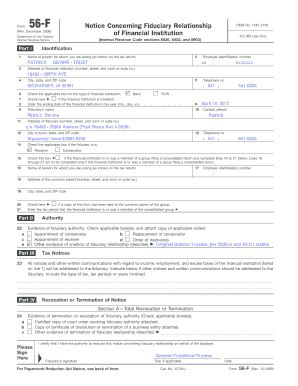

56f 2009

What is the 56f form

The 56f form is a specific document used in the United States for various legal and administrative purposes. It is often associated with certain tax-related processes, particularly for businesses and individuals who need to report specific information to the Internal Revenue Service (IRS). Understanding the purpose of the 56f form is essential for compliance and accurate reporting.

How to use the 56f

Using the 56f form involves several key steps. First, ensure that you have the most current version of the form, which can typically be downloaded from the IRS website or obtained from a tax professional. Next, fill out the required fields accurately, providing all necessary information such as your name, address, and any relevant financial details. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS.

Steps to complete the 56f

Completing the 56f form requires careful attention to detail. Start by gathering all necessary documents that support the information you will provide. Follow these steps:

- Download the latest version of the 56f form from an official source.

- Read the instructions carefully to understand what information is required.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided by the IRS.

Legal use of the 56f

The legal use of the 56f form is crucial for individuals and businesses to remain compliant with IRS regulations. This form serves as a formal declaration of specific information, and improper use can lead to penalties or legal repercussions. It is important to understand the legal implications of the information reported and to maintain accurate records that support the data submitted on the form.

Filing Deadlines / Important Dates

Filing deadlines for the 56f form can vary based on the specific context in which it is used. Typically, it is essential to submit the form by the due date established by the IRS to avoid penalties. Keeping track of these dates is vital for compliance and to ensure that all necessary documentation is submitted on time.

Required Documents

When completing the 56f form, certain documents may be required to support your claims or information provided. Commonly needed documents include:

- Identification documents, such as a driver's license or Social Security number.

- Financial statements or records that substantiate the information reported.

- Any previous forms or correspondence related to the matter at hand.

Quick guide on how to complete 56f

Complete 56f effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage 56f on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and eSign 56f seamlessly

- Locate 56f and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or overlooked documents, the hassle of searching through forms, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign 56f and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 56f

Create this form in 5 minutes!

How to create an eSignature for the 56f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where do I file form 56F?

Form 56-F Notice Concerning Fiduciary Relationship of Financial Institution. For purposes of section 6402(k) and section 6903, send Form 56-F to the Internal Revenue Service Center where the financial institution for whom the fiduciary is acting files its income tax return.

-

What is the IRS form 56F used for?

Use Form 56-F to notify the IRS of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

-

How do I submit form 56F to the IRS?

File Form 56 at Internal Revenue Service Center where the person for whom you are acting is required to file tax returns. If you wish to receive tax notices for more than one form and one of the forms is Form 1040, file Form 56 with the IRS center where the person for whom you are acting is required to file Form 1040.

-

What is the difference between form 56 and form 56F?

Form 56-F should be filed instead of Form 56, Notice Concerning Fiduciary Relationship, by the federal agency acting as a fiduciary (defined below) in order to notify the IRS of the creation, termination, or change in status of a fiduciary relationship with a financial institution.

-

What is the purpose of form 56F?

All taxpayers who wish to claim deductions under Section 10AA need to file Form 56F. This is applicable for industries that undertake activities like operating ships, goods production etc. in the previous financial year.

-

Who should file IRS form 56?

Form 56 should be filed by a fiduciary (see Definitions below) to notify the IRS of the creation or termination of a fiduciary relationship under section 6903. For example, if you are acting as fiduciary for an individual, a decedent's estate, or a trust, you may file Form 56.

-

When should form 56 be filed?

Form 56 is filed with the IRS at the beginning and end of a fiduciary relationship — one where one person is responsible for the assets of another. Form 56 must also be filed whenever a fiduciary relationship changes.

-

What is form 56F of Income Tax Act?

What is the Form 56F rule? Form 56F rule refers to the new Rule 16D in the Income-tax Rules, 1962. It states that all taxpayers who want to claim deductions under section 10AA for activities like operating ship, goods production, etc. in the Financial Year have to file Form 56F.

Get more for 56f

Find out other 56f

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter