W 011 Form WT 11 Nonresident Entertainer Withholding Report

What is the W-011 Form WT-11 Nonresident Entertainer Withholding Report

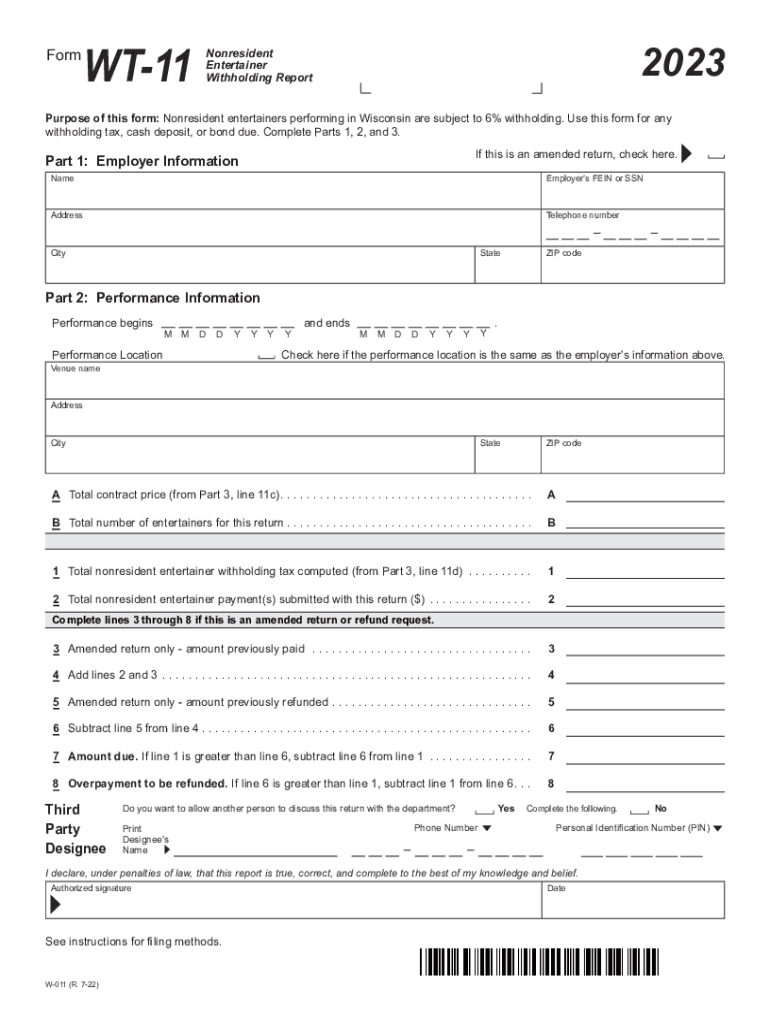

The W-011 Form WT-11 Nonresident Entertainer Withholding Report is a tax form used in the United States for reporting income earned by nonresident entertainers. This form is essential for ensuring compliance with U.S. tax laws, particularly for foreign artists, musicians, and performers who receive payments for their services in the country. It helps businesses and organizations to accurately withhold the appropriate amount of tax from payments made to nonresident entertainers, thereby fulfilling their tax obligations.

How to use the W-011 Form WT-11 Nonresident Entertainer Withholding Report

To use the W-011 Form WT-11, businesses must first determine if the entertainer qualifies as a nonresident for tax purposes. After confirming their status, the business should complete the form by providing necessary details such as the entertainer's name, address, and the amount paid. It is crucial to ensure that all information is accurate to avoid any issues with the IRS. Once completed, the form must be submitted along with the withheld taxes to the appropriate tax authority.

Steps to complete the W-011 Form WT-11 Nonresident Entertainer Withholding Report

Completing the W-011 Form WT-11 involves several key steps:

- Gather required information about the nonresident entertainer, including their legal name, address, and taxpayer identification number.

- Determine the total amount paid to the entertainer for their services.

- Calculate the appropriate withholding amount based on IRS guidelines for nonresident entertainers.

- Fill out the W-011 Form WT-11 with the gathered information, ensuring accuracy.

- Submit the form along with the withheld taxes to the IRS or state tax authority by the specified deadline.

Key elements of the W-011 Form WT-11 Nonresident Entertainer Withholding Report

The W-011 Form WT-11 includes several critical elements that must be accurately filled out:

- Entertainer's name and contact information.

- Details of the payment received, including the total amount and date of payment.

- Withholding tax amount calculated based on applicable rates.

- Signature of the person responsible for submitting the form, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the W-011 Form WT-11 are crucial to avoid penalties. Typically, the form must be submitted by the end of the month following the payment made to the nonresident entertainer. It is essential to keep track of these dates to ensure timely compliance with tax regulations. Additionally, any changes in tax laws or regulations should be monitored to stay informed about potential updates to filing requirements.

Penalties for Non-Compliance

Failure to properly complete and file the W-011 Form WT-11 can result in significant penalties. These may include fines for late submission, as well as potential interest on unpaid taxes. Businesses may also face scrutiny from the IRS, which can lead to further complications. It is vital for organizations to understand their responsibilities regarding withholding taxes and to ensure that they comply with all filing requirements to avoid these penalties.

Quick guide on how to complete w 011 form wt 11 nonresident entertainer withholding report

Complete W 011 Form WT 11 Nonresident Entertainer Withholding Report effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage W 011 Form WT 11 Nonresident Entertainer Withholding Report on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to edit and electronically sign W 011 Form WT 11 Nonresident Entertainer Withholding Report with ease

- Locate W 011 Form WT 11 Nonresident Entertainer Withholding Report and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign W 011 Form WT 11 Nonresident Entertainer Withholding Report and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 011 form wt 11 nonresident entertainer withholding report

Create this form in 5 minutes!

How to create an eSignature for the w 011 form wt 11 nonresident entertainer withholding report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

The W 011 Form WT 11 Nonresident Entertainer Withholding Report is a tax form used by businesses to report income paid to nonresident entertainers. This form ensures compliance with withholding tax regulations for nonresident performers. Using airSlate SignNow, you can easily manage and eSign this document, streamlining your reporting process.

-

How can airSlate SignNow help with the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the W 011 Form WT 11 Nonresident Entertainer Withholding Report. Our solution simplifies the document management process, ensuring that you can complete your tax reporting efficiently. With our features, you can track the status of your forms and maintain compliance effortlessly.

-

Is there a cost associated with using airSlate SignNow for the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our plans are designed to be cost-effective while providing all the necessary features for managing documents like the W 011 Form WT 11 Nonresident Entertainer Withholding Report. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the W 011 Form WT 11 Nonresident Entertainer Withholding Report. These features enhance your workflow, making it easier to manage tax documents efficiently. Additionally, our platform ensures that your data is secure and compliant with regulations.

-

Can I integrate airSlate SignNow with other software for the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow for the W 011 Form WT 11 Nonresident Entertainer Withholding Report. Whether you use accounting software or CRM systems, our integrations help you manage your documents seamlessly. This connectivity enhances productivity and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

Using airSlate SignNow for the W 011 Form WT 11 Nonresident Entertainer Withholding Report provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your core business activities. Additionally, you can access your documents anytime, anywhere, ensuring flexibility and convenience.

-

How secure is airSlate SignNow when handling the W 011 Form WT 11 Nonresident Entertainer Withholding Report?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the W 011 Form WT 11 Nonresident Entertainer Withholding Report. Our platform complies with industry standards, ensuring that your sensitive information remains safe and confidential throughout the signing process.

Get more for W 011 Form WT 11 Nonresident Entertainer Withholding Report

Find out other W 011 Form WT 11 Nonresident Entertainer Withholding Report

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free