If Your Parents Did Not File a IRS Income Tax Return, Please Indicate that below and Attach Copies of ALL IRS W 2 or 1099 Forms

Understanding the IRS Income Tax Return Requirement

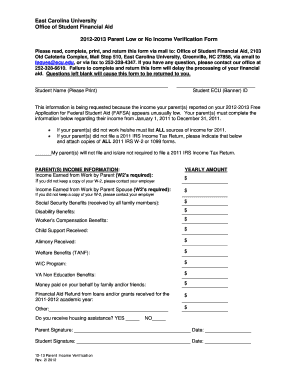

The statement regarding "If Your Parents Did Not File A IRS Income Tax Return, Please Indicate That Below And Attach Copies Of ALL IRS W-2 Or 1099 Forms Ecu" is crucial for individuals who may be applying for financial aid or other benefits. This statement indicates that if your parents did not file a tax return, you must provide documentation of their income through IRS W-2 or 1099 forms. These forms serve as proof of income and are essential for assessing eligibility for various programs.

Steps to Complete the IRS Income Tax Return Statement

Completing the statement involves several key steps:

- Gather all relevant IRS W-2 and 1099 forms from your parents for the tax year in question.

- Clearly indicate on the form that your parents did not file an IRS income tax return.

- Attach copies of the W-2 or 1099 forms to the completed statement.

- Review the entire document for accuracy before submission.

Required Documentation for the IRS Income Tax Return Statement

When filling out the statement, it is essential to include the following documentation:

- Copies of all IRS W-2 forms that report wages earned by your parents.

- Copies of all IRS 1099 forms that report other income sources, such as freelance work or interest income.

- Any additional documentation that may help clarify your parents' financial situation.

Legal Implications of Not Filing a Tax Return

Not filing an IRS income tax return can have legal implications for your parents. It may affect their eligibility for certain benefits and could lead to penalties from the IRS. Understanding these implications is important, especially when applying for financial aid or other forms of support that require accurate income reporting.

IRS Guidelines for Income Reporting

The IRS provides specific guidelines regarding income reporting and tax filing requirements. If your parents earned below a certain income threshold, they may not have been required to file a tax return. However, it is still necessary to report their income accurately when requested, especially in contexts like financial aid applications.

Submission Methods for the IRS Income Tax Return Statement

The completed statement, along with the attached W-2 or 1099 forms, can typically be submitted in several ways:

- Online submission through the relevant financial aid or application portal.

- Mailing the documents to the designated office or agency.

- In-person submission, if applicable, at the local office handling your application.

Examples of Scenarios Involving the IRS Income Tax Return Statement

There are various scenarios where this statement may be relevant:

- A student applying for federal financial aid who comes from a household where parents did not file taxes.

- An individual seeking assistance programs that require proof of income but whose parents have not filed a tax return.

- Cases where parents are self-employed and have income that is documented through W-2 or 1099 forms but did not file a return.

Quick guide on how to complete if your parents did not file a irs income tax return please indicate that below and attach copies of all irs w 2 or 1099 forms

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign [SKS] without any hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to secure your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to If Your Parents Did Not File A IRS Income Tax Return, Please Indicate That Below And Attach Copies Of ALL IRS W 2 Or 1099 Forms

Create this form in 5 minutes!

How to create an eSignature for the if your parents did not file a irs income tax return please indicate that below and attach copies of all irs w 2 or 1099 forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if my parents did not file an IRS income tax return?

If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU. This information is crucial for processing your application accurately and efficiently.

-

How does airSlate SignNow help with document signing?

airSlate SignNow empowers businesses to send and eSign documents seamlessly. If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU to ensure all necessary documentation is included.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to essential features, including eSigning and document management. If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU for accurate processing.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates with numerous applications to enhance your workflow. This allows for a more streamlined process when handling documents. If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU to ensure all relevant information is captured.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools help simplify the signing process for users. If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU for comprehensive documentation.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security with encryption and compliance with industry standards. You can trust that your documents, including those related to IRS income tax returns, are handled securely. If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU.

-

How can I get support if I have questions about airSlate SignNow?

airSlate SignNow provides excellent customer support through various channels, including live chat and email. Our team is ready to assist you with any inquiries. If your parents did not file an IRS income tax return, please indicate that below and attach copies of ALL IRS W-2 or 1099 forms ECU for specific guidance.

Get more for If Your Parents Did Not File A IRS Income Tax Return, Please Indicate That Below And Attach Copies Of ALL IRS W 2 Or 1099 Forms

- Wwwsignnowcomfill and sign pdf form105246 it 635it 635 fill out and sign printable pdf templatesignnow

- Form it 640 start up ny telecommunication services excise tax credit tax year 2021

- Form it 135 sales and use tax report for purchases of items and services costing 25000 or more tax year 2021

- Form it 236 credit for taxicabs and livery service vehicles

- Fillable online tax ny tax law article 9 a it 204 cp new form

- Instructions for form it 217 claim for farmers school tax

- Form it 249 claim for long term care insurance credit tax year 2021

- Form it 212 att claim for historic barn rehabilitation credit

Find out other If Your Parents Did Not File A IRS Income Tax Return, Please Indicate That Below And Attach Copies Of ALL IRS W 2 Or 1099 Forms

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure