56 F Notice Concerning Fiduciary Relationship IRS Tax Forms 2022-2026

What is the IRS 56 F Notice Concerning Fiduciary Relationship?

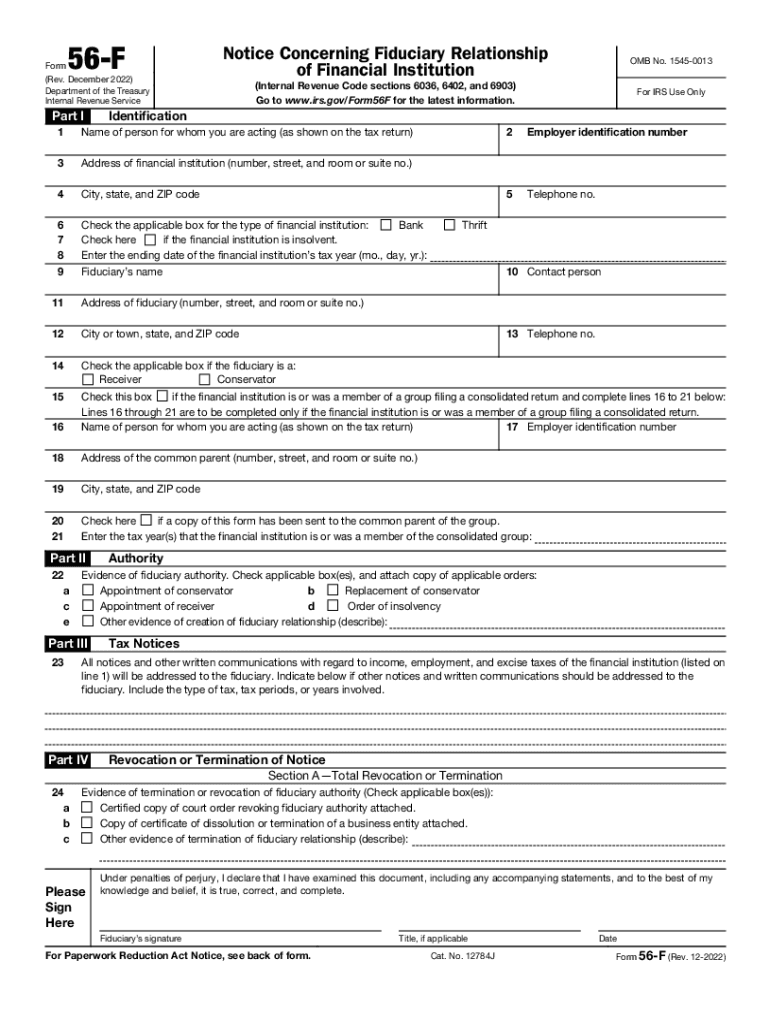

The IRS 56 F form, officially known as the Notice Concerning Fiduciary Relationship, is a tax document used to inform the Internal Revenue Service of the appointment of a fiduciary. This form is essential for individuals or entities acting on behalf of another party, such as a deceased person or an estate. By submitting this form, the fiduciary establishes their authority to manage the tax affairs of the individual or entity they represent. This includes filing tax returns and handling any tax-related communications with the IRS.

Steps to Complete the IRS 56 F Form

Filling out the IRS 56 F form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Begin by entering the name and address of the fiduciary in the designated section.

- Provide the name and address of the individual or entity for whom you are acting as fiduciary.

- Include the taxpayer identification number (TIN) of both the fiduciary and the individual or entity.

- Specify the type of fiduciary relationship, such as executor, administrator, or trustee.

- Sign and date the form to certify the information provided is accurate.

Legal Use of the IRS 56 F Form

The IRS 56 F form serves a critical legal function in establishing a fiduciary's authority. This form is recognized by the IRS as a legitimate means of notifying them of a fiduciary relationship. Properly completing and submitting this form ensures that the fiduciary can act on behalf of the taxpayer in all tax matters. Failure to file this form may result in complications, such as the IRS not recognizing the fiduciary's authority, which could hinder the management of tax obligations.

Filing Deadlines for the IRS 56 F Form

Understanding the filing deadlines for the IRS 56 F form is crucial for compliance. Generally, the form should be submitted as soon as the fiduciary relationship is established. It is advisable to file the form before any tax returns are submitted on behalf of the individual or entity. Timely filing helps prevent delays in processing tax returns and ensures that the IRS has the necessary information to communicate with the fiduciary.

Required Documents for the IRS 56 F Form

When completing the IRS 56 F form, certain documents may be necessary to support the submission. These include:

- Proof of the fiduciary's identity, such as a government-issued ID.

- Documentation establishing the fiduciary relationship, like a will or trust agreement.

- Any relevant tax identification numbers for both the fiduciary and the individual or entity.

Form Submission Methods for the IRS 56 F Form

The IRS 56 F form can be submitted through various methods to accommodate different preferences. The available submission options include:

- Mailing the completed form to the appropriate IRS address.

- Submitting the form electronically, if applicable, through authorized e-filing services.

- In-person delivery at designated IRS offices, if necessary.

Quick guide on how to complete 56 f notice concerning fiduciary relationship irs tax forms

Effortlessly prepare 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms on any device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and digitally sign your documents promptly without issues. Handle 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and digitally sign 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms without hassle

- Locate 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and digitally sign 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 56 f notice concerning fiduciary relationship irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the IRS 56 F Form and how does it relate to airSlate SignNow?

The IRS 56 F Form, also known as the Application for Extension of Time to File, is a critical document for businesses needing additional time for compliance. With airSlate SignNow, you can easily create, send, and eSign the IRS 56 F Form, ensuring your submissions are timely and accurately processed.

-

How can airSlate SignNow help me complete the IRS 56 F Form efficiently?

airSlate SignNow streamlines the process of completing the IRS 56 F Form through its user-friendly interface. You can quickly fill out required fields, securely eSign, and send the document to relevant parties without delays, simplifying your tax filing workflow.

-

What features does airSlate SignNow offer for managing the IRS 56 F Form?

airSlate SignNow offers a range of features such as customizable templates, real-time tracking, and mobile accessibility, all of which enhance the management of the IRS 56 F Form. These features ensure that users can edit, send, and receive documents efficiently while maintaining legal compliance.

-

Is there a cost associated with using airSlate SignNow for the IRS 56 F Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options suitable for teams requiring to handle the IRS 56 F Form. You can choose a plan that fits your budget while taking advantage of powerful features to enhance your document processes.

-

Can I integrate airSlate SignNow with other software for the IRS 56 F Form?

Absolutely! airSlate SignNow supports integrations with various applications, such as CRM systems and cloud storage services, to help manage the IRS 56 F Form seamlessly. This ensures that you can incorporate eSigning into your existing workflows without any hassle.

-

What benefits does eSigning the IRS 56 F Form with airSlate SignNow provide?

eSigning the IRS 56 F Form with airSlate SignNow offers enhanced security, quicker turnaround times, and legal compliance. The platform guarantees that your signed documents are legally binding and securely stored, providing peace of mind for your business transactions.

-

How can I ensure my IRS 56 F Form is secure using airSlate SignNow?

airSlate SignNow employs advanced encryption protocols and secure cloud storage to protect your IRS 56 F Form and sensitive data. The platform also provides audit trails, allowing you to track every action taken on your documents, further ensuring their security.

Get more for 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms

- Notice of default for past due payments in connection with contract for deed new mexico form

- Final notice of default for past due payments in connection with contract for deed new mexico form

- Assignment of contract for deed by seller new mexico form

- Notice of assignment of contract for deed new mexico form

- Nm purchase form

- Buyers home inspection checklist new mexico form

- Sellers information for appraiser provided to buyer new mexico

- New mexico real estate form

Find out other 56 F Notice Concerning Fiduciary Relationship IRS Tax Forms

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online