12 008 Utah State Tax Commission Tax Utah Form

What is the 12 008 Utah State Tax Commission Tax Utah

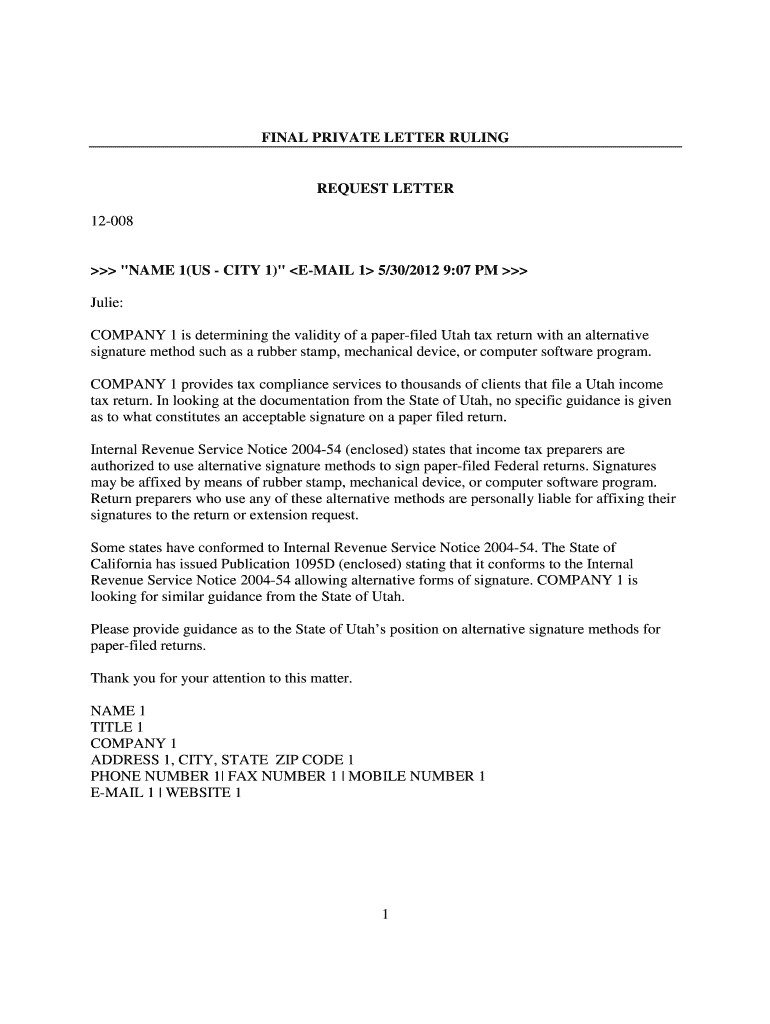

The 12 008 Utah State Tax Commission Tax form is a specific document used for tax reporting and compliance within the state of Utah. This form is essential for individuals and businesses to accurately report their income and calculate their tax obligations. It is designed to help taxpayers fulfill their legal requirements while ensuring that the state can effectively collect revenue. Understanding the purpose and requirements of this form is crucial for maintaining compliance with state tax laws.

Steps to complete the 12 008 Utah State Tax Commission Tax Utah

Completing the 12 008 Utah State Tax Commission Tax form involves several key steps:

- Gather necessary financial documents, including income statements, expense records, and previous tax returns.

- Fill out the form accurately, ensuring all required fields are completed. Pay attention to income categories and deductions.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Submit the form by the designated deadline, either electronically or by mail, following the submission guidelines provided by the Utah State Tax Commission.

Required Documents

To complete the 12 008 Utah State Tax Commission Tax form, certain documents are necessary. These typically include:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for any additional income received, such as freelance work or interest earnings.

- Receipts and records for deductible expenses, including business-related costs, medical expenses, and charitable contributions.

- Previous year’s tax return for reference and consistency in reporting.

Legal use of the 12 008 Utah State Tax Commission Tax Utah

The 12 008 Utah State Tax Commission Tax form serves a legal purpose in tax compliance. Filing this form accurately is a legal requirement for residents and businesses in Utah. Failure to submit the form or providing false information can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is essential for all taxpayers to avoid complications with the Utah State Tax Commission.

Filing Deadlines / Important Dates

Awareness of filing deadlines for the 12 008 Utah State Tax Commission Tax form is crucial for compliance. Typically, the filing deadline aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify any state-specific extensions or changes. It is advisable to mark these dates on a calendar to ensure timely submission and avoid late fees.

Who Issues the Form

The 12 008 Utah State Tax Commission Tax form is issued by the Utah State Tax Commission. This state agency is responsible for administering tax laws, collecting taxes, and providing guidance to taxpayers. It is important for individuals and businesses to refer to the Utah State Tax Commission for official updates and resources related to the form.

Quick guide on how to complete 12 008 utah state tax commission tax utah

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS apps and streamline any document-related process today.

A Simple Way to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Access Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Signature feature, which takes mere seconds and has the same legal validity as a classic ink signature.

- Verify all the details and click on the Complete button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 12 008 Utah State Tax Commission Tax Utah

Create this form in 5 minutes!

How to create an eSignature for the 12 008 utah state tax commission tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 12 008 Utah State Tax Commission Tax Utah form?

The 12 008 Utah State Tax Commission Tax Utah form is a crucial document for businesses operating in Utah. It is used to report and pay state taxes, ensuring compliance with local tax regulations. Understanding this form is essential for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the 12 008 Utah State Tax Commission Tax Utah form?

airSlate SignNow simplifies the process of completing and submitting the 12 008 Utah State Tax Commission Tax Utah form. Our platform allows users to eSign documents securely and efficiently, reducing the time spent on paperwork. This ensures that your tax submissions are timely and compliant.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans are designed to provide cost-effective solutions for managing documents, including the 12 008 Utah State Tax Commission Tax Utah form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features for efficient tax document management, including customizable templates, secure eSigning, and real-time tracking. These features streamline the process of handling the 12 008 Utah State Tax Commission Tax Utah form, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax management software. This allows you to easily manage the 12 008 Utah State Tax Commission Tax Utah form alongside your other financial documents. Integrating our platform enhances your workflow and improves efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the 12 008 Utah State Tax Commission Tax Utah form, offers numerous benefits. It enhances document security, reduces processing time, and ensures compliance with state regulations. Our user-friendly interface makes it accessible for all business sizes.

-

Is airSlate SignNow suitable for small businesses handling the 12 008 Utah State Tax Commission Tax Utah?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing the 12 008 Utah State Tax Commission Tax Utah form. Our cost-effective solutions and easy-to-use features make it an ideal choice for small business owners looking to streamline their tax processes.

Get more for 12 008 Utah State Tax Commission Tax Utah

- Driver39s license check authorization form niagara university niagara

- Introduction to the teaching assistantship manual niagara university form

- Certificate program in financial planning registration form niagara

- Section 14 eligibility amp squad rosters niagara university niagara form

- In ontario niagara university niagara form

- Section 12 1 recruiting compliance forms niagara

- Work study deferment option form

- Antrag auf erteilung eines aufenthaltstitels erstantrag form

Find out other 12 008 Utah State Tax Commission Tax Utah

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice