1 Gross Proceeds from Lottery This Quarter from Li Form

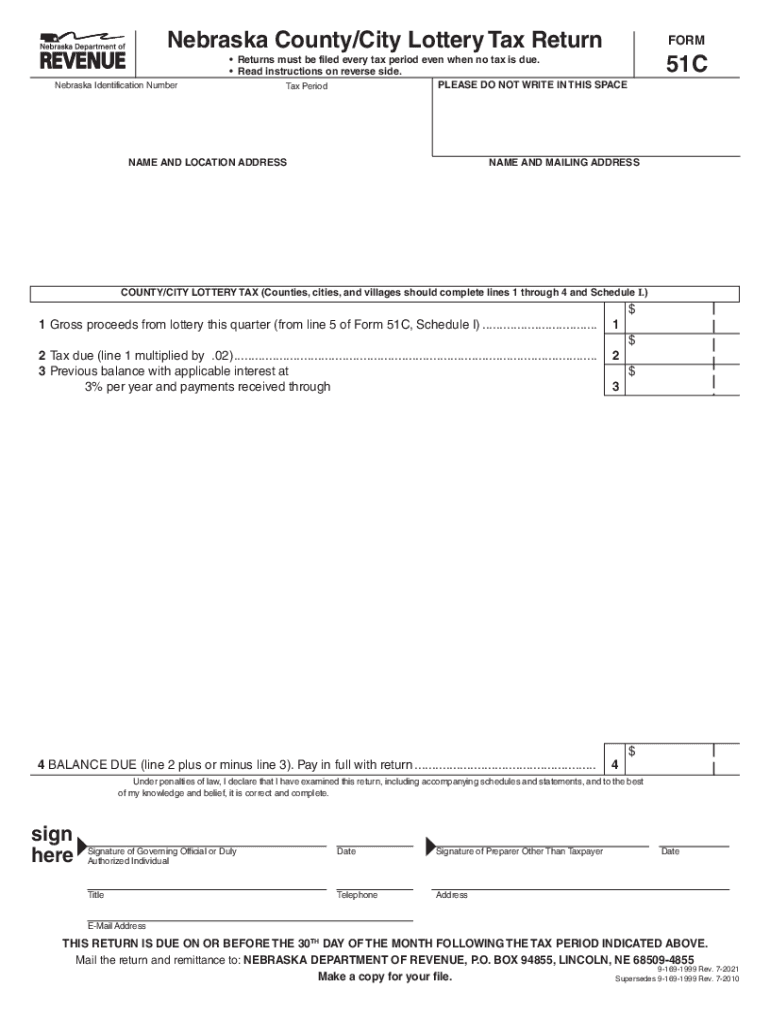

Understanding the 51c Lottery Tax Form

The 51c form, also known as the 51c lottery tax form, is essential for reporting gross proceeds from lottery winnings in the United States. This form is typically utilized by individuals or entities that have received lottery winnings and need to comply with state tax regulations. Understanding the purpose of this form is crucial for ensuring accurate reporting and compliance with tax obligations.

How to Complete the 51c Form

Filling out the 51c form involves several key steps. First, gather all necessary information regarding your lottery winnings, including the total amount won and any applicable deductions. Next, accurately enter this information into the designated fields on the form. Ensure that all figures are correct to avoid penalties or delays in processing. Finally, review the completed form for accuracy before submission.

Legal Considerations for the 51c Form

When using the 51c form, it is important to be aware of the legal implications associated with lottery winnings. This form serves as an official record for tax purposes, and failure to report winnings accurately can lead to penalties. Be sure to familiarize yourself with both federal and state tax laws regarding lottery winnings to ensure compliance.

Filing Deadlines for the 51c Form

Timely submission of the 51c form is crucial to avoid late fees and penalties. Generally, the form must be filed by the state’s tax deadline, which may vary depending on individual circumstances. It is advisable to check with the Nebraska Department of Revenue or your local tax authority for specific deadlines related to the 51c form.

Required Documents for Filing the 51c Form

To successfully file the 51c form, certain documents are typically required. These may include proof of lottery winnings, identification documents, and any previous tax returns that may be relevant. Having these documents readily available can streamline the filing process and ensure that all necessary information is submitted.

Submission Methods for the 51c Form

The 51c form can be submitted through various methods, including online submission, mail, or in-person delivery to the appropriate tax authority. Each method has its own advantages, such as the speed of online filing versus the traditional approach of mailing a paper form. Choose the method that best suits your needs and ensures timely processing of your tax obligations.

Examples of 51c Form Usage

Understanding how the 51c form is used in practical scenarios can provide clarity on its importance. For instance, an individual who wins a significant lottery prize must report this income using the 51c form to comply with state tax laws. Similarly, businesses that receive lottery proceeds must also use this form to report their earnings accurately. These examples highlight the necessity of the 51c form in various contexts.

Quick guide on how to complete 1 gross proceeds from lottery this quarter from li

Finish 1 Gross Proceeds From Lottery This Quarter From Li effortlessly on any gadget

Web-based document management has become increasingly common among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage 1 Gross Proceeds From Lottery This Quarter From Li on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to alter and electronically sign 1 Gross Proceeds From Lottery This Quarter From Li with ease

- Locate 1 Gross Proceeds From Lottery This Quarter From Li and click Get Form to begin.

- Employ the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1 Gross Proceeds From Lottery This Quarter From Li and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1 gross proceeds from lottery this quarter from li

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 51c in relation to airSlate SignNow?

The term '51c' refers to a specific feature set within airSlate SignNow that enhances document signing and management. This feature allows users to streamline their workflows, making it easier to send and eSign documents efficiently. By utilizing 51c, businesses can improve their overall productivity and reduce turnaround times.

-

How does airSlate SignNow's 51c feature improve document security?

The 51c feature in airSlate SignNow includes advanced security measures such as encryption and secure access controls. This ensures that all documents are protected during the signing process, safeguarding sensitive information. With 51c, businesses can confidently manage their documents without compromising on security.

-

What are the pricing options for airSlate SignNow's 51c feature?

airSlate SignNow offers competitive pricing plans that include access to the 51c feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality. This flexibility allows businesses of all sizes to find a plan that fits their budget while leveraging the benefits of 51c.

-

Can I integrate airSlate SignNow's 51c feature with other applications?

Yes, the 51c feature in airSlate SignNow supports integrations with a wide range of applications, enhancing its functionality. This allows users to connect their existing tools and streamline their workflows seamlessly. By integrating 51c with other platforms, businesses can create a more cohesive document management system.

-

What benefits does the 51c feature provide for remote teams?

The 51c feature in airSlate SignNow is particularly beneficial for remote teams, as it enables easy document sharing and signing from anywhere. This flexibility ensures that team members can collaborate effectively, regardless of their location. With 51c, remote teams can maintain productivity and keep projects moving forward.

-

Is training available for using the 51c feature in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive training resources for users to get acquainted with the 51c feature. These resources include tutorials, webinars, and customer support to ensure that users can maximize the benefits of 51c. Training helps businesses implement the feature effectively and enhance their document workflows.

-

How does the 51c feature enhance user experience?

The 51c feature in airSlate SignNow is designed with user experience in mind, offering an intuitive interface that simplifies document management. Users can easily navigate through the signing process, reducing the learning curve for new users. This focus on usability ensures that businesses can adopt 51c quickly and efficiently.

Get more for 1 Gross Proceeds From Lottery This Quarter From Li

- Construction permit application form city of atchison

- Global placement application form

- Locksmith key code books download form

- Bacs form template

- Sbl from fill form

- Ez custom measurement form for flat knit stockings

- Maine certificate of discharge of estate tax lien form

- Joint product development agreement template form

Find out other 1 Gross Proceeds From Lottery This Quarter From Li

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document