Formulario 4807 Oe 2008

What is the Formulario 4807 Oe

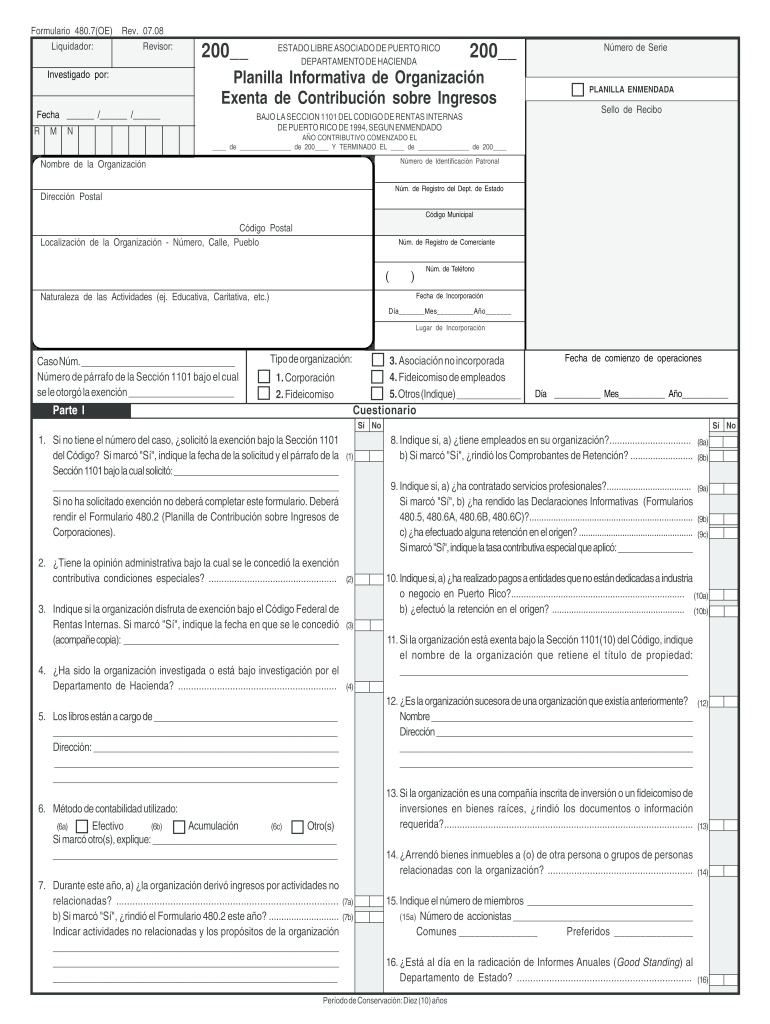

The Formulario 4807 Oe is a specific tax form used in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is designed to facilitate the accurate reporting of income and deductions, ensuring compliance with federal tax regulations. It is essential for individuals and businesses to understand the purpose of this form to avoid potential issues during tax filing.

How to use the Formulario 4807 Oe

Using the Formulario 4807 Oe involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and records of deductions. Next, access the form through an authorized platform or the IRS website. Fill out the required fields with accurate information. Once completed, review the form for any errors before signing and submitting it. Utilizing eSignature solutions can streamline this process, making it easier to manage and submit your tax documents securely.

Steps to complete the Formulario 4807 Oe

Completing the Formulario 4807 Oe requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Access the Formulario 4807 Oe online or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections.

- Include any applicable deductions or credits.

- Review the completed form for accuracy.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the form electronically or mail it to the appropriate IRS address.

Legal use of the Formulario 4807 Oe

The Formulario 4807 Oe must be used in accordance with IRS regulations to ensure its legal validity. This form is legally recognized when completed accurately and submitted within the designated deadlines. It is crucial to adhere to all federal guidelines to avoid penalties or issues with tax compliance. Utilizing eSignature options can provide an additional layer of security and legitimacy to your submission, as electronic signatures are recognized under the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 4807 Oe are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to stay informed about any changes to deadlines due to special circumstances, such as extensions granted during emergencies or natural disasters, which can affect filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The Formulario 4807 Oe can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically using authorized e-filing services, which can expedite processing times.

- Mail: The form can be printed, completed, and mailed to the appropriate IRS address. Ensure that you use the correct mailing address based on your location and the type of return.

- In-Person: Some taxpayers may choose to deliver their forms in person at designated IRS offices, though this method is less common.

Quick guide on how to complete formulario 4807 oe 2008

Your assistance manual on how to prepare your Formulario 4807 Oe

If you’re seeking guidance on how to complete and submit your Formulario 4807 Oe, here are some brief instructions on how to make tax processing simpler.

To begin, you only need to set up your airSlate SignNow account to revolutionize your approach to managing documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to modify, draft, and finalize your tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and return to modify answers as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and convenient sharing.

Follow the instructions below to finalize your Formulario 4807 Oe in just a few minutes:

- Create your account and start editing PDFs in moments.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Formulario 4807 Oe in our editor.

- Complete the required fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Please be aware that filing on paper can lead to increased errors and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct formulario 4807 oe 2008

FAQs

-

I own a 2008 Honda Civic. When going to do an oil change, I felt air pressure out of the oil fill area. Is this sign of the engine being worn out?

the engine was running when you put your hand over the oil filler? did you cover the filler completely allowing pressure to build? Or just feel air pulsing out against your skin as it the engine was running?some pressure is normal. The Valve Cover has a vent on top, attached to a tube. This captures any Hydro Carbon vapours (crank case ventilation) that would normally escape from the valve cover and go into the atmosphere. The Positive Crank Case Ventilation or PCV for short is part of the EVAP system. Or Evaporative Emissions System. These vapours are filtered and re introduced into the air going in to the engine to be burned with the gasoline. if you had excessive Crank Case pressure, an oil leak would develop from the weaker gaskets on the engine, such as the Valve Cover gasket. So, if you don't have any noticeable oil leaks coming from the Valve Cover gasket, this is Normal Crank Case pressure. Your engine is not worn out.Your Ford F-150 may have a bigger vent for Crank Case pressure (reducing the pressure) or may even vent this pressure to atmosphere. Instead of capturing the Hydro Carbons and combusting them. Honda engines are quite Eco friendly. I'm willing to bet the Honda EVAP system is doing a better job at recycling otherwise un used Hydro Carbons than the Ford is. I wouldn't worry about it.

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

How do you find out if a company is open to using a staffing agency to fill positions?

Get an introduction to the target company through a referral if possible. A lot of the companies that retain us even talk explicitly about "no agency referrals" on their website. There are times that going in through HR or their staffing org can be to your benefit but more often that not it helps to have a referral with a "VP" in their title to get you that introduction. You might still be a long way from getting a fee agreement signed (retained or contingent) but you'll be a lot close than being one of the hundreds of agency recruiters leaving voicemails for the VP HR or Staffing Manager.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Musicians: How many songs do you think you'd need to perform to fill out a two-hour gig?

A two-hour gig? That's 120 minutes of on stage performance or setup inclusion? I'll go with stage time, and also assume you've negotiated appropriate setup, and such.Another assumption is genre. I'll assume it's pop structured (as most radio friendly music is these days), so average song time would be roughly 3 and a half minutes…give or take.You're looking at roughly 30 songs. Thats…over 2 hours. Now, that's a rough estimate, as song times vary, etc.Oh, but wait. You'll need to include breaks, for “personnel” i.e. the band members. Normally, the drummer will need the longest break, followed by others. The drummer is using all four limbs continuously, so…they need them.If you're headlining, and depending on what you've negotiated, you might not be allotted “dead air”, so someone's staying on stage on breaks. Usually, that means at least a guitar player and/or the singer. Maybe not a long guitar solo, but…maybe an acoustic filler/singalong for the crowd. Plus, in between banter, there's that too (paring that down was always a plus for us back in the day)So, practice 30ish and get them flawless, because you're only going to need 20ish. Why 30ish? Because…more is good for flexibility. Always. Plus, it allows you to keep your set list semi-”fresh”, while only putting in a little extra work.setlist.fm - the setlist wiki is a good resource for structuring a setlist in a professional way (I wish it was around during the “trial and error” days.)

Create this form in 5 minutes!

How to create an eSignature for the formulario 4807 oe 2008

How to make an electronic signature for the Formulario 4807 Oe 2008 in the online mode

How to generate an electronic signature for the Formulario 4807 Oe 2008 in Chrome

How to generate an electronic signature for signing the Formulario 4807 Oe 2008 in Gmail

How to create an eSignature for the Formulario 4807 Oe 2008 straight from your mobile device

How to make an eSignature for the Formulario 4807 Oe 2008 on iOS devices

How to make an electronic signature for the Formulario 4807 Oe 2008 on Android

People also ask

-

What is Formulario 4807 Oe?

Formulario 4807 Oe is a specialized document used for various official processes. It serves as a formal request or application form, often required by businesses and individuals to comply with specific regulatory requirements. Understanding how to properly fill out and submit Formulario 4807 Oe is crucial for ensuring compliance and efficient processing.

-

How can airSlate SignNow help with Formulario 4807 Oe?

airSlate SignNow provides a seamless platform for sending and eSigning Formulario 4807 Oe. With its user-friendly interface, you can easily upload, edit, and send your documents for electronic signatures, ensuring a smooth and efficient workflow. This not only saves time but also enhances the security of your important documents.

-

What are the pricing options for using airSlate SignNow for Formulario 4807 Oe?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users, whether for individuals or businesses. You can choose from various subscription tiers based on your usage and feature requirements for handling Formulario 4807 Oe. Each plan ensures that you get the most value for your investment in document management solutions.

-

What features does airSlate SignNow offer for managing Formulario 4807 Oe?

airSlate SignNow includes a variety of features that streamline the management of Formulario 4807 Oe. Key features include customizable templates, real-time tracking of document status, automated reminders for signers, and secure cloud storage. These tools empower you to handle your documents more efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for Formulario 4807 Oe?

Yes, airSlate SignNow offers seamless integration with a broad range of applications, enhancing your ability to manage Formulario 4807 Oe. You can connect it with popular tools like Google Drive, Salesforce, and Microsoft Office, allowing you to work within your preferred environment while ensuring that your documents are accessible and easily managed.

-

What are the benefits of using airSlate SignNow for Formulario 4807 Oe?

Using airSlate SignNow for Formulario 4807 Oe offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signing process reduces the time it takes to finalize documents, while robust security measures protect sensitive information. Additionally, the platform's ease of use means anyone can quickly learn to manage their documents effectively.

-

Is airSlate SignNow secure for handling Formulario 4807 Oe?

Absolutely! airSlate SignNow employs top-notch security protocols to ensure that your Formulario 4807 Oe and other documents are safe. With features like encrypted signatures and secure cloud storage, you can trust that your sensitive information remains confidential and protected from unauthorized access.

Get more for Formulario 4807 Oe

Find out other Formulario 4807 Oe

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form