State Sector Retirement Savings Scheme Members' Guide 2021-2026

Understanding the Superlife Account Number

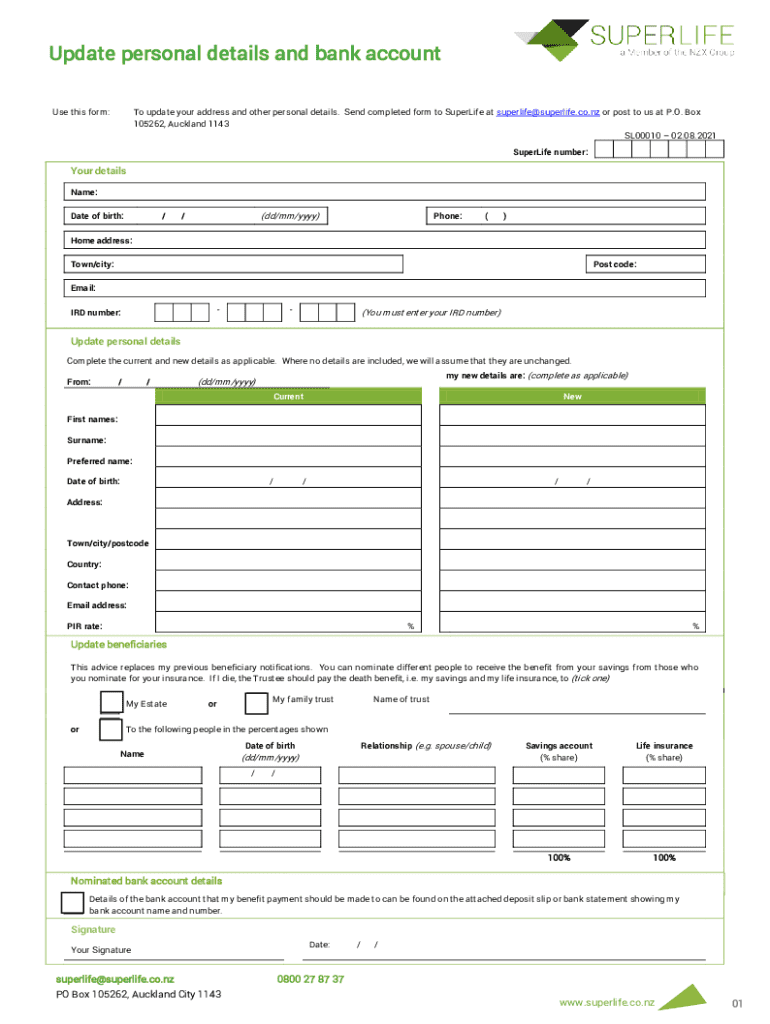

The superlife account number is a unique identifier assigned to each member within the Superlife retirement savings scheme. This number is crucial for managing your account, accessing your information, and facilitating transactions. It allows you to track your contributions, view your investment performance, and make necessary adjustments to your retirement planning. Keeping this number secure is important, as it is tied to your financial information.

How to Log In to Your Superlife Account

To access your superlife account, you will need your account number and the associated password. Visit the Superlife login page, enter your account number in the designated field, and follow the prompts to input your password. If you encounter issues logging in, ensure that you are using the correct credentials. If you forget your password, there is typically a recovery option available to reset it securely.

Steps to Retrieve Your Superlife Account Number

If you have misplaced your superlife account number, there are several ways to retrieve it. You can check your account statements, as the number is usually printed on them. Alternatively, you can contact customer support for assistance. They may require you to verify your identity before providing your account number. It is advisable to have personal information ready for verification purposes.

Legal Considerations for Superlife Account Management

Managing your superlife account involves understanding the legal implications of retirement savings in the United States. It is important to be aware of the regulations governing retirement accounts, including contribution limits and withdrawal rules. Non-compliance with these regulations can lead to penalties, so staying informed about your rights and responsibilities is essential for effective account management.

Key Features of the Superlife Account

The superlife account offers several key features designed to enhance your retirement savings experience. Members benefit from flexible contribution options, allowing for regular deposits or one-time contributions. Additionally, the account provides access to various investment options, enabling members to tailor their portfolios according to their risk tolerance and retirement goals. Understanding these features can help you maximize the benefits of your superlife account.

Eligibility Criteria for Opening a Superlife Account

To open a superlife account, individuals must meet certain eligibility criteria. Typically, this includes being of legal age and having a valid Social Security number. Some accounts may also have specific requirements based on employment status or income levels. It is advisable to review these criteria before initiating the application process to ensure that you qualify for the account.

Quick guide on how to complete state sector retirement savings scheme members guide

Prepare State Sector Retirement Savings Scheme Members' Guide seamlessly on any gadget

Web-based document management has increasingly gained traction among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle State Sector Retirement Savings Scheme Members' Guide on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign State Sector Retirement Savings Scheme Members' Guide effortlessly

- Locate State Sector Retirement Savings Scheme Members' Guide and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign State Sector Retirement Savings Scheme Members' Guide and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state sector retirement savings scheme members guide

Create this form in 5 minutes!

How to create an eSignature for the state sector retirement savings scheme members guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a superlife account number and how do I obtain one?

A superlife account number is a unique identifier assigned to your account within the airSlate SignNow platform. To obtain your superlife account number, simply sign up for an account on our website, and it will be generated automatically upon registration.

-

How can I find my superlife account number?

You can find your superlife account number by logging into your airSlate SignNow account and navigating to your account settings. It is displayed prominently in your profile information, making it easy to access whenever you need it.

-

Is there a cost associated with obtaining a superlife account number?

No, there is no cost associated with obtaining a superlife account number. Signing up for an airSlate SignNow account is free, and your superlife account number is provided at no additional charge, allowing you to start using our services immediately.

-

What features are available with my superlife account number?

With your superlife account number, you gain access to a variety of features including document eSigning, templates, and secure storage. These features are designed to streamline your document management process and enhance collaboration within your team.

-

Can I integrate my superlife account number with other applications?

Yes, your superlife account number allows for seamless integration with various applications such as Google Drive, Dropbox, and CRM systems. This integration enhances your workflow by enabling you to manage documents across different platforms effortlessly.

-

What are the benefits of using airSlate SignNow with my superlife account number?

Using airSlate SignNow with your superlife account number provides numerous benefits, including increased efficiency in document handling, reduced turnaround times for signatures, and enhanced security for your sensitive information. These advantages help businesses operate more effectively.

-

How secure is my superlife account number?

Your superlife account number is protected by advanced security measures, including encryption and secure access protocols. airSlate SignNow prioritizes the safety of your data, ensuring that your account information remains confidential and secure.

Get more for State Sector Retirement Savings Scheme Members' Guide

- Immigration formpdf save reset form print form

- Revalidation form amvets

- Application for group enrolment medical services form

- Privacy statement the department of transport and main roads is collecting the information on this form

- Fillable online certificate of reinstatement or renewal fax form

- Pptc 155 e child general passport application for canadians under 16 years of age applying in canada or the usa form

- 14 cfr4761 dealers aircraft registration certificates form

- Form apply for a registration certificate as an eea qualified

Find out other State Sector Retirement Savings Scheme Members' Guide

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors