Fillin Tax Abatement Form Brazoria County

What is the Fillin Tax Abatement Form Brazoria County

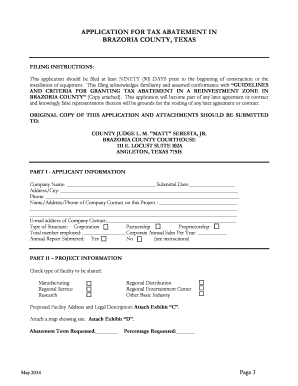

The Fillin Tax Abatement Form Brazoria County is a legal document used by property owners in Brazoria County, Texas, to apply for tax abatement on their property taxes. This form is designed to provide financial relief to eligible property owners who meet specific criteria set by the county. Tax abatement can reduce the amount of property tax owed, making it an important tool for homeowners and businesses looking to manage their tax liabilities effectively.

Steps to complete the Fillin Tax Abatement Form Brazoria County

Completing the Fillin Tax Abatement Form Brazoria County involves several key steps:

- Gather necessary information, including your property details, tax identification number, and any supporting documentation required.

- Download the form from the official Brazoria County website or obtain a physical copy from the county office.

- Carefully fill out the form, ensuring all sections are completed accurately to avoid delays.

- Attach any required documents, such as proof of income or property ownership, as specified in the form instructions.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the designated method, whether online, by mail, or in person at the county office.

Eligibility Criteria

To qualify for tax abatement in Brazoria County, applicants must meet specific eligibility criteria. Generally, these may include:

- Ownership of the property for which tax abatement is being sought.

- Compliance with local zoning and building regulations.

- Demonstrating financial need or meeting income thresholds as defined by the county.

- Utilization of the property for approved purposes, such as residential or commercial use that aligns with county development goals.

Required Documents

When completing the Fillin Tax Abatement Form Brazoria County, applicants must provide several supporting documents. Commonly required documents include:

- Proof of property ownership, such as a deed or title.

- Recent property tax statements.

- Financial statements or income verification, if applicable.

- Any additional documentation requested on the form itself.

Form Submission Methods

The Fillin Tax Abatement Form Brazoria County can be submitted through various methods, ensuring convenience for applicants. The available submission options typically include:

- Online submission through the Brazoria County website, if available.

- Mailing the completed form and supporting documents to the designated county office.

- In-person submission at the Brazoria County tax office during business hours.

Legal use of the Fillin Tax Abatement Form Brazoria County

The Fillin Tax Abatement Form Brazoria County is legally binding and must be used in accordance with the regulations set forth by the county. Proper use of the form ensures that applicants can receive the tax benefits they are entitled to while adhering to local laws. Misuse of the form or providing false information can lead to penalties, including denial of the application or legal repercussions.

Quick guide on how to complete fillin tax abatement form brazoria county

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents swiftly without hindrances. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most efficient way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new paper copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Fillin Tax Abatement Form Brazoria County

Create this form in 5 minutes!

How to create an eSignature for the fillin tax abatement form brazoria county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fillin Tax Abatement Form Brazoria County?

The Fillin Tax Abatement Form Brazoria County is a document that allows property owners to apply for tax abatements in Brazoria County. This form helps reduce property taxes for eligible properties, making it a valuable tool for homeowners and businesses looking to save on taxes.

-

How can airSlate SignNow help with the Fillin Tax Abatement Form Brazoria County?

airSlate SignNow simplifies the process of completing and submitting the Fillin Tax Abatement Form Brazoria County. With our platform, you can easily fill out the form, eSign it, and send it directly to the relevant authorities, ensuring a smooth and efficient submission process.

-

Is there a cost associated with using airSlate SignNow for the Fillin Tax Abatement Form Brazoria County?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions ensure that you can efficiently manage the Fillin Tax Abatement Form Brazoria County without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for the Fillin Tax Abatement Form Brazoria County?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and secure document storage. These features make it easy to manage the Fillin Tax Abatement Form Brazoria County and ensure that your documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other applications for the Fillin Tax Abatement Form Brazoria County?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Fillin Tax Abatement Form Brazoria County. This means you can connect with tools you already use, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the Fillin Tax Abatement Form Brazoria County?

Using airSlate SignNow for the Fillin Tax Abatement Form Brazoria County provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform ensures that your forms are completed correctly and submitted on time, helping you maximize your tax savings.

-

Is airSlate SignNow user-friendly for filling out the Fillin Tax Abatement Form Brazoria County?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to fill out the Fillin Tax Abatement Form Brazoria County, regardless of their technical skills, ensuring a hassle-free experience.

Get more for Fillin Tax Abatement Form Brazoria County

Find out other Fillin Tax Abatement Form Brazoria County

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice