Illinois Payment 2018

What is the Illinois Payment?

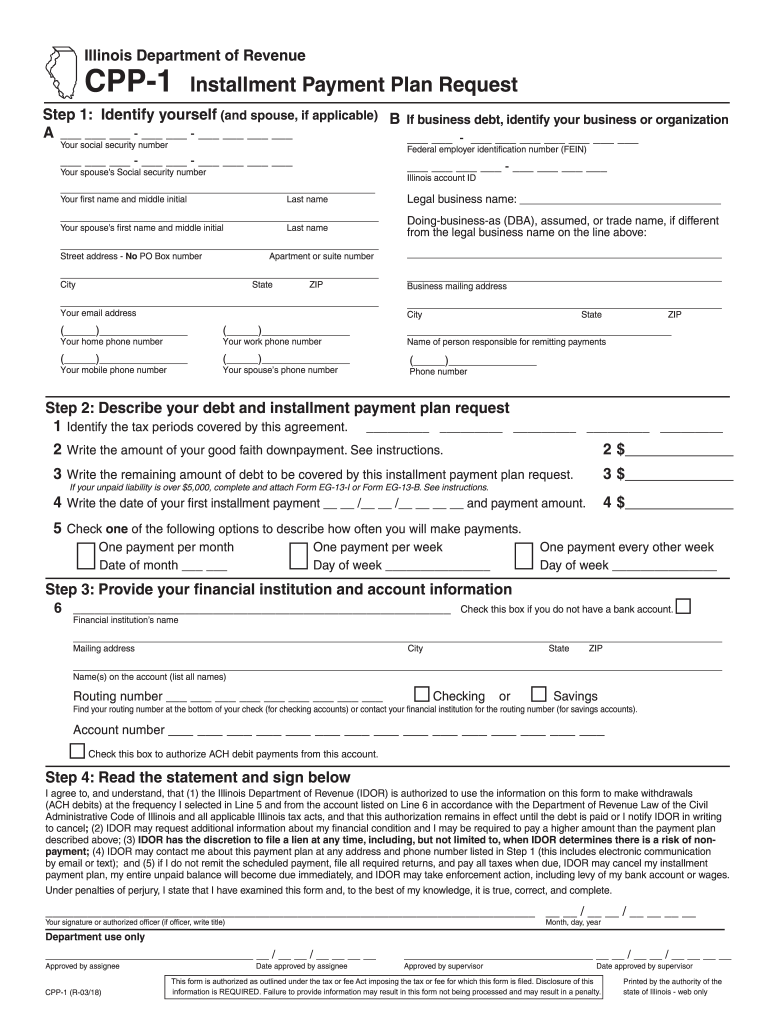

The Illinois Payment refers to the payment plan established by the Illinois Department of Revenue for taxpayers who need assistance in managing their tax liabilities. This plan allows individuals to make installment payments on their tax obligations, providing a structured approach to settle outstanding amounts over time. Utilizing the cpp 1 form, taxpayers can formally request to enter into this payment arrangement, ensuring compliance with state tax regulations.

Steps to Complete the Illinois Payment

To complete the Illinois Payment process, follow these steps:

- Gather necessary financial information, including your total tax liability and any previous payments made.

- Access the cpp 1 form through the official tax Illinois government website.

- Fill out the form accurately, providing details such as your name, address, and the amount you wish to pay.

- Review the form for completeness and accuracy to avoid delays.

- Submit the completed form online or via mail, as per the provided instructions.

Legal Use of the Illinois Payment

The Illinois Payment plan is legally sanctioned by the Illinois Department of Revenue, allowing taxpayers to fulfill their tax obligations while managing their financial situation. By utilizing the cpp 1 form, individuals can ensure that their payment plan is recognized and protected under state law, safeguarding them from potential penalties associated with non-compliance.

Required Documents

When applying for the Illinois Payment plan using the cpp 1 form, certain documents may be required to support your application. These typically include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of any existing debts or financial obligations.

- Identification documents, such as a driver's license or Social Security number.

Form Submission Methods

Taxpayers can submit the cpp 1 form through various methods, ensuring flexibility based on individual preferences. The available submission options include:

- Online submission via the Illinois Department of Revenue website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local tax offices, if applicable.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Illinois Payment plan. Typically, these deadlines align with the overall tax filing calendar. Key dates to remember include:

- The annual tax filing deadline, usually April 15.

- Specific deadlines for submitting the cpp 1 form, which may vary based on individual circumstances.

Eligibility Criteria

To qualify for the Illinois Payment plan, taxpayers must meet certain eligibility criteria. Generally, these criteria include:

- Having an outstanding tax liability with the Illinois Department of Revenue.

- Demonstrating a genuine need for a payment plan due to financial hardship.

- Complying with all state tax regulations and requirements.

Quick guide on how to complete cpp 1 2018 2019 form

Your assistance manual on how to prepare your Illinois Payment

If you're curious about how to finalize and submit your Illinois Payment, here are some brief tips to simplify the tax submission process.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, generate, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to modify responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and simple sharing features.

Adhere to the steps below to complete your Illinois Payment in just a few minutes:

- Create your account and begin editing PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Illinois Payment in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to include your legally-binding eSignature (if required).

- Examine your record and rectify any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may heighten return errors and postpone reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission rules applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct cpp 1 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the cpp 1 2018 2019 form

How to make an eSignature for your Cpp 1 2018 2019 Form online

How to create an eSignature for the Cpp 1 2018 2019 Form in Chrome

How to generate an eSignature for signing the Cpp 1 2018 2019 Form in Gmail

How to make an electronic signature for the Cpp 1 2018 2019 Form from your mobile device

How to create an electronic signature for the Cpp 1 2018 2019 Form on iOS devices

How to make an electronic signature for the Cpp 1 2018 2019 Form on Android OS

People also ask

-

What is airSlate SignNow and how does it simplify Illinois Payment processes?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. By streamlining the Illinois Payment process, it helps reduce paperwork and speeds up transactions, allowing users to focus on their core business activities.

-

Is there a free trial available for airSlate SignNow's Illinois Payment solution?

Yes, airSlate SignNow offers a free trial that allows users to explore its features and benefits, including those related to Illinois Payment processing. This trial period enables businesses to evaluate how the platform can enhance their document management and payment workflows before committing to a subscription.

-

What are the pricing options for airSlate SignNow's Illinois Payment services?

airSlate SignNow provides flexible pricing plans tailored to the needs of different businesses. These plans include various features for managing Illinois Payment processes efficiently, ensuring that you select the best option for your organization’s requirements.

-

How does airSlate SignNow enhance security for Illinois Payment transactions?

Security is a top priority for airSlate SignNow, especially for Illinois Payment transactions. The platform employs advanced encryption methods and complies with industry regulations to protect sensitive information, ensuring that all electronic signatures and payments are secure and legally binding.

-

What integrations does airSlate SignNow offer for Illinois Payment workflows?

airSlate SignNow integrates seamlessly with a variety of popular software and platforms, enhancing your Illinois Payment workflows. Whether you use CRM systems, accounting software, or project management tools, the integrations ensure a smooth transition between applications, boosting efficiency.

-

Can airSlate SignNow help in managing recurring Illinois Payment billing?

Absolutely! airSlate SignNow provides features that allow businesses to set up and manage recurring Illinois Payment billing. This functionality simplifies the process of invoicing and collecting payments, ensuring that you never miss a due date and maintain a steady cash flow.

-

How user-friendly is airSlate SignNow for managing Illinois Payment documents?

airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage Illinois Payment documents. Its intuitive interface allows users to quickly send, sign, and track documents, minimizing the learning curve and maximizing productivity.

Get more for Illinois Payment

- Langley leap application packet fcpsedu form

- Optional attendance form 545b tdsb school web site list

- Form 3006

- Us department of labor omb 1218 0236 occupational nalc form

- Customer dispute form kotak mahindra bank

- Form cs5 application for inspection of electrical

- Adopt 205 form

- International wire transfer request form bbvacompasscom

Find out other Illinois Payment

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later