features simplify the preparation and signing of the 990 pf, making the process efficient and hassle-free.

-

How does airSlate SignNow's pricing structure work for services related to the 990 pf?

The pricing for airSlate SignNow is competitive and tailored to fit various business needs, including those needing to manage the 990 pf form. Plans vary based on features and the number of users, ensuring you only pay for what you need when handling important documents like the 990 pf.

-

Can I integrate airSlate SignNow with my existing systems for 990 pf management?

Yes, airSlate SignNow supports integrations with various tools that can assist in the management of the 990 pf form, such as CRM systems and document management software. This seamless integration lets you enhance efficiency while ensuring compliance and easy access to important documents.

-

What are the benefits of using airSlate SignNow for the 990 pf form?

Using airSlate SignNow for the 990 pf form signNowly reduces turnaround time for document signing and enhances compliance. The platform offers a user-friendly interface, secure storage options, and the ability to track changes, ensuring your foundation meets all filing deadlines effortlessly.

-

Is airSlate SignNow secure for handling sensitive information on the 990 pf form?

Absolutely, airSlate SignNow prioritizes security when handling the 990 pf form and other sensitive documents. The platform complies with industry security standards, employing encryption and secure access controls to protect your private data throughout the signing process.

-

What kind of customer support does airSlate SignNow provide for 990 pf inquiries?

airSlate SignNow offers robust customer support to assist users with any inquiries regarding the 990 pf form, including live chat, email, and phone support. Our dedicated team is available to ensure your experience is smooth, addressing any challenges you may face while using the platform.

Get more for Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

- Sleep diary form university of utah health care healthcare utah

- Aetna managed dental specialty referral form for dmo

- Provider claim reconsideration form

- Occfit solutions order form

- Form authorization to release protected health information to metrohealth

- Avmed cobra form

- Authorization for release request of protected health form

- Ficlatuzumab wwo in patients wcetuximab resistant form

Find out other Form 990 PF Return Of Private Foundation Or Section 4947a1 Trust Treated As Private Foundation

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document