About Form 5754, Statement by Persons Receiving IRS 2021

What is Form 5754, Statement By Persons Receiving IRS

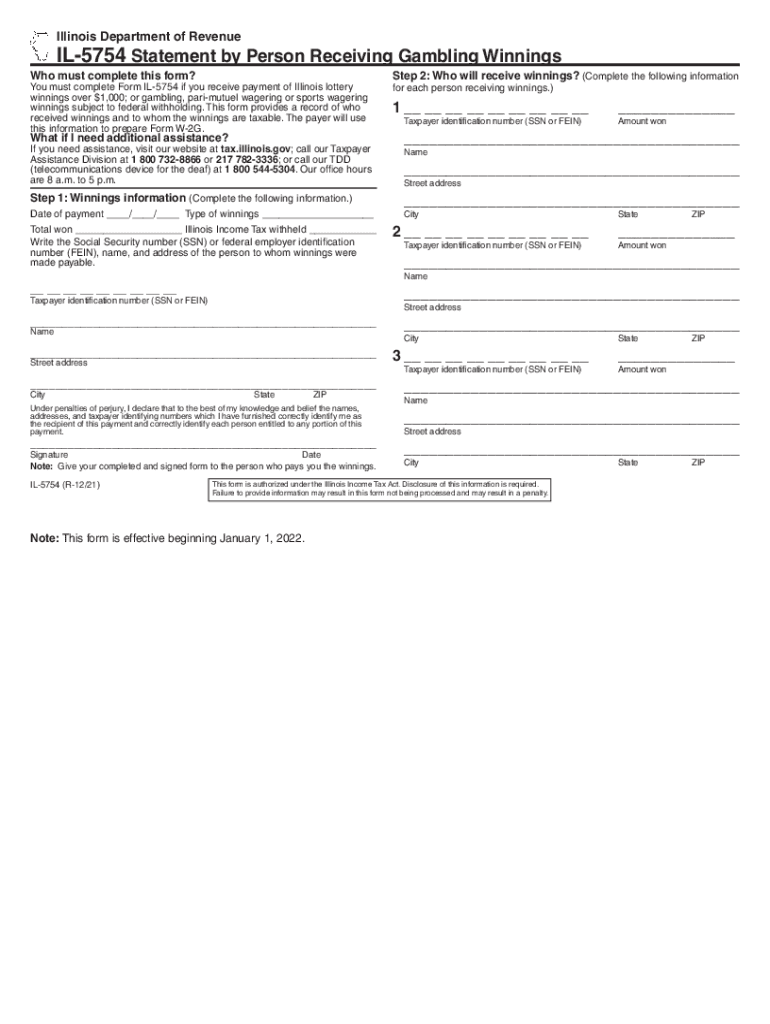

Form 5754, Statement By Persons Receiving, is an IRS document used by individuals who receive gambling winnings. This form is essential for reporting the identities of multiple recipients of winnings and ensuring proper tax withholding. It is primarily utilized in situations where winnings exceed a certain threshold, requiring the payer to report the distribution to the IRS. Understanding this form is crucial for compliance with tax regulations and for avoiding potential penalties.

How to Use Form 5754, Statement By Persons Receiving IRS

Using Form 5754 involves providing accurate information about the recipients of gambling winnings. This includes details such as names, addresses, and Social Security numbers. The form must be completed by the payer when the winnings are distributed to multiple individuals. It is important to ensure that all information is correct to facilitate proper reporting to the IRS. The completed form should be submitted alongside the relevant tax documents to maintain compliance.

Steps to Complete Form 5754, Statement By Persons Receiving IRS

Completing Form 5754 requires careful attention to detail. Follow these steps:

- Gather necessary information about each recipient, including their full name, address, and Social Security number.

- Fill out the form accurately, ensuring that all entries are legible and correct.

- Double-check the information for any errors or omissions.

- Submit the completed form to the IRS along with any required tax documents.

Legal Use of Form 5754, Statement By Persons Receiving IRS

The legal use of Form 5754 is primarily tied to compliance with IRS regulations regarding gambling winnings. This form is required when winnings are distributed to multiple recipients, ensuring that the IRS receives accurate information about the individuals involved. Failure to use this form correctly can result in penalties for both the payer and the recipients. It is essential to understand the legal implications of this form to avoid complications during tax filing.

Eligibility Criteria for Form 5754, Statement By Persons Receiving IRS

Eligibility to use Form 5754 typically applies to individuals who receive gambling winnings that exceed the reporting threshold set by the IRS. This includes winnings from lotteries, casinos, and other gaming establishments. Each recipient must provide their information on the form to ensure accurate reporting. Understanding the eligibility criteria helps ensure compliance and proper tax handling for all parties involved.

Filing Deadlines for Form 5754, Statement By Persons Receiving IRS

Filing deadlines for Form 5754 align with the general tax filing deadlines set by the IRS. Typically, this form must be submitted by the end of the tax year in which the winnings were received. It is crucial for payers to be aware of these deadlines to avoid late submissions, which could result in penalties. Keeping track of important dates ensures that all necessary forms are filed in a timely manner.

Quick guide on how to complete about form 5754 statement by persons receiving irs

Effortlessly Prepare About Form 5754, Statement By Persons Receiving IRS on Any Device

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage About Form 5754, Statement By Persons Receiving IRS on any device using the airSlate SignNow applications for Android or iOS and enhance your document-centric processes today.

The easiest way to modify and electronically sign About Form 5754, Statement By Persons Receiving IRS with ease

- Obtain About Form 5754, Statement By Persons Receiving IRS and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Alter and electronically sign About Form 5754, Statement By Persons Receiving IRS to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 5754 statement by persons receiving irs

Create this form in 5 minutes!

How to create an eSignature for the about form 5754 statement by persons receiving irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5754, Statement By Persons Receiving IRS?

Form 5754, Statement By Persons Receiving IRS, is a document used to report the distribution of gambling winnings to multiple recipients. This form helps ensure that the IRS receives accurate information regarding the allocation of winnings among individuals. Understanding Form 5754 is crucial for compliance with tax regulations.

-

How can airSlate SignNow assist with Form 5754?

airSlate SignNow provides a streamlined platform for electronically signing and sending Form 5754, Statement By Persons Receiving IRS. Our solution simplifies the process, making it easy for businesses to manage their documentation efficiently. With airSlate SignNow, you can ensure that your forms are completed accurately and securely.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans include features that support the management of documents like Form 5754, Statement By Persons Receiving IRS. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the management of important documents like Form 5754, Statement By Persons Receiving IRS. Our platform is designed to improve efficiency and ensure compliance.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is compliant with IRS regulations, ensuring that your use of Form 5754, Statement By Persons Receiving IRS, meets all necessary legal requirements. Our platform employs advanced security measures to protect sensitive information. You can trust airSlate SignNow for your document signing needs.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This includes popular tools that can help you manage Form 5754, Statement By Persons Receiving IRS, alongside your other business processes. Integration capabilities make it easier to streamline your operations.

-

What are the benefits of using airSlate SignNow for Form 5754?

Using airSlate SignNow for Form 5754, Statement By Persons Receiving IRS, provides numerous benefits, including time savings and improved accuracy. Our platform allows for quick eSigning and document sharing, reducing the risk of errors. Additionally, you can track the status of your forms in real-time.

Get more for About Form 5754, Statement By Persons Receiving IRS

- Uccjea form

- Ch 100 info can a civil harassment restraining order help me civil harassment prevention judicial council forms

- Free alaska notarial certificate jurat pdf word form

- Alaska and shc 1124 form

- Alabama child support form cs 42

- Form 16 alabama judicial system

- Alabama child support forms 497230392

- Alabama writ to execute form

Find out other About Form 5754, Statement By Persons Receiving IRS

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now