Comparative Overview of Self Directed Brokerage Options SDBOs Form

Understanding Self-Directed Brokerage Options (SDBOs)

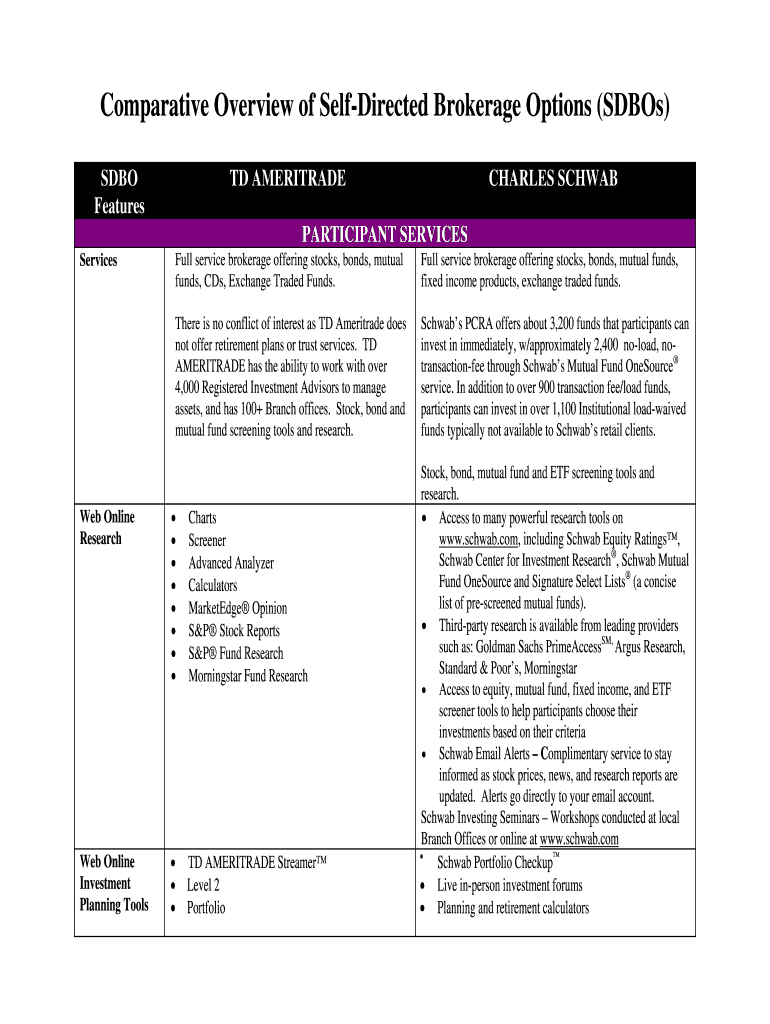

Self-Directed Brokerage Options (SDBOs) provide investors with the flexibility to manage their investment portfolios independently. These options allow individuals to select and trade a variety of investment products, such as stocks, bonds, and mutual funds, without relying on a traditional brokerage firm. SDBOs are particularly appealing for those who prefer a hands-on approach to investing, as they offer greater control over investment decisions and strategies.

Investors can access SDBOs through various platforms, which often include user-friendly interfaces for executing trades and monitoring portfolio performance. It is essential to understand the features and benefits of different SDBOs to make informed choices that align with personal investment goals.

How to Utilize Self-Directed Brokerage Options

To effectively use Self-Directed Brokerage Options, investors should follow several key steps. First, it is crucial to research and select a brokerage platform that offers SDBOs tailored to individual needs. Look for features such as low fees, a wide range of investment options, and robust customer support.

Once a platform is chosen, investors can open an account and fund it with the desired amount. After funding, users can begin exploring available investment options. It is advisable to create a diversified portfolio to mitigate risks and enhance potential returns. Regularly reviewing and adjusting the portfolio based on market conditions and personal financial goals is also beneficial.

Key Components of Self-Directed Brokerage Options

Understanding the key components of Self-Directed Brokerage Options is vital for successful investing. One significant aspect is the variety of investment vehicles available, including individual stocks, exchange-traded funds (ETFs), and mutual funds. Each option comes with its own risk profile and potential returns, making it important for investors to evaluate their risk tolerance.

Another important factor is the fee structure associated with SDBOs. Different platforms may charge varying fees for trades, account maintenance, and other services. Being aware of these costs can help investors choose the most cost-effective option. Additionally, the level of customer support and educational resources provided by the brokerage can significantly impact the overall investing experience.

Legal Considerations for Self-Directed Brokerage Options

When engaging with Self-Directed Brokerage Options, it is crucial to be aware of the legal implications involved. Investors must comply with federal and state regulations regarding securities trading. This includes understanding the rules set forth by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Furthermore, investors should be mindful of tax implications related to their investment activities. Gains from trades may be subject to capital gains tax, and it is essential to maintain accurate records for tax reporting purposes. Consulting with a tax professional can provide clarity on these matters and help ensure compliance with all legal requirements.

Examples of Self-Directed Brokerage Options in Action

Self-Directed Brokerage Options can be illustrated through various scenarios. For instance, an individual investor may choose to invest in a diversified portfolio of ETFs to achieve long-term growth. By utilizing an SDBO, the investor can buy and sell these ETFs based on market trends and personal investment strategies.

Another example involves a self-employed individual who uses an SDBO to manage retirement savings through a Solo 401(k). This allows for greater flexibility in investment choices and the potential for higher returns compared to traditional retirement accounts. These examples highlight the versatility and benefits of SDBOs in meeting diverse investment needs.

Eligibility Criteria for Self-Directed Brokerage Options

Eligibility for Self-Directed Brokerage Options typically requires investors to meet certain criteria set by the brokerage firm. Generally, individuals must be of legal age, usually eighteen years or older, and possess a valid Social Security number or taxpayer identification number.

Some brokerages may also have minimum funding requirements to open an account. Additionally, investors should demonstrate an understanding of investment principles, as SDBOs often require a higher level of engagement and knowledge compared to traditional brokerage services. Meeting these criteria ensures that investors are prepared to make informed decisions within their self-directed accounts.

Quick guide on how to complete comparative overview of self directed brokerage options sdbos

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from a device of your preference. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Comparative Overview Of Self Directed Brokerage Options SDBOs

Create this form in 5 minutes!

How to create an eSignature for the comparative overview of self directed brokerage options sdbos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Self Directed Brokerage Options (SDBOs)?

Self Directed Brokerage Options (SDBOs) allow investors to manage their own investment portfolios by providing access to a wide range of investment options. This comparative overview of Self Directed Brokerage Options SDBOs highlights how they empower users to make informed decisions and tailor their investments according to personal financial goals.

-

How do I choose the right SDBO for my needs?

Choosing the right Self Directed Brokerage Option (SDBO) involves evaluating your investment goals, risk tolerance, and the features offered by different platforms. A comparative overview of Self Directed Brokerage Options SDBOs can help you assess which platform aligns best with your financial strategy and investment preferences.

-

What are the costs associated with using SDBOs?

The costs of using Self Directed Brokerage Options (SDBOs) can vary signNowly based on the platform and services offered. A comparative overview of Self Directed Brokerage Options SDBOs will provide insights into typical fees, including trading commissions, account maintenance fees, and any additional charges that may apply.

-

What features should I look for in an SDBO?

When evaluating Self Directed Brokerage Options (SDBOs), consider features such as user-friendly interfaces, research tools, investment tracking, and customer support. A comprehensive comparative overview of Self Directed Brokerage Options SDBOs will help you identify which features are essential for your investment journey.

-

Can I integrate SDBOs with other financial tools?

Many Self Directed Brokerage Options (SDBOs) offer integration capabilities with various financial tools and software. This integration can enhance your investment management experience, and a comparative overview of Self Directed Brokerage Options SDBOs will highlight which platforms provide seamless connectivity with other financial applications.

-

What are the benefits of using SDBOs?

The benefits of using Self Directed Brokerage Options (SDBOs) include greater control over investment decisions, access to a diverse range of assets, and the ability to tailor your portfolio. A comparative overview of Self Directed Brokerage Options SDBOs can help you understand how these advantages can align with your financial objectives.

-

How secure are Self Directed Brokerage Options?

Security is a critical consideration when using Self Directed Brokerage Options (SDBOs). Most reputable platforms implement robust security measures, including encryption and two-factor authentication. A comparative overview of Self Directed Brokerage Options SDBOs will provide insights into the security features that protect your investments.

Get more for Comparative Overview Of Self Directed Brokerage Options SDBOs

- If you die without a will the court decides who will form

- Type the names of children from spouses previous form

- Will or a will that provides that any assets not transferred to the living trust at the time of form

- I of county idaho form

- Idaho passed away on form

- With the terms of the will and laws of the state of idaho in reference to the procedures and form

- With no interest or form

- Section 153110 basis and rate of the tax illinois general form

Find out other Comparative Overview Of Self Directed Brokerage Options SDBOs

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT