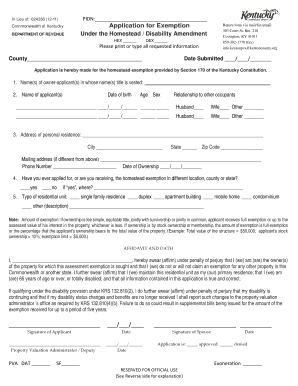

the Homestead and Disability Exemption Application 2016

Understanding The Homestead And Disability Exemption Application

The Homestead And Disability Exemption Application is a crucial document for homeowners in the United States seeking tax relief based on their disability status or age. This application allows eligible individuals to reduce their property tax burden, making homeownership more affordable. Typically, this exemption is available to seniors, individuals with disabilities, and in some cases, veterans. Each state has its specific guidelines regarding eligibility and the amount of exemption granted.

Eligibility Criteria for The Homestead And Disability Exemption Application

To qualify for The Homestead And Disability Exemption Application, applicants must meet certain criteria. Generally, eligibility includes:

- Ownership of the property for which the exemption is sought.

- Being a resident of the property as your primary home.

- Meeting age or disability requirements as defined by state law.

- Income limitations, which may vary by state.

It is essential to review your state's specific requirements, as they can differ significantly across jurisdictions.

Steps to Complete The Homestead And Disability Exemption Application

Completing The Homestead And Disability Exemption Application involves several key steps:

- Gather necessary documentation, including proof of age or disability, income statements, and property ownership records.

- Obtain the application form from your local tax assessor's office or their website.

- Fill out the application form accurately, ensuring all required information is provided.

- Submit the completed application by the specified deadline, either online, by mail, or in person, depending on your state’s guidelines.

Following these steps carefully can help ensure your application is processed smoothly.

Required Documents for The Homestead And Disability Exemption Application

When applying for The Homestead And Disability Exemption, applicants must provide specific documents to support their claims. Commonly required documents include:

- Proof of age or disability, such as a birth certificate or medical documentation.

- Tax returns or income statements to verify eligibility based on income limits.

- Documentation proving ownership of the property, like a deed or tax bill.

Having these documents ready can expedite the application process and help avoid delays.

Form Submission Methods for The Homestead And Disability Exemption Application

The submission methods for The Homestead And Disability Exemption Application can vary by state. Common methods include:

- Online submission through the state or local tax authority's website.

- Mailing the completed application to the appropriate tax office.

- In-person submission at local tax assessor's offices.

It is advisable to check your local tax authority's website for specific submission guidelines and options available in your area.

Legal Use of The Homestead And Disability Exemption Application

The Homestead And Disability Exemption Application is a legal document that must be completed truthfully and accurately. Misrepresentation or failure to disclose relevant information can lead to penalties, including the denial of the exemption or legal repercussions. Understanding the legal implications of this application is crucial for applicants to ensure compliance with state laws.

Quick guide on how to complete the homestead and disability exemption application

Easily Prepare The Homestead And Disability Exemption Application on Any Device

Managing documents online has gained immense popularity among companies and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents swiftly and without any holdups. Manage The Homestead And Disability Exemption Application on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to Edit and Electronically Sign The Homestead And Disability Exemption Application Effortlessly

- Locate The Homestead And Disability Exemption Application and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact confidential information using the tools that airSlate SignNow offers specifically for that task.

- Generate your electronic signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow manages all your document handling needs within a few clicks from the device you prefer. Edit and electronically sign The Homestead And Disability Exemption Application to ensure excellent communication at every step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the homestead and disability exemption application

Create this form in 5 minutes!

How to create an eSignature for the the homestead and disability exemption application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Homestead And Disability Exemption Application?

The Homestead And Disability Exemption Application is a form that allows eligible homeowners to apply for property tax exemptions based on disability status. This application can signNowly reduce property taxes, making homeownership more affordable for those with disabilities.

-

How can airSlate SignNow assist with The Homestead And Disability Exemption Application?

airSlate SignNow provides a seamless platform for completing and eSigning The Homestead And Disability Exemption Application. Our user-friendly interface ensures that you can fill out the application quickly and securely, streamlining the process of submitting your exemption request.

-

What are the benefits of using airSlate SignNow for The Homestead And Disability Exemption Application?

Using airSlate SignNow for The Homestead And Disability Exemption Application offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to manage documents efficiently, ensuring that your application is submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for The Homestead And Disability Exemption Application?

airSlate SignNow offers a cost-effective solution for managing The Homestead And Disability Exemption Application. We provide various pricing plans to suit different needs, ensuring that you can access our services without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for The Homestead And Disability Exemption Application?

Yes, airSlate SignNow supports integrations with various applications, enhancing your experience with The Homestead And Disability Exemption Application. You can connect with popular tools to streamline your workflow and improve document management.

-

What features does airSlate SignNow offer for The Homestead And Disability Exemption Application?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for The Homestead And Disability Exemption Application. These tools help ensure that your application process is efficient and organized.

-

How secure is my information when using airSlate SignNow for The Homestead And Disability Exemption Application?

Security is a top priority at airSlate SignNow. When using our platform for The Homestead And Disability Exemption Application, your information is protected with advanced encryption and compliance with industry standards, ensuring your data remains confidential.

Get more for The Homestead And Disability Exemption Application

- Form 560 alaska price report 2018

- Tax alaska 6967206 form

- Alaska gas exploration and development tax creditas form

- Saveresetprintalaskafishery resource landing form

- Cigarette and tobacco tax alaska department of revenue tax tax alaska form

- Alaska application deferred basis online form

- 774 form

- Birmingham al occupational tax file online form

Find out other The Homestead And Disability Exemption Application

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free