What is Inheritance Tax IHT421 Form and How to Use It? 2024-2026

Understanding the Inheritance Tax IHT421 Form

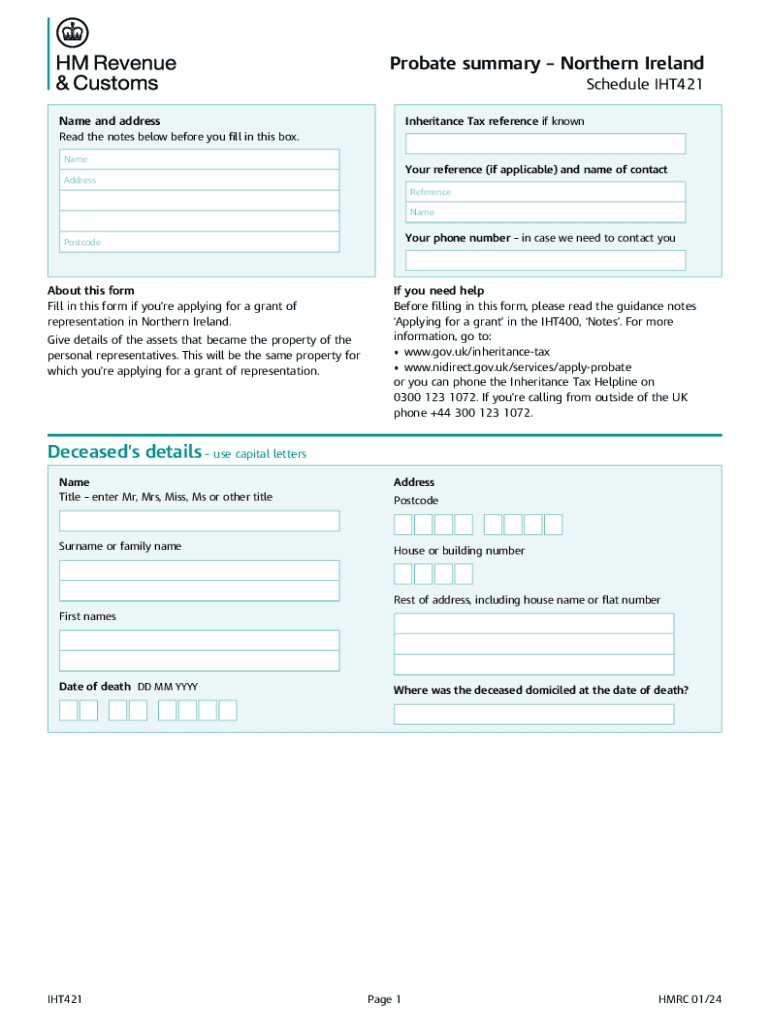

The Inheritance Tax IHT421 form is a crucial document used in the United Kingdom to report the value of an estate and assess any inheritance tax due. This form is typically required when an individual passes away, and their estate exceeds a certain value threshold. The IHT421 helps the HM Revenue and Customs (HMRC) determine the tax liability associated with the estate. It is essential for executors and administrators to understand the purpose of this form to ensure compliance with tax regulations.

Steps to Complete the Inheritance Tax IHT421 Form

Completing the IHT421 form involves several key steps. First, gather all necessary information regarding the deceased's assets, liabilities, and any gifts made in the seven years prior to their death. This includes property, bank accounts, investments, and personal belongings. Next, accurately value each asset and liability to determine the net estate value. Once the information is compiled, fill out the form carefully, ensuring all sections are completed. Finally, review the form for accuracy before submission to HMRC.

Required Documents for the IHT421 Form

When completing the IHT421 form, several documents are necessary to support the information provided. These may include:

- Death certificate of the deceased

- Will or probate documents

- Bank statements and property deeds

- Valuations of assets and liabilities

- Details of any gifts made by the deceased

Having these documents ready will streamline the completion of the form and help ensure that all information is accurate and comprehensive.

Legal Use of the Inheritance Tax IHT421 Form

The IHT421 form is legally required for estates that fall above the inheritance tax threshold. Failure to submit this form can result in penalties and interest charges on any unpaid tax. Executors and administrators must ensure that the form is completed correctly and submitted within the specified timeframe to avoid legal complications. Understanding the legal implications of this form is essential for proper estate management.

Form Submission Methods

The IHT421 form can be submitted to HMRC through various methods. Individuals can complete the form online via the HMRC website or download a paper version to fill out manually. Once completed, the form can be submitted by mail. It is important to keep a copy of the submitted form for personal records. Choosing the right submission method can depend on personal preference and the complexity of the estate.

Common Scenarios for Using the IHT421 Form

Different scenarios may necessitate the use of the IHT421 form. For instance, if an individual inherits a family home or significant assets, they may need to complete this form to report the estate's value. Additionally, if there are multiple beneficiaries or complex asset structures, the IHT421 can help clarify tax obligations. Understanding these scenarios can help individuals prepare for potential inheritance tax responsibilities.

Quick guide on how to complete what is inheritance tax iht421 form and how to use it

Effortlessly complete What Is Inheritance Tax IHT421 Form And How To Use It? on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hold-ups. Manage What Is Inheritance Tax IHT421 Form And How To Use It? on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign What Is Inheritance Tax IHT421 Form And How To Use It? without hassle

- Find What Is Inheritance Tax IHT421 Form And How To Use It? and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this function.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, cumbersome form searching, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Alter and eSign What Is Inheritance Tax IHT421 Form And How To Use It? while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is inheritance tax iht421 form and how to use it

Create this form in 5 minutes!

How to create an eSignature for the what is inheritance tax iht421 form and how to use it

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the iht421 form download process with airSlate SignNow?

The iht421 form download process with airSlate SignNow is straightforward. Users can easily access the iht421 form through our platform, fill it out, and download it for their records. Our user-friendly interface ensures that you can complete the process quickly and efficiently.

-

Is there a cost associated with the iht421 form download?

Downloading the iht421 form using airSlate SignNow is part of our subscription plans. We offer various pricing tiers to suit different business needs, ensuring that you get the best value for your investment. Check our pricing page for detailed information on costs and features.

-

What features does airSlate SignNow offer for the iht421 form download?

AirSlate SignNow provides several features for the iht421 form download, including electronic signatures, document templates, and secure cloud storage. These features streamline the process, making it easier to manage your documents efficiently. Additionally, our platform allows for real-time collaboration on forms.

-

How can I integrate airSlate SignNow with other applications for iht421 form download?

AirSlate SignNow offers seamless integrations with various applications, enhancing the iht421 form download experience. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage your documents more effectively. Our integration capabilities ensure that your workflow remains uninterrupted.

-

What are the benefits of using airSlate SignNow for iht421 form download?

Using airSlate SignNow for iht421 form download provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to complete and sign documents electronically, saving time and resources. Additionally, you can track the status of your forms in real-time.

-

Is airSlate SignNow secure for iht421 form download?

Yes, airSlate SignNow prioritizes security for all document transactions, including iht421 form download. We utilize advanced encryption and secure cloud storage to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

-

Can I access the iht421 form download on mobile devices?

Absolutely! AirSlate SignNow is optimized for mobile devices, allowing you to access the iht421 form download anytime, anywhere. Our mobile app provides the same features as the desktop version, ensuring that you can manage your documents on the go.

Get more for What Is Inheritance Tax IHT421 Form And How To Use It?

- Form 1019 notice of assessment taxable state of michigan michigan

- Michigan withholding exemption certificate form oakland

- Michigan 4567 form 2016

- Mi 1040cr 2 2016 form

- Principal residence exemption pre audit questionnaire principal residence exemption pre audit questionnaire form

- D 1040nr 2015 form

- Reciprocity exemptionaffidavit of residency for tax year 2017 form

- M1prx amended homestead credit refund for homeowners form

Find out other What Is Inheritance Tax IHT421 Form And How To Use It?

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free