4333f Irs Code Form 2003

What is the 4333f Irs Code Form

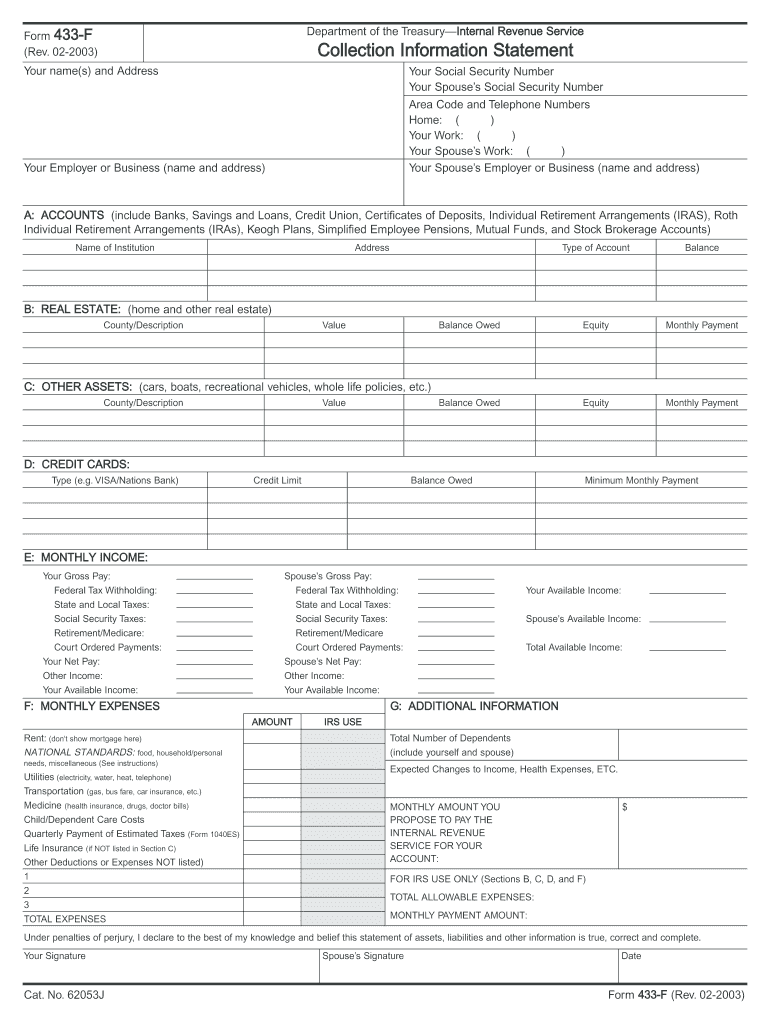

The 4333f IRS Code Form is a specific document used by taxpayers to report certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It typically includes details regarding income, deductions, and credits that affect tax liability. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the 4333f Irs Code Form

Using the 4333f IRS Code Form involves several steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, accurately fill out the form by entering the required information in each section. It is important to double-check all entries for accuracy to avoid potential issues with the IRS. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific instructions provided by the IRS.

Steps to complete the 4333f Irs Code Form

Completing the 4333f IRS Code Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Start filling out the form by entering your personal information at the top.

- Provide details about your income, including wages and any additional earnings.

- List any deductions you are eligible for, ensuring you have documentation to support each claim.

- Review the form thoroughly for accuracy and completeness.

- Submit the form according to IRS guidelines, either electronically or by mailing it to the appropriate address.

Legal use of the 4333f Irs Code Form

The legal use of the 4333f IRS Code Form is governed by federal tax laws. It is important to ensure that the form is filled out truthfully and accurately, as providing false information can lead to penalties. The IRS requires that all forms be submitted by specific deadlines to avoid additional fees. Understanding the legal implications of this form helps ensure compliance and protects taxpayers from potential audits or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 4333f IRS Code Form are critical for compliance. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website or consult a tax professional for the most current deadlines and any changes that may occur in tax law.

Form Submission Methods (Online / Mail / In-Person)

The 4333f IRS Code Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers opt to file electronically through authorized e-filing services, which can streamline the process.

- Mail: The form can be printed and mailed to the appropriate IRS address. Ensure to use the correct postage and keep a copy for your records.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete 4333f irs code 2003 form

Complete 4333f Irs Code Form effortlessly on any gadget

Web-based document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents rapidly and without interruptions. Manage 4333f Irs Code Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign 4333f Irs Code Form with ease

- Locate 4333f Irs Code Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 4333f Irs Code Form and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4333f irs code 2003 form

Create this form in 5 minutes!

How to create an eSignature for the 4333f irs code 2003 form

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the 4333f IRS Code Form and its significance?

The 4333f IRS Code Form is used by businesses and individuals to report financial information and request a collection due process hearing. Understanding this form is crucial for proper tax compliance and financial management.

-

How does airSlate SignNow facilitate the signing of the 4333f IRS Code Form?

AirSlate SignNow allows users to easily upload, sign, and send the 4333f IRS Code Form electronically. This streamlines the process, saving time and ensuring that documents are signed securely and in compliance with IRS regulations.

-

What are the key features of airSlate SignNow for handling the 4333f IRS Code Form?

Key features include easy document uploads, customizable templates, in-app signing, and real-time tracking of document status. These features enhance the efficiency of managing the 4333f IRS Code Form and other important documents.

-

Is airSlate SignNow a cost-effective solution for managing the 4333f IRS Code Form?

Yes, airSlate SignNow offers competitive pricing plans designed to fit various budgets, making it a cost-effective solution for businesses needing to handle the 4333f IRS Code Form. This includes options for individuals and large enterprises alike.

-

Can I integrate airSlate SignNow with other software when dealing with the 4333f IRS Code Form?

Absolutely! AirSlate SignNow easily integrates with popular applications such as Google Drive, Dropbox, and many CRM systems. This allows for smoother workflows involving the 4333f IRS Code Form and related documents.

-

What security measures does airSlate SignNow use for the 4333f IRS Code Form?

AirSlate SignNow employs top-notch security measures, including end-to-end encryption and secure cloud storage, to keep the information on the 4333f IRS Code Form safe. This ensures that your sensitive data remains confidential and protected.

-

How can airSlate SignNow improve efficiency in processing the 4333f IRS Code Form?

By using airSlate SignNow, users can reduce the time it takes to get the 4333f IRS Code Form signed and returned. Automated reminders, templates, and mobile accessibility ensure that the process is swift and convenient.

Get more for 4333f Irs Code Form

- Llc notices resolutions and other operations forms package illinois

- Illinois realtors real property disclosure form

- Notice of dishonored check civil keywords bad check bounced check illinois form

- Mutual wills containing last will and testaments for unmarried persons living together with no children illinois form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children illinois form

- Mutual wills or last will and testaments for unmarried persons living together with minor children illinois form

- Illinois non marital 497306259 form

- Il procedure form

Find out other 4333f Irs Code Form

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free