Federal Tax Information Disclosure Oregon

What is the Federal Tax Information Disclosure Oregon

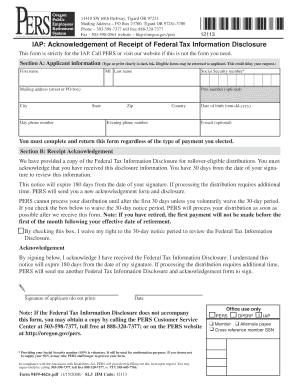

The Federal Tax Information Disclosure in Oregon refers to the process through which taxpayers can access and share their federal tax information with authorized entities. This disclosure is crucial for various purposes, including loan applications, government assistance programs, and other financial transactions that require verification of income and tax status. It is essential for individuals and businesses to understand the implications of sharing this information and the legal protections in place to safeguard their privacy.

How to obtain the Federal Tax Information Disclosure Oregon

To obtain the Federal Tax Information Disclosure in Oregon, individuals must follow specific procedures set by the Internal Revenue Service (IRS) and state regulations. Typically, this involves submitting Form 4506-T, Request for Transcript of Tax Return, to the IRS. This form allows taxpayers to request a transcript of their tax return information, which can then be shared with the requesting party. It is important to ensure that all required information is accurately filled out to avoid delays in processing.

Steps to complete the Federal Tax Information Disclosure Oregon

Completing the Federal Tax Information Disclosure involves several key steps:

- Gather necessary documentation, including Social Security numbers and tax identification numbers.

- Fill out Form 4506-T accurately, ensuring all information is current and correct.

- Submit the completed form to the IRS via mail or fax, as specified in the form instructions.

- Wait for the IRS to process the request, which may take several weeks.

- Receive the tax information transcript and share it with the authorized party as needed.

Legal use of the Federal Tax Information Disclosure Oregon

The legal use of the Federal Tax Information Disclosure in Oregon is governed by both federal and state laws. Taxpayers must ensure that their information is shared only with authorized individuals or entities, such as lenders or government agencies, who have a legitimate need for this data. Unauthorized disclosure can lead to legal consequences, including penalties and potential criminal charges. It is essential to be aware of the legal framework surrounding tax information to protect oneself from misuse.

IRS Guidelines

The IRS provides specific guidelines regarding the disclosure of federal tax information. These guidelines outline who can request tax information, the types of documents that can be disclosed, and the procedures for obtaining this information. Taxpayers should familiarize themselves with these guidelines to ensure compliance and to understand their rights regarding the privacy of their tax information. Adhering to IRS guidelines helps protect against identity theft and unauthorized access to sensitive information.

Required Documents

When seeking the Federal Tax Information Disclosure, certain documents are typically required. These may include:

- Completed Form 4506-T.

- Identification documents, such as a driver's license or Social Security card.

- Any additional forms or documents requested by the IRS or the entity requesting the tax information.

Having these documents ready can streamline the process and ensure that requests are processed efficiently.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Federal Tax Information Disclosure can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, and even criminal charges for willful neglect or fraudulent activities. It is crucial to understand the responsibilities associated with sharing tax information and to adhere to all legal requirements to avoid these consequences. Awareness of potential penalties can encourage responsible handling of tax information.

Quick guide on how to complete federal tax information disclosure oregon

Complete [SKS] effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools specifically offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your preference. Modify and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Tax Information Disclosure Oregon

Create this form in 5 minutes!

How to create an eSignature for the federal tax information disclosure oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Federal Tax Information Disclosure in Oregon?

Federal Tax Information Disclosure in Oregon refers to the regulations and processes governing how tax information is shared and disclosed within the state. Understanding these regulations is crucial for businesses to ensure compliance and protect sensitive information. airSlate SignNow provides tools to help manage these disclosures effectively.

-

How can airSlate SignNow assist with Federal Tax Information Disclosure in Oregon?

airSlate SignNow offers a user-friendly platform that simplifies the process of sending and eSigning documents related to Federal Tax Information Disclosure in Oregon. With its secure features, businesses can ensure that sensitive tax information is handled properly and in compliance with state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that support Federal Tax Information Disclosure in Oregon, ensuring that users can find a solution that fits their budget.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing Federal Tax Information Disclosure in Oregon. These tools help streamline the document workflow, making it easier for businesses to stay organized and compliant.

-

Is airSlate SignNow compliant with Oregon's tax regulations?

Yes, airSlate SignNow is designed to comply with Oregon's tax regulations, including those related to Federal Tax Information Disclosure. The platform ensures that all documents are handled securely and that users can maintain compliance with state and federal laws.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software, enhancing its functionality for Federal Tax Information Disclosure in Oregon. This allows businesses to streamline their processes and improve efficiency by connecting their existing tools.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including increased efficiency, enhanced security, and improved compliance with Federal Tax Information Disclosure in Oregon. The platform's intuitive interface makes it easy for users to manage their documents without extensive training.

Get more for Federal Tax Information Disclosure Oregon

- 075emergency preparedness075emergency preparednessatw qxd qxd general uniform regulations

- Department of teacher preparation and special education gwu form

- Please fax completed form to 703 726 3711 or email to hrisgwu

- Mcv class i george washington university gwu form

- The george washington university graduate school of gwu form

- Es95 6 18 mandatory 1 19 form

- Bexar county community supervision and corrections department form

- Cremation authorization liberty grove memorial gardens form

Find out other Federal Tax Information Disclosure Oregon

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now