Payment Calculations for Mortgage Backed Securities Form

Understanding Payment Calculations for Mortgage Backed Securities

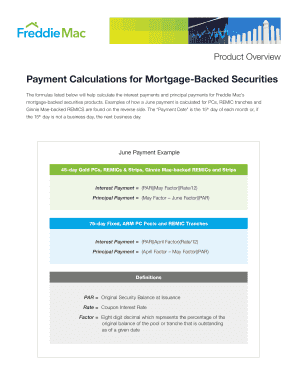

Payment calculations for mortgage backed securities (MBS) involve determining the cash flows generated from the underlying mortgage loans. These calculations are crucial for investors and financial institutions to assess the value and risk associated with MBS. The key components of these calculations include the interest rates, principal amounts, and payment schedules of the mortgage loans. Accurate payment calculations help in evaluating the expected returns and in making informed investment decisions.

Steps to Perform Payment Calculations for Mortgage Backed Securities

To effectively calculate payments for mortgage backed securities, follow these steps:

- Gather data on the underlying mortgage loans, including interest rates, loan amounts, and payment frequencies.

- Determine the total number of payments over the life of the loans.

- Calculate the monthly payment amount using the loan details and a standard mortgage formula.

- Assess the prepayment rates, as they can affect cash flows and overall returns.

- Compile the results to project cash flows over time, adjusting for potential defaults or prepayments.

Key Elements of Payment Calculations for Mortgage Backed Securities

Several key elements play a vital role in payment calculations for mortgage backed securities:

- Principal Amount: The total loan amount that borrowers owe.

- Interest Rate: The percentage charged on the principal, influencing the payment amounts.

- Amortization Schedule: A table detailing each payment's breakdown into principal and interest over time.

- Payment Frequency: The schedule of payments, typically monthly, which affects cash flow timing.

- Prepayment Penalties: Fees that may apply if borrowers pay off loans early, impacting overall returns.

Examples of Payment Calculations for Mortgage Backed Securities

Understanding practical examples can clarify how payment calculations work. For instance, consider a mortgage backed security with a principal of $200,000, an interest rate of four percent, and a 30-year term. The monthly payment can be calculated using the formula for a fixed-rate mortgage. This results in a monthly payment of approximately $955. In another scenario, if a borrower prepays $50,000 after five years, the cash flows will change, requiring a recalculation of future payments and returns.

Legal Use of Payment Calculations for Mortgage Backed Securities

Payment calculations for mortgage backed securities must comply with U.S. financial regulations. These calculations are subject to oversight by the Securities and Exchange Commission (SEC) and must adhere to the guidelines set forth in the Dodd-Frank Act. Accurate calculations are essential for transparency and investor protection, ensuring that all parties have a clear understanding of the risks and returns associated with MBS investments.

Obtaining Payment Calculations for Mortgage Backed Securities

To obtain accurate payment calculations for mortgage backed securities, investors can utilize financial software or consult with financial advisors. Many financial institutions provide tools and resources for performing these calculations. Additionally, online calculators can assist in estimating payments based on specific loan parameters. It is essential to ensure that the data used in these calculations is current and reflects market conditions.

Quick guide on how to complete payment calculations for mortgage backed securities

Complete Payment Calculations For Mortgage Backed Securities effortlessly on any device

Digital document management has gained immense popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow provides all the tools you need to generate, modify, and electronically sign your documents swiftly without delays. Manage Payment Calculations For Mortgage Backed Securities on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and electronically sign Payment Calculations For Mortgage Backed Securities with ease

- Obtain Payment Calculations For Mortgage Backed Securities and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Payment Calculations For Mortgage Backed Securities to ensure exceptional communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payment calculations for mortgage backed securities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Payment Calculations For Mortgage Backed Securities?

Payment Calculations For Mortgage Backed Securities refer to the methods used to determine the cash flows generated by mortgage-backed securities. These calculations are crucial for investors to assess the value and risk associated with these financial instruments. Understanding these calculations can help you make informed investment decisions.

-

How can airSlate SignNow assist with Payment Calculations For Mortgage Backed Securities?

airSlate SignNow provides tools that streamline the documentation process related to Payment Calculations For Mortgage Backed Securities. By enabling easy eSigning and document management, businesses can focus on accurate calculations without the hassle of paperwork. This efficiency can lead to better financial decision-making.

-

What features does airSlate SignNow offer for managing Payment Calculations For Mortgage Backed Securities?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning that enhance the management of Payment Calculations For Mortgage Backed Securities. These features ensure that all necessary documents are easily accessible and can be processed quickly. This ultimately saves time and reduces errors in calculations.

-

Is airSlate SignNow cost-effective for businesses dealing with Payment Calculations For Mortgage Backed Securities?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling Payment Calculations For Mortgage Backed Securities. With competitive pricing plans, companies can choose a package that fits their needs without overspending. This affordability allows businesses to allocate resources more effectively.

-

Can airSlate SignNow integrate with other financial tools for Payment Calculations For Mortgage Backed Securities?

Absolutely! airSlate SignNow offers integrations with various financial tools that can enhance your Payment Calculations For Mortgage Backed Securities processes. These integrations allow for seamless data transfer and improved accuracy in calculations, making it easier to manage your financial documents.

-

What benefits does airSlate SignNow provide for Payment Calculations For Mortgage Backed Securities?

The primary benefits of using airSlate SignNow for Payment Calculations For Mortgage Backed Securities include increased efficiency, reduced paperwork, and enhanced accuracy. By automating document workflows, businesses can minimize errors and speed up the calculation process. This leads to better financial outcomes and improved client satisfaction.

-

How secure is airSlate SignNow when handling Payment Calculations For Mortgage Backed Securities?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information related to Payment Calculations For Mortgage Backed Securities. The platform employs advanced encryption and compliance measures to protect your data. This ensures that your financial documents remain confidential and secure throughout the process.

Get more for Payment Calculations For Mortgage Backed Securities

Find out other Payment Calculations For Mortgage Backed Securities

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple