Form 2848 Rev January Power of Attorney and Declaration of Representative 2021-2026

What is the Form 2848 Power of Attorney and Declaration of Representative

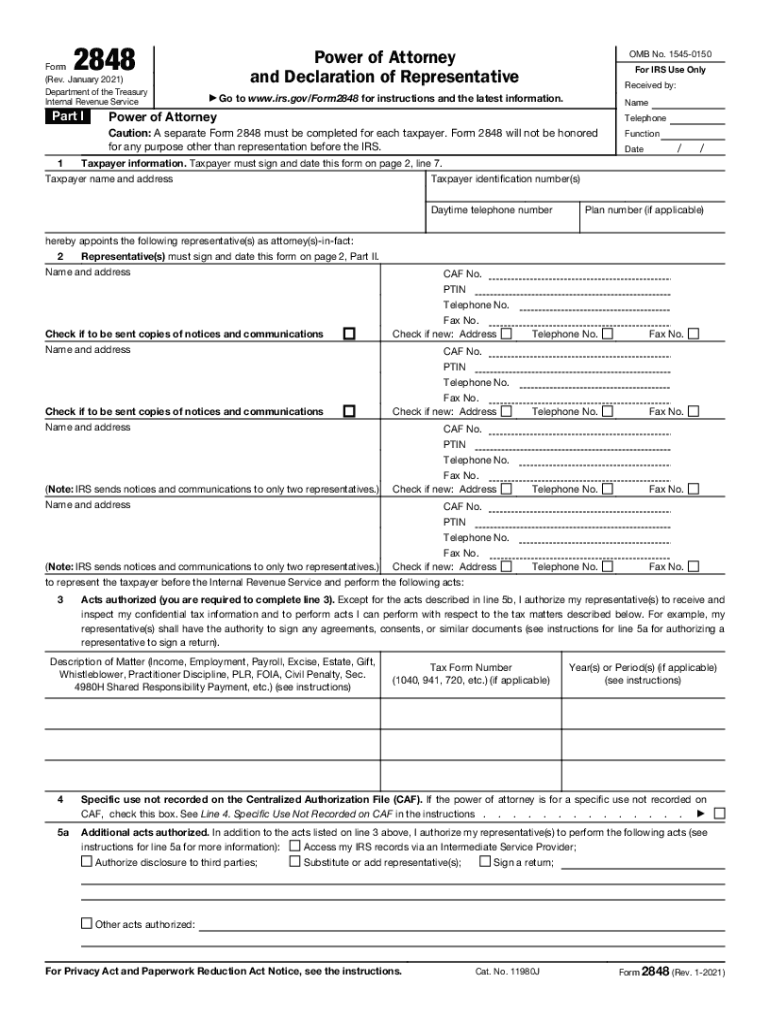

The Form 2848, officially known as the Power of Attorney and Declaration of Representative, is a crucial document used by taxpayers in the United States. This form allows individuals to authorize an attorney or other qualified representative to act on their behalf in dealings with the Internal Revenue Service (IRS). It is particularly useful for managing tax matters, such as responding to IRS inquiries, representing taxpayers during audits, and handling various tax-related issues. By completing this form, taxpayers can ensure that their chosen representative has the authority to receive confidential information and make decisions regarding their tax affairs.

How to Use the Form 2848 Power of Attorney and Declaration of Representative

Using the Form 2848 involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained from the IRS website. Next, fill out the form with accurate information, including your details and those of your representative. It is essential to specify the types of tax matters for which the representative is authorized. After completing the form, both the taxpayer and the representative must sign it. Once signed, the form can be submitted to the IRS, allowing your representative to act on your behalf. Keep a copy for your records to track the authorization status.

Steps to Complete the Form 2848 Power of Attorney and Declaration of Representative

Completing the Form 2848 requires careful attention to detail. Follow these steps to ensure accuracy:

- Download the latest version of the Form 2848 from the IRS website.

- Provide your name, address, and taxpayer identification number (TIN).

- Enter the name and address of your representative, ensuring they are authorized to practice before the IRS.

- Specify the tax matters for which the power of attorney is granted, such as income tax or estate tax.

- Indicate the tax years or periods applicable to the authorization.

- Both you and your representative must sign and date the form.

- Submit the completed form to the IRS, either by mail or electronically, as appropriate.

Legal Use of the Form 2848 Power of Attorney and Declaration of Representative

The Form 2848 is legally recognized and binding when properly completed and submitted. It complies with IRS regulations, allowing representatives to access confidential tax information and represent taxpayers in various matters. The form must be filled out accurately to avoid issues with IRS acceptance. Additionally, it is important to ensure that the representative is qualified to act on your behalf, as unauthorized individuals may not be able to represent you effectively. This form provides a legal framework for representation, ensuring that taxpayers can receive the assistance they need in navigating tax complexities.

IRS Guidelines for the Form 2848 Power of Attorney and Declaration of Representative

The IRS provides specific guidelines for the use of Form 2848. Taxpayers should be aware of the following:

- The form must be signed by both the taxpayer and the representative to be valid.

- It is advisable to submit the form well in advance of any deadlines to ensure timely processing.

- Taxpayers can revoke the power of attorney at any time by submitting a written notice to the IRS.

- In case of changes in representation, a new Form 2848 must be submitted.

Eligibility Criteria for Using the Form 2848 Power of Attorney and Declaration of Representative

To use the Form 2848, taxpayers must meet certain eligibility criteria. Primarily, the taxpayer must be an individual or entity with a valid taxpayer identification number. The representative must be an attorney, certified public accountant, enrolled agent, or an individual who meets the IRS requirements for representation. Additionally, the taxpayer must have the capacity to grant power of attorney, meaning they should be of sound mind and legally able to make decisions regarding their tax matters. Understanding these criteria ensures that the form is used appropriately and effectively.

Quick guide on how to complete form 2848 rev january 2021 power of attorney and declaration of representative

Complete Form 2848 Rev January Power Of Attorney And Declaration Of Representative easily on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the right form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without hold-ups. Manage Form 2848 Rev January Power Of Attorney And Declaration Of Representative on any device using airSlate SignNow mobile applications for Android or iOS and simplify any document-related process today.

The easiest way to modify and electronically sign Form 2848 Rev January Power Of Attorney And Declaration Of Representative without hassle

- Find Form 2848 Rev January Power Of Attorney And Declaration Of Representative and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information carefully and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 2848 Rev January Power Of Attorney And Declaration Of Representative and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2848 rev january 2021 power of attorney and declaration of representative

Create this form in 5 minutes!

How to create an eSignature for the form 2848 rev january 2021 power of attorney and declaration of representative

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What features does airSlate SignNow offer for attorneys?

airSlate SignNow provides attorneys with features like document eSigning, customizable templates, and real-time tracking. These tools enable attorneys to manage their documents efficiently, ensuring seamless collaboration with clients while maintaining compliance.

-

How does airSlate SignNow improve workflow for attorneys?

By utilizing airSlate SignNow, attorneys can streamline their document processes, reducing the time spent on manual tasks. This results in faster turnaround times for contracts and agreements, allowing attorneys to focus more on their clients and less on administrative duties.

-

Is airSlate SignNow cost-effective for law firms?

Yes, airSlate SignNow offers flexible pricing plans that cater to the budgets of various law firms. With its affordable solutions, attorneys can save on operational costs while enjoying a robust eSignature platform that enhances productivity.

-

Can airSlate SignNow integrate with other tools attorneys already use?

Absolutely! airSlate SignNow integrates seamlessly with several popular software solutions, including Google Workspace and Microsoft Office. This makes it easier for attorneys to incorporate eSigning into their existing workflows without disruption.

-

What security measures does airSlate SignNow provide for attorney documents?

Security is a top priority at airSlate SignNow, especially for sensitive attorney documents. The platform employs bank-level encryption and complies with regulations such as GDPR and HIPAA, ensuring that your documents are safe from unauthorized access.

-

How do I get started with airSlate SignNow as an attorney?

Getting started with airSlate SignNow is simple for attorneys. You can sign up for a free trial on our website, allowing you to explore the platform's features and see how it can enhance your legal practice before committing to a subscription.

-

Does airSlate SignNow offer mobile support for attorneys?

Yes, airSlate SignNow provides a mobile-friendly interface, allowing attorneys to manage and eSign documents on the go. This flexibility ensures that you can stay productive and responsive to clients, no matter where your practice takes you.

Get more for Form 2848 Rev January Power Of Attorney And Declaration Of Representative

- Tr 6 challan form pdf

- Jv wholesale contract pdf form

- Nevada dmv duplicate title expedited form

- Application for short attendance form

- Reg 256 42675336 form

- 4 696 charlotte mecklenburg schools class trip student permission form date dear parents a class trip has been approved to

- S60 fireguard test questions and answers form

- Interview feedback format

Find out other Form 2848 Rev January Power Of Attorney And Declaration Of Representative

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed