Ny Absentee 2015

What is the New York Absentee Ballot?

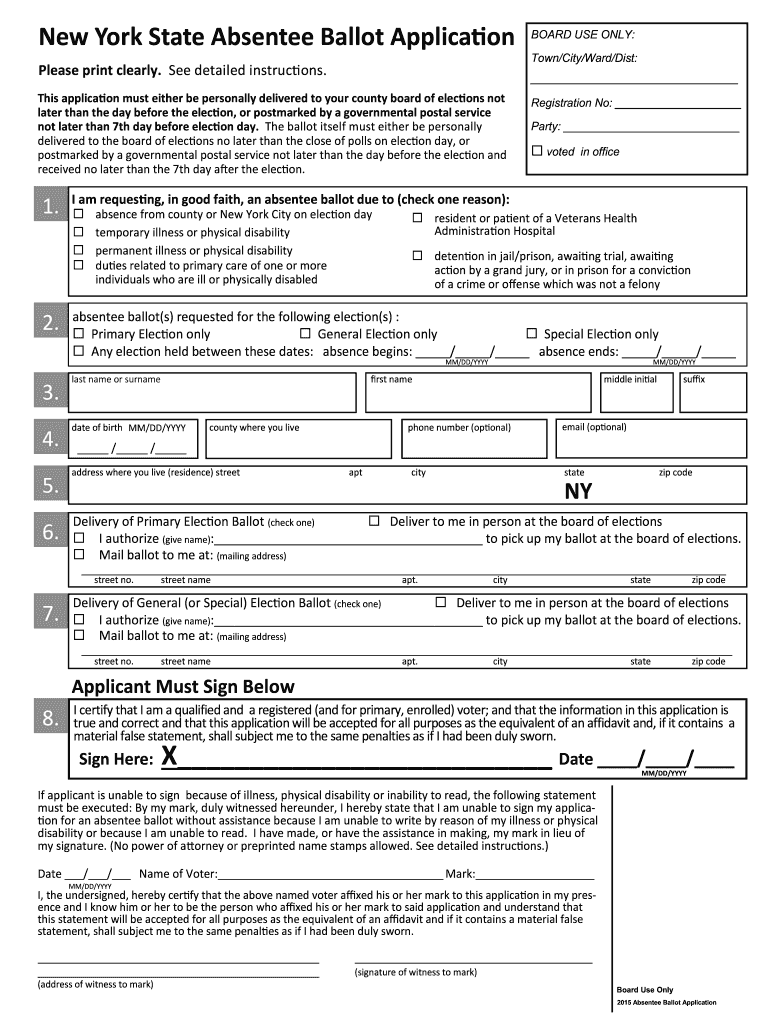

The New York absentee ballot allows voters to participate in elections without being physically present at their designated polling places. This option is available for various reasons, including being out of the county on Election Day, illness, disability, or being a caregiver. The absentee ballot ensures that all eligible voters can exercise their right to vote, regardless of their circumstances on Election Day.

Eligibility Criteria for the New York Absentee Ballot

To obtain an absentee ballot in New York, voters must meet specific eligibility criteria. These include:

- Being a registered voter in New York State.

- Providing a valid reason for requesting an absentee ballot, such as being out of the county, illness, or disability.

- Submitting the absentee ballot application before the deadline.

It is important for voters to verify their registration status and ensure they meet these criteria to successfully obtain their absentee ballot.

Steps to Complete the New York Absentee Ballot Application

The process for obtaining an absentee ballot in New York involves several steps:

- Visit the New York State Board of Elections website or your local election office to access the absentee ballot application.

- Fill out the application form, providing necessary information such as your name, address, and reason for requesting an absentee ballot.

- Submit the completed application via mail, fax, or email, depending on the submission options available in your county.

- Once your application is approved, you will receive your absentee ballot in the mail.

Following these steps carefully ensures that you receive your absentee ballot in a timely manner.

Form Submission Methods for the New York Absentee Ballot

Voters can submit their absentee ballot applications through various methods, making the process convenient. The available submission methods include:

- By Mail: Send the completed application to your local Board of Elections office.

- By Fax: Some counties allow fax submissions for absentee ballot applications.

- By Email: Certain counties may permit email submissions, but it is essential to check local regulations.

Choosing the appropriate submission method is crucial to ensure your application is processed correctly and on time.

Important Deadlines for the New York Absentee Ballot

Being aware of deadlines is vital for successfully obtaining and submitting your absentee ballot. Key dates include:

- Application Deadline: Applications for absentee ballots must be received by the local Board of Elections no later than seven days before Election Day.

- Ballot Submission Deadline: Completed absentee ballots must be postmarked by Election Day and received by the Board of Elections within a specified timeframe.

Staying informed about these deadlines helps ensure that your vote counts.

Legal Use of the New York Absentee Ballot

The New York absentee ballot is legally binding when used according to state regulations. Voters must ensure that they:

- Complete the ballot accurately, following all instructions.

- Sign the ballot envelope as required to validate their vote.

- Return the ballot within the specified deadlines to ensure it is counted.

Understanding the legal aspects of using an absentee ballot is essential for all voters to ensure compliance with voting laws.

Quick guide on how to complete new york state absentee ballot application new york state board elections ny

Complete Ny Absentee effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the required form and securely store it online. airSlate SignNow provides all the resources you need to design, modify, and eSign your documents swiftly without any holdups. Manage Ny Absentee on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Ny Absentee effortlessly

- Obtain Ny Absentee and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Ny Absentee and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state absentee ballot application new york state board elections ny

FAQs

-

How far in advance can I apply for an absentee ballot (for New York State)?

The answers to all your questions about New York State elections are on the NYS Board of Elections website.

-

Which forms do I need to fill in order to file New York state taxes?

You must determine your New York State residency status. You need to answer these questions:Did you live in an on-campus apartment or an apartment or house off-campus in New York State in 2012?Did you maintain, or rent, the on-campus apartment or off-campus residence for at least 11 months in 2012?Were you physically present in New York State for at least 183 days in 2012?If the answers to all three questions are "Yes", and you were not a full-time undergraduate student (which as an F-1 OPT I assume you were not), you are a New York State resident for tax purposes. Otherwise you are a nonresident.You file Form IT-201, http://www.tax.ny.gov/pdf/curren..., if you are a resident of New York State, Form IT-203, http://www.tax.ny.gov/pdf/curren..., if you are not.

-

Is it possible to run a NY LLC out of the New York State and even out of the US?

Sure, it is possible.Registering Business in New YorkIf you decided to open a new business that will be based in New York you can choose from several options:Sole OwnersSole Proprietorship: Sole owners of New York-based businesses could opt for sole proprietorship as the easiest form of business organization. Not the most recommended, given the liability a sole proprietor assumes as a result of owning a business. No registration with New York State Department of State is necessary, but it is recommended to obtain a Business Certificate (DBA), and if you plan to hire employees then also obtain an EIN.Single Member LLC: Limited liability company, as the name suggests, is an entity that allows its owners to limit the liability of the business to the entity itself, shielding the owners' personal assets. This type of entity is recommended for most small businesses. By default your LLC will be taxed as "disregarded entity", meaning you will file your LLC tax return as part of your personal tax return. Keep in mind though - LLC is a flexible entity, which means you have the option of electing it to be taxed as S-Corp (assuming you are a U.S. person) or C-Corp. Learn more about LLC here, and about the details of forming LLC in New York here.Corporation: You can also form a corporation and be a sole shareholder with 100% of all shares. Corporations have more formalities than LLCs (for example in New York you are required to have bylaws and maintain minutes of meetings in corporate records), but provide similar limited liability protection. That's one of the reasons this entity type is often more suitable for bigger companies, or those who seek major investment. Corporations can be taxed as S-Corp or C-Corp, with each form of taxation having its pros and cons. Keep in mind, you can elect your corporation to be S-Corp only if you, as the sole shareholder, are a U.S. person. Learn more about corporations here, and about the details of incorporating in New York here.PartnersGeneral Partnership: Like sole proprietorship, this entity type does not require registration with the New York State Department of State, but it also does not protect the owners from business liability, and therefore is usually not recommended. A General Partnership needs to obtain a Business Certificate (DBA), and obtain an EIN.Multiple Member LLC: like Single Member LLC for sole owner, Multiple Member LLC is often the entity of choice for small and new businesses with more than one partner.Corporation: Since corporation can have many shareholders, and transfering ownership is relatively easy (though share transfer) corporation might be a good choice of entity for business with partners. Keep in mind though - S Corporations are limited to 100 shareholders who must be physical U.S. persons. That means corporations owned (partially or fully) by non-U.S. persons or legal entities, cannot be elected as S-Corp, and therefore subject to double taxation of an C-Corp. In cases like that it would be recommended to consider choosing LLC instead.Limited Partnerships: Limited partnerships come in different forms, depending on the state (LP, LLP, LLLP). Though Limited Partnerships have their own purpose and place, for most cases we believe an LLC would serve its owners well enough, therefore at this point we do not cover Limited Partnerships.Existing Out-of-State CompaniesAn existing company registered in another state or country (called "foreign corporation", "foreign LLC", etc) looking to conduct business in New York might be required to foreign qualify in New York. This rule typically applies to companies looking to open a physical branch in New York, lease an office or warehouse, hire employees, etc."Foreign" businesses that do not create "strong nexus" by moving physically to New York might still be required to obtain Certificate of Authority to Collect Sales Tax from New York Department of Taxation and Finance if selling taxable products or services using local dropshippers.

-

How do I report Form 1042 S for New York State Tax on their website https://tax.ny.gov/?

Just give a call to the Personal Income Tax Information Center at 518-457-5181.They will ask you to report it as W-2 and attach scanned copy of your 1042-S. They will also make a note about that is how they asked you to report it.So, dont just report 1042-S as W-2. Give them a call first.

-

How many signatures does a candidate have to gather in order to appear on the ballot for the U.S. House in New York State?

https://www.elections.ny.gov/Run...

-

Do you agree that "it is time for the United States to offer Mr. Snowden a plea bargain or some form of clemency that would allow him to return home" as opined by the New York Times editorial board?

No. He should get a life sentence in prison, as per the law. A nation, a corporation and many other entities, even a marriage must be able to maintain secrecy if it is to function.To offer clemency will simply encourage further chaos.Official channels should be used for the dissemination of information to the public. If the laws or controls in place to monitor the NSA are inadequate, then they should be updated.

Create this form in 5 minutes!

How to create an eSignature for the new york state absentee ballot application new york state board elections ny

How to generate an electronic signature for the New York State Absentee Ballot Application New York State Board Elections Ny in the online mode

How to generate an eSignature for the New York State Absentee Ballot Application New York State Board Elections Ny in Google Chrome

How to make an electronic signature for putting it on the New York State Absentee Ballot Application New York State Board Elections Ny in Gmail

How to generate an electronic signature for the New York State Absentee Ballot Application New York State Board Elections Ny right from your smart phone

How to create an electronic signature for the New York State Absentee Ballot Application New York State Board Elections Ny on iOS devices

How to make an eSignature for the New York State Absentee Ballot Application New York State Board Elections Ny on Android

People also ask

-

What steps should I take to learn how to obtain an absentee ballot in NY?

To learn how to obtain an absentee ballot in NY, start by visiting the New York State Board of Elections website. You'll find detailed guidelines on eligibility, as well as instructions on how to request an absentee ballot by mail or online. Additionally, ensure you are aware of important deadlines for requesting and submitting your ballot.

-

What is the cost of obtaining an absentee ballot in NY?

Obtaining an absentee ballot in NY is free of charge. There are no fees associated with requesting or receiving your absentee ballot, making it an accessible option for voters. However, ensure to check if any associated costs arise from mailing your completed ballot back.

-

Can I eSign my absentee ballot application using airSlate SignNow?

Yes, you can easily eSign your absentee ballot application with airSlate SignNow. Our platform provides a user-friendly interface that simplifies the electronic signing process, ensuring that your application is submitted quickly and securely. This feature makes it more convenient to manage your absentee voting needs.

-

Are there deadlines for requesting an absentee ballot in NY?

Yes, there are specific deadlines for how to obtain an absentee ballot in NY. Generally, you must request your absentee ballot at least a week before the election, and your completed ballot must be received by the Board of Elections by 9 PM on Election Day. Always confirm the exact dates based on the upcoming election cycle.

-

What are the benefits of voting absentee in NY?

Voting absentee in NY provides numerous benefits, including the convenience of casting your vote from anywhere, especially if you are unable to be at your polling place on Election Day. It allows you to take your time reviewing the candidates and measures without the pressure of waiting in line or rushing. Additionally, eSigning your absentee ballot application through platforms like airSlate SignNow simplifies the process.

-

Can I track the status of my absentee ballot in NY?

Yes, you can track the status of your absentee ballot in NY after it has been mailed. The New York State Board of Elections offers a tracking tool that lets you see if your ballot has been received and accepted. This provides peace of mind as you ensure your vote counts.

-

What if I make a mistake on my absentee ballot application?

If you make a mistake on your absentee ballot application in NY, you can correct it by submitting a new application. Be sure to follow up that any corrections are made before the deadlines. Using airSlate SignNow can streamline the process of amending your application quickly and efficiently.

Get more for Ny Absentee

- Indian river county tourist development tax return clerk indian river form

- Return form bavarian autosport

- Mediation request form fcps

- Kentucky department for public health instructions for the chfs ky form

- Kyc form askari investment management limited

- Request for reimbursement request for reimbursement form

- Employment application form 688265199

- Medical information and liability release form thi

Find out other Ny Absentee

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple