1 Ohio's Forest Property Tax Laws Draft 72508 DOC Validation Criteria and Record Layouts for Electronic Filing of Form 1065

Understanding the 1 Ohio's Forest Property Tax Laws Draft 72508 Document

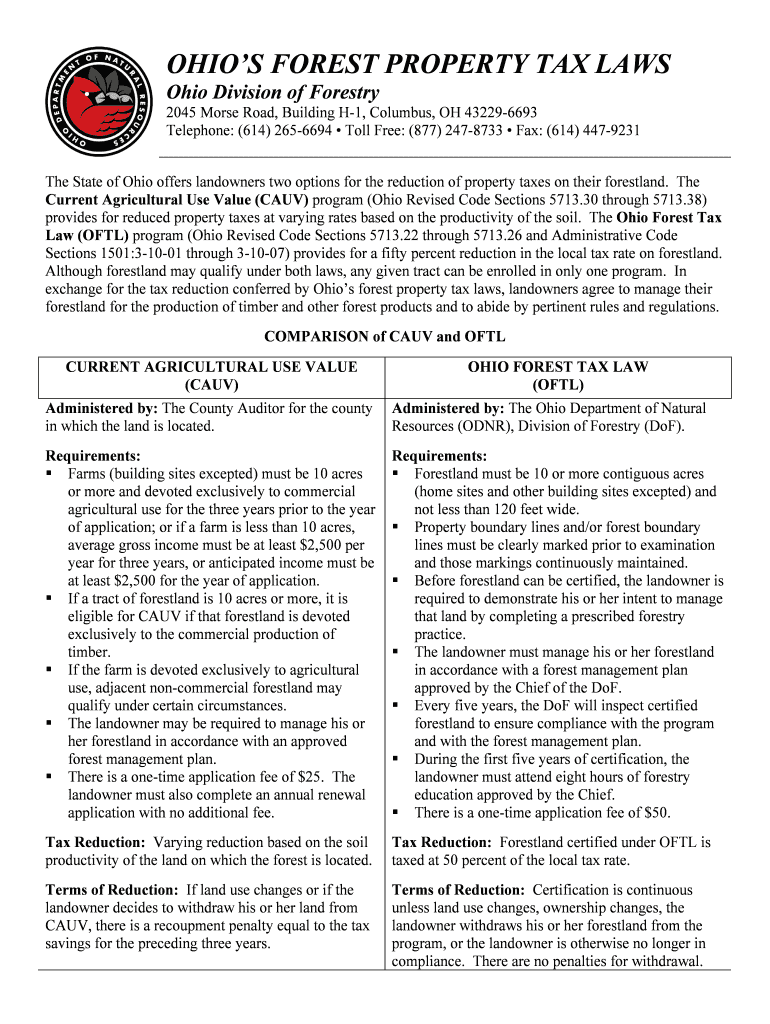

The 1 Ohio's Forest Property Tax Laws Draft 72508 document outlines the validation criteria and record layouts necessary for the electronic filing of Form 1065. This form is essential for partnerships and certain multi-member LLCs to report income, deductions, gains, and losses. The document serves as a guide to ensure compliance with Ohio's property tax laws, specifically related to forest property. It includes detailed specifications on how to format and submit the required information electronically, which helps streamline the filing process and reduce errors.

Steps to Complete the 1 Ohio's Forest Property Tax Laws Draft 72508 Document

Completing the 1 Ohio's Forest Property Tax Laws Draft 72508 involves several key steps:

- Gather necessary documents, including financial records and partnership agreements.

- Review the validation criteria outlined in the document to ensure all information meets the required standards.

- Fill out Form 1065 accurately, ensuring all fields are completed as per the guidelines.

- Utilize the record layouts provided in the draft to format your submission correctly.

- Submit the completed form electronically through the designated channels.

Legal Use of the 1 Ohio's Forest Property Tax Laws Draft 72508 Document

The legal use of the 1 Ohio's Forest Property Tax Laws Draft 72508 document is crucial for ensuring compliance with state regulations. This document provides the framework for filing taxes related to forest property, which is subject to specific tax laws in Ohio. By adhering to the guidelines set forth in the draft, filers can avoid potential legal issues and penalties associated with non-compliance. It is important to consult with a tax professional if there are any uncertainties regarding the legal implications of the document.

Key Elements of the 1 Ohio's Forest Property Tax Laws Draft 72508 Document

Several key elements are integral to the 1 Ohio's Forest Property Tax Laws Draft 72508 document:

- Validation Criteria: Specific requirements that must be met for the electronic filing to be accepted.

- Record Layouts: Detailed instructions on how to format the data for submission.

- Filing Procedures: Guidelines on how to electronically submit Form 1065.

- Compliance Standards: Information on maintaining compliance with Ohio's forest property tax laws.

Obtaining the 1 Ohio's Forest Property Tax Laws Draft 72508 Document

To obtain the 1 Ohio's Forest Property Tax Laws Draft 72508 document, individuals or businesses can access it through the Clermont County Auditor's office or the official state tax website. It is important to ensure that you are using the most current version of the document, as tax laws and filing requirements can change. Checking for updates regularly will help ensure compliance and accuracy in filings.

Examples of Using the 1 Ohio's Forest Property Tax Laws Draft 72508 Document

Examples of using the 1 Ohio's Forest Property Tax Laws Draft 72508 document include:

- A partnership filing its annual tax return using Form 1065 while adhering to the specified validation criteria.

- A multi-member LLC submitting its tax information electronically, following the record layouts provided.

- Tax professionals utilizing the document to guide their clients through the filing process, ensuring all requirements are met.

Quick guide on how to complete 1 ohios forest property tax laws draft 72508 doc validation criteria and record layouts for electronic filing of form 1065

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria And Record Layouts For Electronic Filing Of Form 1065

Create this form in 5 minutes!

How to create an eSignature for the 1 ohios forest property tax laws draft 72508 doc validation criteria and record layouts for electronic filing of form 1065

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria?

The 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria outline the necessary requirements for validating documents related to forest property tax. These criteria ensure that all submissions meet state regulations, facilitating a smoother electronic filing process for Form 1065 with Clermont Auditor.

-

How does airSlate SignNow assist with electronic filing of Form 1065?

airSlate SignNow simplifies the electronic filing of Form 1065 by providing a user-friendly platform that adheres to 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria. Our solution allows users to easily prepare, sign, and submit their documents, ensuring compliance with Clermont Auditor's requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including eSigning, document templates, and real-time collaboration. These features are designed to streamline the process of managing documents related to 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria, making it easier for users to handle their Form 1065 submissions.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their document signing needs. By utilizing our platform, businesses can efficiently comply with 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria without incurring high costs associated with traditional document management methods.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing its functionality. This allows users to seamlessly incorporate our solution into their existing workflows, ensuring compliance with 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria while using their preferred tools.

-

What benefits does airSlate SignNow provide for electronic filing?

airSlate SignNow provides numerous benefits for electronic filing, including increased efficiency, reduced errors, and enhanced security. By following the 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria, users can ensure their Form 1065 submissions are accurate and secure, leading to a smoother filing experience.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, employing advanced encryption and authentication measures. This ensures that all documents, including those related to 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria, are protected throughout the signing and filing process.

Get more for 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria And Record Layouts For Electronic Filing Of Form 1065

- Service request form

- Social security number retention exception request form

- Purchase requisition ndsu form

- Mls reference request2012 ndsu form

- Candidate data form ndsu

- Departmental request to process credit card and electronic fund form

- North dakota state university conflict of interest disclosure statement form

- 4 h sheep breeding project lifetime record form

Find out other 1 Ohio's Forest Property Tax Laws Draft 72508 doc Validation Criteria And Record Layouts For Electronic Filing Of Form 1065

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT