AR8453 C Form

What is the AR8453 C

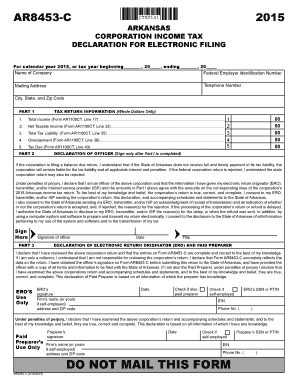

The AR8453 C is a specific form used for Arkansas income tax declaration purposes. This form is essential for residents and businesses in Arkansas to report their income and calculate the amount of state tax owed. It serves as a formal declaration to the Arkansas Department of Finance and Administration, ensuring compliance with state tax laws. Understanding the purpose and requirements of the AR8453 C is crucial for accurate tax reporting and avoiding penalties.

How to use the AR8453 C

Using the AR8453 C involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, fill out the form with your personal information, including your Social Security number and filing status. Be sure to report all sources of income, such as wages, dividends, and interest. After completing the form, review it for accuracy before submission to avoid delays or issues with the Arkansas Department of Finance and Administration.

Steps to complete the AR8453 C

Completing the AR8453 C requires careful attention to detail. Follow these steps for successful completion:

- Gather all required financial documents, including W-2s and 1099s.

- Provide your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline.

Legal use of the AR8453 C

The AR8453 C must be used in accordance with Arkansas state tax laws. It is legally binding and serves as a formal declaration of income and tax liability. Failing to use the form correctly or submitting false information can result in penalties, including fines or audits. It is essential to ensure that all information provided is accurate and complete to maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the AR8453 C are critical to avoid penalties. Typically, the form must be submitted by April 15 each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes to deadlines or extensions that may be announced by the Arkansas Department of Finance and Administration.

Who Issues the Form

The AR8453 C is issued by the Arkansas Department of Finance and Administration. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance for individuals and businesses to help them understand their tax obligations and the proper use of forms like the AR8453 C.

Quick guide on how to complete ar8453 c

Prepare AR8453 C easily on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely archive it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents promptly without delays. Manage AR8453 C on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign AR8453 C effortlessly

- Find AR8453 C and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign AR8453 C and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar8453 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Arkansas income tax declaration?

An Arkansas income tax declaration is a formal statement that individuals and businesses must file to report their income and calculate their tax obligations in the state of Arkansas. It is essential for compliance with state tax laws and helps ensure that taxpayers pay the correct amount of taxes owed.

-

How can airSlate SignNow assist with Arkansas income tax declaration?

airSlate SignNow provides a streamlined platform for businesses to send and eSign documents related to Arkansas income tax declaration. With its user-friendly interface, users can easily manage their tax documents, ensuring timely submissions and compliance with state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it a cost-effective solution for managing Arkansas income tax declaration documents. Users can choose from different tiers based on features required, ensuring they only pay for what they need.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing Arkansas income tax declaration documents. These features enhance efficiency and ensure that all tax-related documents are easily accessible and securely stored.

-

Is airSlate SignNow compliant with Arkansas tax regulations?

Yes, airSlate SignNow is designed to comply with Arkansas tax regulations, ensuring that all documents related to Arkansas income tax declaration meet state requirements. This compliance helps users avoid potential penalties and ensures a smooth filing process.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your Arkansas income tax declaration alongside other financial tasks. This seamless integration enhances productivity and simplifies the overall tax filing process.

-

What are the benefits of using airSlate SignNow for tax declarations?

Using airSlate SignNow for Arkansas income tax declaration provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive tax documents. The platform's ease of use allows businesses to focus more on their core operations rather than getting bogged down by tax filing processes.

Get more for AR8453 C

- In the matter of the estate of form

- Trust registration statement co courts form

- Settlor testator form

- Petition for allowance of claims by personal representative form

- Colorado judicial branch self help forms co courts

- Information of appointment important notice co courts

- To clerk of the court form

- On the petition motion of name name form

Find out other AR8453 C

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document