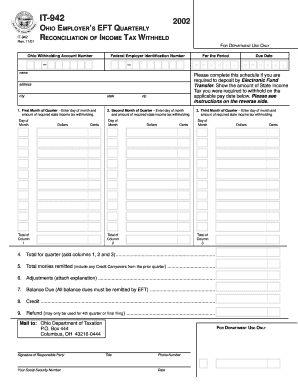

it 942 2002-2026

What is the IT 942

The IT 942 form, also known as the Ohio IT 942, is a tax document used by certain taxpayers in Ohio to report income and calculate their tax liability. This form is specifically designed for individuals and businesses that meet specific criteria set by the Ohio Department of Taxation. It is essential for ensuring compliance with state tax laws and for accurately reporting income earned within the state.

How to use the IT 942

The IT 942 form is utilized primarily for reporting income earned in Ohio. Taxpayers must fill out the form with accurate information regarding their income sources, deductions, and any applicable credits. Once completed, it is submitted to the Ohio Department of Taxation as part of the annual tax filing process. Understanding how to properly use this form is crucial for avoiding penalties and ensuring that all tax obligations are met.

Steps to complete the IT 942

Completing the IT 942 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out the form with accurate personal and financial information, ensuring all income sources are reported.

- Calculate any deductions and credits that apply to your situation.

- Review the completed form for accuracy before submission.

- Submit the form to the Ohio Department of Taxation either online, by mail, or in person, depending on your preference.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IT 942 form. Typically, the deadline for submitting this form coincides with the federal tax filing deadline, which is usually April 15. However, taxpayers should verify any specific dates or extensions that may apply in Ohio. Staying informed about these deadlines helps avoid late fees and penalties.

Required Documents

When preparing to file the IT 942, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any deductions or credits being claimed

- Previous year’s tax return for reference

Having these documents organized will streamline the process of completing the form and ensure that all necessary information is included.

Penalties for Non-Compliance

Failure to file the IT 942 form or inaccuracies in reporting can lead to significant penalties. Taxpayers may face fines, interest on unpaid taxes, and potential legal action from the Ohio Department of Taxation. It is essential to complete the form accurately and submit it on time to avoid these consequences.

Quick guide on how to complete it 942

Complete IT 942 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle IT 942 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign IT 942 without any hassle

- Locate IT 942 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and eSign IT 942 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 942

Create this form in 5 minutes!

How to create an eSignature for the it 942

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 942 and how can airSlate SignNow help with it?

Form 942 is a tax form used for reporting certain types of income. airSlate SignNow simplifies the process of completing and signing form 942 by providing an intuitive platform that allows users to fill out, eSign, and send the document securely.

-

Is there a cost associated with using airSlate SignNow for form 942?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and signing of form 942, ensuring a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for managing form 942?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage form 942 efficiently, ensuring that you can complete and send it without hassle.

-

Can I integrate airSlate SignNow with other applications for form 942?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling form 942. This means you can connect with tools you already use, enhancing productivity and efficiency.

-

How does airSlate SignNow ensure the security of form 942?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your data, ensuring that your form 942 and other documents are safe from unauthorized access.

-

Can I access form 942 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage form 942 from your smartphone or tablet. This flexibility ensures that you can complete and sign documents on the go, making it convenient for busy professionals.

-

What are the benefits of using airSlate SignNow for form 942?

Using airSlate SignNow for form 942 offers numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. The platform's user-friendly interface makes it easy to complete and eSign documents, improving overall efficiency.

Get more for IT 942

- Defendants motion for trial continuance form

- Change of venue in a criminal casenolo form

- Motion to compel and for form

- Plaintiffs motion to enter protective order and memorandum form

- Motion for judgment notwithstanding the form

- Motion for order of remand form

- Motion for continuance to complete discovery or in form

- Rule 59 new trials amendment of judgments miss r civ form

Find out other IT 942

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT