Form 8821 Rev January Tax Information Authorization 2021-2026

What is the Form 8821 Tax Information Authorization

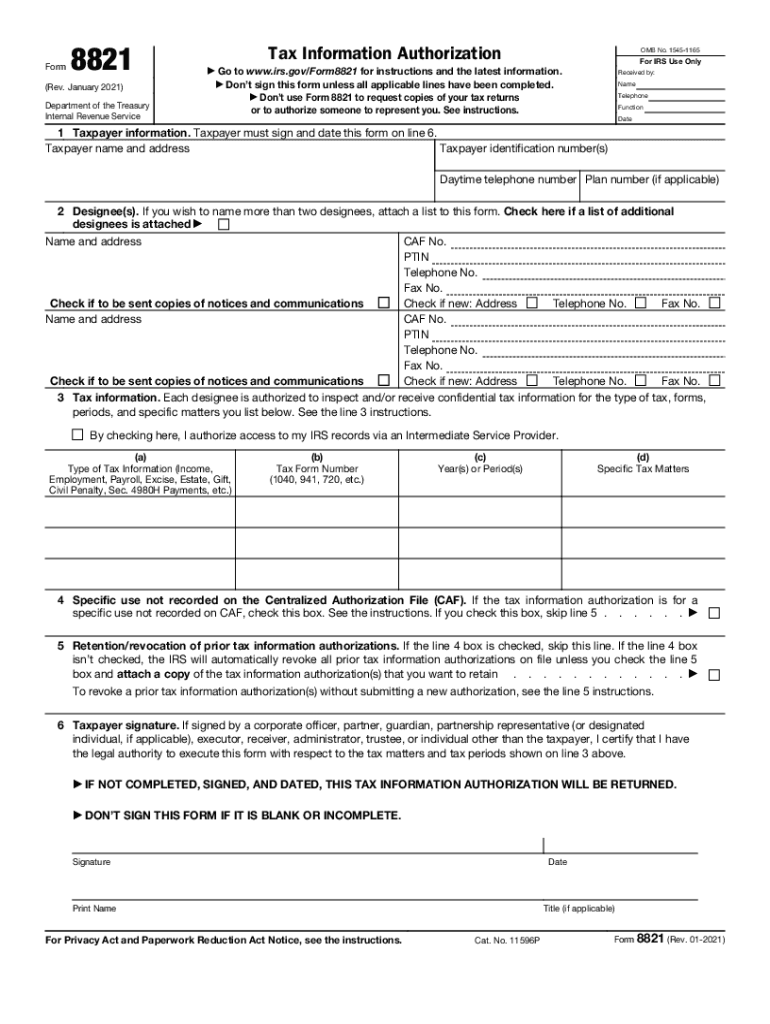

The Form 8821, also known as the Tax Information Authorization, is an official document issued by the IRS that allows individuals or entities to authorize another person to receive confidential tax information on their behalf. This form is essential for taxpayers who wish to grant access to their tax records to a third party, such as a tax professional or family member. The form ensures that the designated individual can obtain information regarding the taxpayer’s account, including tax returns, account balances, and payment history.

How to use the Form 8821 Tax Information Authorization

Using the Form 8821 is straightforward. Taxpayers must fill out the form with their personal information, including their name, address, and Social Security number. They must also provide the details of the person they are authorizing, including their name, address, and relationship to the taxpayer. Once completed, the form can be submitted to the IRS, allowing the designated individual to access the taxpayer's information. It is important to ensure that the authorized person understands their responsibilities and the limits of their access to the taxpayer's information.

Steps to complete the Form 8821 Tax Information Authorization

Completing the Form 8821 involves several key steps:

- Download the Form 8821 from the IRS website or obtain a physical copy.

- Fill in the taxpayer's information, including name, address, and Social Security number.

- Provide the name and contact information of the individual being authorized.

- Specify the tax information that the authorized individual can access.

- Sign and date the form to validate it.

- Submit the completed form to the IRS by mail or fax, as per the instructions provided.

Legal use of the Form 8821 Tax Information Authorization

The Form 8821 is legally binding once it is signed and submitted to the IRS. It complies with the regulations set forth by the IRS for authorizing individuals to access tax information. The form does not grant the authorized individual the power to act on behalf of the taxpayer in terms of filing returns or making payments; it solely allows access to information. Therefore, it is vital for taxpayers to understand the limitations of this authorization to prevent unauthorized actions.

IRS Guidelines for the Form 8821 Tax Information Authorization

The IRS provides specific guidelines for completing and submitting the Form 8821. Taxpayers should ensure that all information is accurate and up-to-date to avoid processing delays. The IRS recommends that taxpayers keep a copy of the completed form for their records. Additionally, the form should be submitted to the appropriate IRS office based on the taxpayer's location and the type of tax information being requested. Following these guidelines helps ensure compliance and facilitates the efficient processing of the authorization.

Form Submission Methods for the Form 8821 Tax Information Authorization

The Form 8821 can be submitted to the IRS through various methods. Taxpayers may choose to send the completed form by mail or fax. The IRS provides specific fax numbers for different types of tax information requests. It is important to check the latest IRS instructions to determine the correct submission method and ensure that the form reaches the appropriate department. Keeping a record of the submission can also help in tracking the authorization process.

Quick guide on how to complete form 8821 rev january 2021 tax information authorization

Prepare Form 8821 Rev January Tax Information Authorization with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Form 8821 Rev January Tax Information Authorization on any device using airSlate SignNow's Android or iOS applications, and enhance any document-driven process today.

How to edit and eSign Form 8821 Rev January Tax Information Authorization effortlessly

- Obtain Form 8821 Rev January Tax Information Authorization and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal value as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you want to send your form: by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8821 Rev January Tax Information Authorization and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8821 rev january 2021 tax information authorization

Create this form in 5 minutes!

How to create an eSignature for the form 8821 rev january 2021 tax information authorization

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the form 8821, and why is it important?

The form 8821 is a tax information authorization form used to allow designated individuals to receive confidential tax information on behalf of a taxpayer. It's important for businesses and individuals who need someone else to handle their tax matters efficiently.

-

How can airSlate SignNow assist with filling out form 8821?

airSlate SignNow provides an intuitive interface for filling out form 8821 electronically. Our platform allows users to easily input their information, ensuring accuracy and compliance with IRS requirements while also simplifying the eSignature process.

-

Is there a cost associated with using airSlate SignNow for form 8821?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing plans that ensure businesses can manage form 8821 efficiently. Our plans are designed to be cost-effective, providing great value for the features offered.

-

What features does airSlate SignNow offer for form 8821 processing?

airSlate SignNow offers features including electronic signatures, easy document sharing, and secure storage for your form 8821. Additionally, our platform integrates seamlessly with various applications to streamline the entire process.

-

Can I integrate airSlate SignNow with other platforms for form 8821?

Yes, airSlate SignNow supports integrations with several popular platforms, allowing you to manage form 8821 alongside your other business tools. This functionality ensures a streamlined workflow and improved efficiency during the document signing process.

-

What are the benefits of using airSlate SignNow for form 8821?

The benefits of using airSlate SignNow for form 8821 include enhanced security, time savings, and increased accuracy. By utilizing our platform, users can ensure that their tax information remains confidential and processes are completed swiftly and reliably.

-

How secure is my information when using airSlate SignNow for form 8821?

airSlate SignNow prioritizes security with robust encryption protocols that protect your information when completing form 8821. Our compliance with industry standards ensures that your sensitive tax information is secure throughout the entire signing process.

Get more for Form 8821 Rev January Tax Information Authorization

Find out other Form 8821 Rev January Tax Information Authorization

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter