Irs 56 F 2021

What is the IRS 56 F?

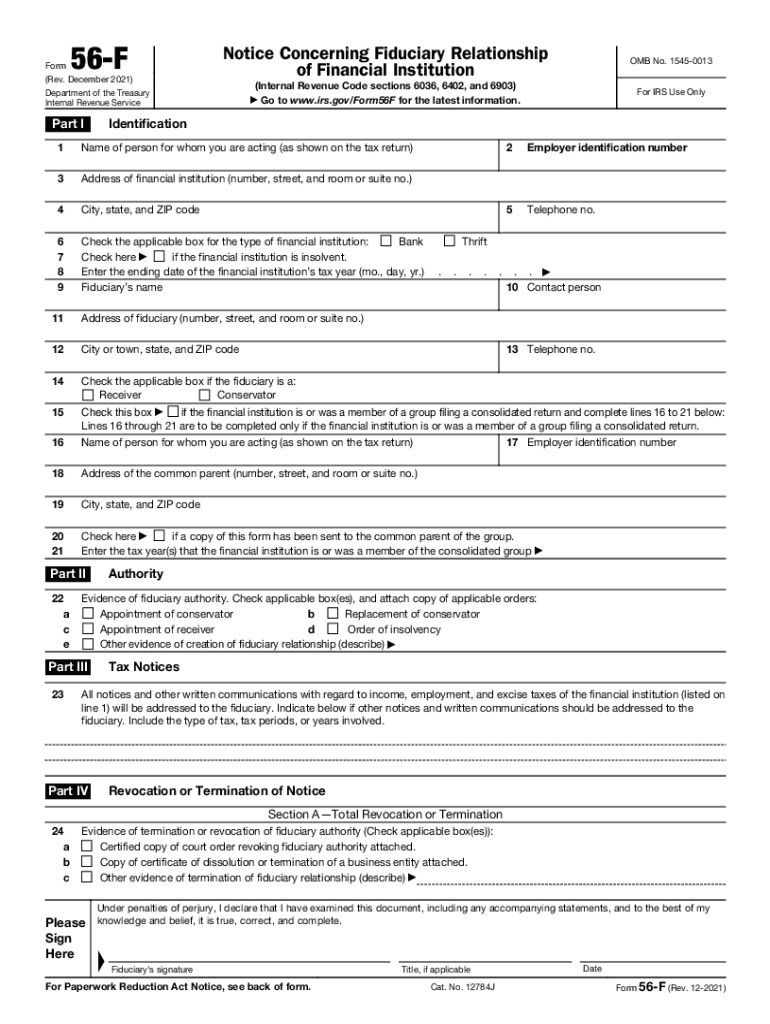

The IRS 56 F form, also known as the 56 F fiduciary, is a document used primarily for tax purposes in the United States. It is designed for fiduciaries, such as executors or administrators of estates, to notify the IRS of their role in managing the tax affairs of a decedent or an estate. This form is essential for ensuring that the IRS recognizes the fiduciary's authority to act on behalf of the estate, allowing them to handle tax matters appropriately.

How to use the IRS 56 F

Using the IRS 56 F form involves several steps to ensure proper completion and submission. First, the fiduciary must gather all necessary information regarding the decedent and the estate. This includes the decedent's Social Security number, the estate's Employer Identification Number (EIN), and other relevant details. Once the form is filled out, it should be submitted to the IRS along with any required documentation to confirm the fiduciary's authority.

Steps to complete the IRS 56 F

Completing the IRS 56 F form requires careful attention to detail. Here are the steps to follow:

- Obtain the IRS 56 F form from the IRS website or through a tax professional.

- Fill in the decedent's information, including their name, address, and Social Security number.

- Provide the fiduciary's details, including their name, address, and relationship to the decedent.

- Include the estate's EIN if applicable.

- Sign and date the form to certify its accuracy.

Legal use of the IRS 56 F

The legal use of the IRS 56 F form is crucial for ensuring compliance with tax regulations. By submitting this form, fiduciaries establish their legal authority to manage the decedent's tax obligations. It is important to understand that failure to file the IRS 56 F may result in complications, including delays in processing tax returns or even penalties for non-compliance.

Key elements of the IRS 56 F

Several key elements define the IRS 56 F form, making it a vital document for fiduciaries:

- Identification of the decedent: Accurate details about the deceased individual are necessary.

- Fiduciary information: The form must clearly state the fiduciary's identity and role.

- Signature: The fiduciary's signature is required to validate the form.

- Submission details: Understanding where and how to submit the form is essential for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 56 F form can vary based on the specific circumstances of the estate. Generally, it is advisable to submit the form as soon as the fiduciary is appointed. This ensures timely compliance with IRS requirements and helps avoid potential penalties. Fiduciaries should consult IRS guidelines or a tax professional for specific deadlines related to their situation.

Quick guide on how to complete irs 56 f

Complete Irs 56 F easily on any device

Online document organization has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Irs 56 F on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Irs 56 F effortlessly

- Obtain Irs 56 F and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Irs 56 F and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 56 f

Create this form in 5 minutes!

People also ask

-

What is irs 56 f and how does it relate to electronic signatures?

The IRS 56 F is a form used to notify the IRS of certain actions that might affect a taxpayer's rights. Utilizing electronic signatures through airSlate SignNow provides a convenient and legally binding way to sign this form, ensuring that all necessary documents are submitted swiftly and securely.

-

How can airSlate SignNow help me complete the irs 56 f form?

airSlate SignNow simplifies the process of completing the IRS 56 F by allowing users to fill out and sign documents digitally. This ensures accuracy and helps avoid mailing delays, offering a seamless experience from start to finish.

-

What features of airSlate SignNow are beneficial for filing the irs 56 f form?

Key features like templates, customizable workflows, and real-time tracking make airSlate SignNow ideal for managing the IRS 56 F form. These tools ensure that you can efficiently prepare, send, and monitor the status of your documents.

-

Is airSlate SignNow cost-effective for small businesses needing to file irs 56 f forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. This cost-effective solution enables you to handle the IRS 56 F forms without breaking the bank, while also gaining access to a variety of essential eSignature tools.

-

Can I integrate airSlate SignNow with other software for handling the irs 56 f?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of applications, enhancing your workflow for handling the IRS 56 F. Whether you're using CRM systems or document management tools, these integrations contribute to a more efficient document process.

-

How secure is it to use airSlate SignNow for signing the irs 56 f form?

airSlate SignNow prioritizes security with encryption and advanced authentication measures. When you sign the IRS 56 F using our platform, you can be confident that your sensitive information is protected against unauthorized access.

-

What are the benefits of using airSlate SignNow for IRS-related documents like the irs 56 f?

Using airSlate SignNow for IRS-related documents like the IRS 56 F enhances efficiency, reduces paperwork, and improves compliance. The platform streamlines the signing process, allowing for faster submission and reducing the risk of human error.

Get more for Irs 56 F

Find out other Irs 56 F

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document