Form 433 F 2019-2026

What is the Form 433 F

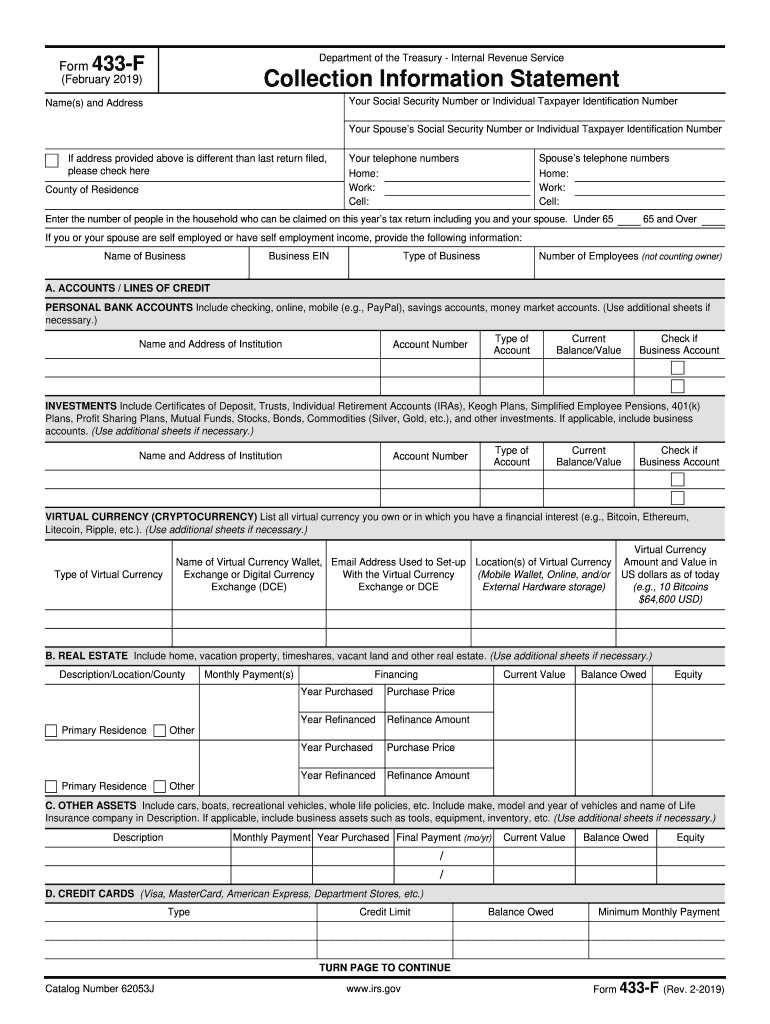

The IRS Form 433 F is a financial statement used by individuals to provide the Internal Revenue Service with a detailed overview of their financial situation. This form is primarily utilized during the process of negotiating tax debts, allowing taxpayers to demonstrate their ability to pay or request a payment plan. It includes information about income, expenses, assets, and liabilities, which helps the IRS assess a taxpayer's financial hardship and determine the appropriate course of action regarding their tax obligations.

How to use the Form 433 F

Using the IRS Form 433 F involves several steps. First, gather all necessary financial information, including income sources, monthly expenses, and details about assets and debts. Next, accurately fill out the form, ensuring that all sections are completed with the correct information. Once the form is filled, it can be submitted to the IRS as part of a request for a payment plan or an offer in compromise. It is essential to keep a copy of the completed form for personal records and future reference.

Steps to complete the Form 433 F

Completing the IRS Form 433 F requires careful attention to detail. Follow these steps for accurate completion:

- Gather financial documents, including pay stubs, bank statements, and bills.

- Provide your personal information, including name, address, and Social Security number.

- Detail your income by listing all sources, such as wages, self-employment income, and any other earnings.

- Outline your monthly expenses, including housing, utilities, and transportation costs.

- List your assets, such as bank accounts, real estate, and vehicles.

- Document your liabilities, including loans and credit card debts.

- Review the completed form for accuracy before submission.

Key elements of the Form 433 F

The IRS Form 433 F includes several key elements that are crucial for accurately representing a taxpayer's financial situation. These elements consist of:

- Personal Information: Basic details such as name, address, and Social Security number.

- Income Information: A comprehensive list of all income sources, including wages and other earnings.

- Expense Breakdown: A detailed account of monthly living expenses.

- Asset Disclosure: Information about owned assets, including cash, property, and vehicles.

- Liabilities: A list of all outstanding debts and obligations.

Form Submission Methods

The IRS Form 433 F can be submitted through various methods, depending on the taxpayer's preference and the IRS guidelines. The available submission methods include:

- Online Submission: If applicable, taxpayers may be able to submit the form electronically through the IRS website.

- Mail: The completed form can be printed and mailed to the appropriate IRS office.

- In-Person: Taxpayers may also have the option to deliver the form in person at their local IRS office.

Legal use of the Form 433 F

The IRS Form 433 F is legally recognized for use in negotiating tax debts and establishing payment plans. It is essential that taxpayers provide accurate and truthful information on the form, as any discrepancies may lead to penalties or complications in the negotiation process. The form serves as a formal declaration of financial status, which the IRS uses to make informed decisions about tax relief options for individuals facing financial hardship.

Quick guide on how to complete form 433 f collection information statement irsgov

Discover the simplest method to complete and endorse your Form 433 F

Are you still spending time assembling your official paperwork on physical copies instead of online? airSlate SignNow offers a superior way to complete and endorse your Form 433 F and associated forms for public services. Our advanced electronic signature platform provides you with all the tools you need to handle documentation quickly and in line with official standards - robust PDF editing, managing, securing, signing, and sharing functionalities are all available within a user-friendly interface.

There are just a few steps required to complete to fill out and endorse your Form 433 F:

- Upload the fillable template to the editor using the Get Form button.

- Verify what details you need to include in your Form 433 F.

- Navigate between the fields using the Next option to avoid missing anything.

- Utilize Text, Checkbox, and Cross tools to complete the fields with your information.

- Edit the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using your preferred method.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your completed Form 433 F in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our platform also offers versatile file sharing. There’s no need to print your forms when you need to send them to the appropriate public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 433 f collection information statement irsgov

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

Create this form in 5 minutes!

How to create an eSignature for the form 433 f collection information statement irsgov

How to create an eSignature for your Form 433 F Collection Information Statement Irsgov online

How to make an electronic signature for your Form 433 F Collection Information Statement Irsgov in Chrome

How to create an eSignature for signing the Form 433 F Collection Information Statement Irsgov in Gmail

How to make an electronic signature for the Form 433 F Collection Information Statement Irsgov right from your smart phone

How to generate an electronic signature for the Form 433 F Collection Information Statement Irsgov on iOS

How to create an eSignature for the Form 433 F Collection Information Statement Irsgov on Android OS

People also ask

-

What is the purpose of form 433 f?

The form 433 f is used by taxpayers to provide comprehensive financial information to the IRS. This form helps the IRS assess a taxpayer's financial situation, which is crucial for creating manageable payment plans or settling tax debts. Understanding the details on the form 433 f is essential for maintaining compliance and securing favorable outcomes.

-

How can airSlate SignNow help with the submission of form 433 f?

Using airSlate SignNow, you can easily prepare, send, and eSign your form 433 f quickly and securely. Our platform streamlines the entire process, allowing you to fill out the form digitally and keep track of its status. This eliminates the hassle of traditional paperwork and ensures that your submission is timely and accurate.

-

Is airSlate SignNow affordable for businesses needing to file form 433 f?

Yes, airSlate SignNow offers a cost-effective solution for businesses that need to manage documents like form 433 f. Our pricing plans are designed to fit various business sizes and needs, ensuring that you have access to powerful eSigning features without breaking the bank. Start with a free trial to see how it can benefit your financial processes.

-

What features does airSlate SignNow provide for managing form 433 f?

AirSlate SignNow offers numerous features that facilitate the efficient handling of form 433 f. You can utilize template saving, real-time tracking, and document sharing capabilities. These features minimize errors and improve collaboration, making sure all stakeholders are informed throughout the process.

-

Can I integrate airSlate SignNow with other tools when working on form 433 f?

Absolutely! AirSlate SignNow supports seamless integrations with various CRM, accounting, and document management systems. This means you can work on your form 433 f within your existing workflow, streamlining your operations and enhancing productivity without needing to switch between multiple applications.

-

What are the benefits of using airSlate SignNow for form 433 f eSigning?

Using airSlate SignNow for the eSigning process of form 433 f offers numerous benefits, including enhanced security and faster turnaround times. Our platform employs advanced encryption to protect sensitive data, ensuring your financial information remains secure. Additionally, you can expect a quicker completion of documents, allowing for timely submissions to the IRS.

-

Is it easy to track the status of form 433 f with airSlate SignNow?

Yes, airSlate SignNow makes tracking the status of your form 433 f straightforward. You receive real-time notifications and updates whenever the document is viewed, signed, or completed. This transparency keeps you informed throughout the process and helps you take necessary actions promptly.

Get more for Form 433 F

- Teejay maths book 3a pdf form

- Fullerton college request transcripts form

- Review for grade 9 math exam unit 6 linear equations and blogs vsb bc form

- Teacher mini grant request form files

- Tenure amp promotion transmital form

- Gid 37 c doc gainsurance form

- Wake county inspections permits 336 fayetteville form

- Supplier distributor agreement template form

Find out other Form 433 F

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure