Finance Department City of Elizabethtown 2021-2026

Overview of the Finance Department in Elizabethtown

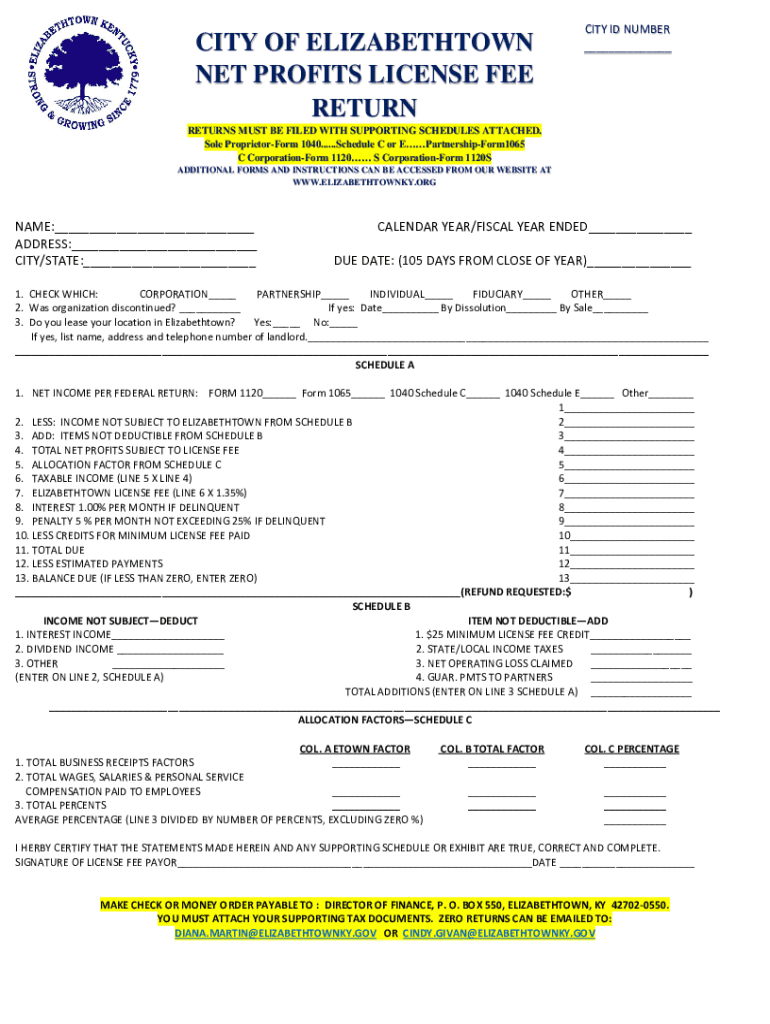

The Finance Department of the City of Elizabethtown is responsible for managing the city's financial operations, including tax collection, budgeting, and financial reporting. This department plays a crucial role in ensuring that city services are funded and that financial regulations are adhered to. The department also oversees the administration of the city of Elizabethtown occupational tax form, which is essential for businesses operating within the city limits.

Steps to Complete the City of Elizabethtown Occupational Tax Form

Completing the city of Elizabethtown occupational tax form involves several key steps. First, gather all necessary information, including your business details, income data, and any relevant financial documents. Next, accurately fill out the form, ensuring that all sections are completed. It is important to double-check your entries for accuracy to avoid potential issues. Once the form is filled out, you can submit it through the designated channels, which may include online submission, mailing, or in-person delivery to the Finance Department.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the city of Elizabethtown occupational tax form is critical for compliance. Typically, the form must be submitted annually, with specific deadlines set by the Finance Department. It is advisable to check the official city website or contact the department directly for the most current dates. Missing these deadlines can result in penalties, so staying informed is essential.

Required Documents for Submission

To successfully submit the city of Elizabethtown occupational tax form, certain documents are required. These may include proof of business registration, financial statements, and any previous tax returns. Having these documents ready will streamline the process and ensure that your submission is complete. Always verify with the Finance Department for any additional documentation that may be needed based on your specific business type.

Form Submission Methods

The city of Elizabethtown offers multiple methods for submitting the occupational tax form. You can choose to submit it online through the city’s official portal, mail it directly to the Finance Department, or deliver it in person. Each method has its own advantages, such as convenience or immediate confirmation of receipt. Be sure to select the method that best suits your needs and ensure that you follow any specific instructions related to your chosen submission method.

Penalties for Non-Compliance

Failure to submit the city of Elizabethtown occupational tax form by the deadline can result in penalties. These penalties may include fines or additional fees that accumulate over time. It is important for businesses to be aware of these consequences and to prioritize timely filing to avoid unnecessary financial burdens. For detailed information on the specific penalties, it is recommended to consult the Finance Department directly.

Quick guide on how to complete finance department city of elizabethtown

Complete Finance Department City Of Elizabethtown effortlessly on any device

Digital document management has become widely accepted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without interruptions. Handle Finance Department City Of Elizabethtown on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Finance Department City Of Elizabethtown without hassle

- Locate Finance Department City Of Elizabethtown and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Finance Department City Of Elizabethtown and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct finance department city of elizabethtown

Create this form in 5 minutes!

How to create an eSignature for the finance department city of elizabethtown

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Elizabethtown occupational tax form?

The city of Elizabethtown occupational tax form is a document required for individuals and businesses operating within the city to report and pay occupational taxes. This form ensures compliance with local tax regulations and helps fund city services. Completing this form accurately is essential for avoiding penalties.

-

How can airSlate SignNow help with the city of Elizabethtown occupational tax form?

airSlate SignNow simplifies the process of completing and submitting the city of Elizabethtown occupational tax form by providing an easy-to-use platform for eSigning and document management. Users can fill out the form digitally, ensuring accuracy and efficiency. This streamlines the submission process and helps you stay compliant.

-

Is there a cost associated with using airSlate SignNow for the city of Elizabethtown occupational tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that enhance the completion of the city of Elizabethtown occupational tax form. Investing in this solution can save time and reduce the hassle of paperwork.

-

What features does airSlate SignNow offer for managing the city of Elizabethtown occupational tax form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the city of Elizabethtown occupational tax form. These tools help ensure that your forms are completed correctly and submitted on time. Additionally, the platform allows for easy collaboration with team members.

-

Can I integrate airSlate SignNow with other software for the city of Elizabethtown occupational tax form?

Yes, airSlate SignNow offers integrations with various software applications, making it easier to manage the city of Elizabethtown occupational tax form alongside your existing tools. This flexibility allows for a seamless workflow, enhancing productivity and ensuring that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the city of Elizabethtown occupational tax form?

Using airSlate SignNow for the city of Elizabethtown occupational tax form provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface makes it easy to navigate, while its robust security features protect sensitive information. This ensures a smooth and compliant tax filing process.

-

How do I get started with airSlate SignNow for the city of Elizabethtown occupational tax form?

Getting started with airSlate SignNow for the city of Elizabethtown occupational tax form is simple. You can sign up for an account on the airSlate SignNow website and choose a pricing plan that suits your needs. Once registered, you can access templates and tools specifically designed for completing your occupational tax form.

Get more for Finance Department City Of Elizabethtown

- Limited power of attorney where you specify powers with sample powers included indiana form

- Limited power of attorney for stock transactions and corporate powers indiana form

- Special durable power of attorney for bank account matters indiana form

- Indiana small business startup package indiana form

- Indiana property management package indiana form

- Sample annual minutes for an indiana professional corporation indiana form

- Indiana bylaws form

- In corporation form

Find out other Finance Department City Of Elizabethtown

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later