MINNESOTA SBA PARTICIPATING LENDERS as of JUNE 15, Sba Form

Understanding the MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15

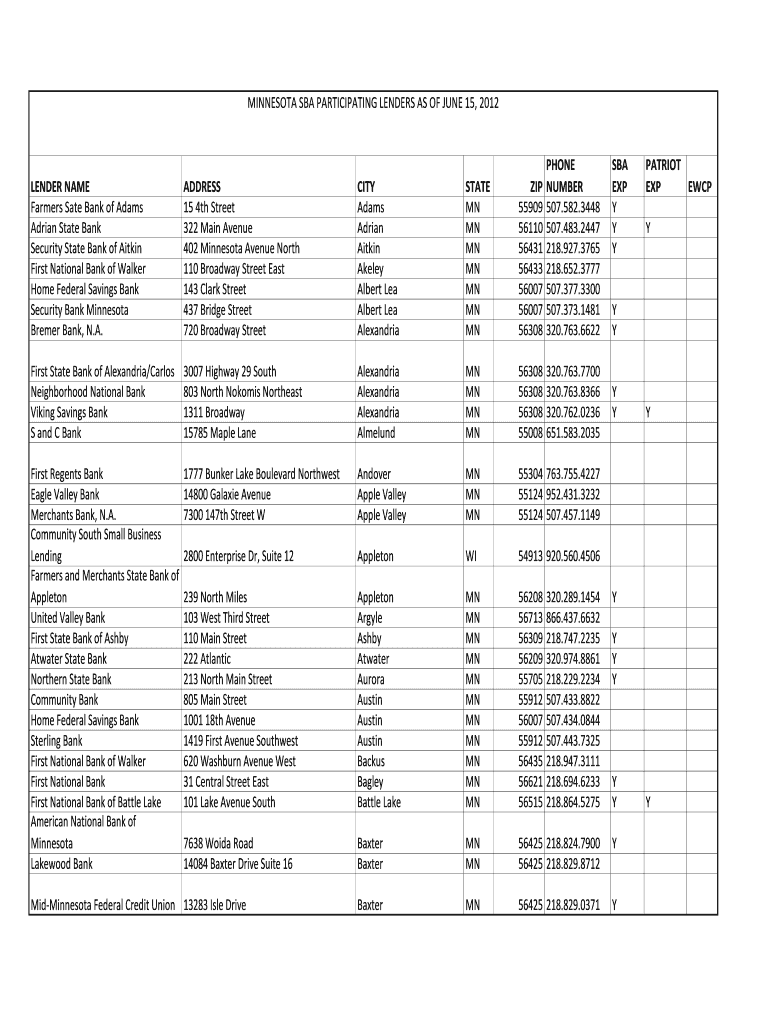

The MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15 is a comprehensive list of financial institutions that are authorized to participate in the Small Business Administration (SBA) loan programs within Minnesota. These lenders play a crucial role in providing funding to small businesses, enabling them to access capital for various needs such as expansion, equipment purchases, and working capital. The list includes banks, credit unions, and other lending institutions that have met specific criteria set by the SBA, ensuring they can offer loans backed by the federal government.

Steps to Utilize the MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15

To effectively use the MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, follow these steps:

- Identify your funding needs and determine the type of SBA loan that suits your business.

- Review the list of participating lenders to find institutions that align with your requirements.

- Contact the selected lender to inquire about their specific loan products and application process.

- Prepare the necessary documentation, which may include financial statements, business plans, and personal credit history.

- Submit your loan application as directed by the lender, ensuring all information is accurate and complete.

Eligibility Criteria for SBA Loans through Participating Lenders

Eligibility for SBA loans through participating lenders in Minnesota typically includes several key criteria:

- Your business must be a for-profit entity operating in the United States.

- The business should meet the SBA's size standards, which vary by industry.

- You must demonstrate a need for the loan and show that the funds will be used for a legitimate business purpose.

- Personal creditworthiness is often assessed, so a good credit score can enhance your chances of approval.

Application Process and Approval Time for SBA Loans

The application process for obtaining an SBA loan through participating lenders involves several stages:

- Initial consultation with the lender to discuss your business needs and loan options.

- Completion of the loan application form and submission of required documents.

- The lender will review your application, which may include a credit check and verification of financial information.

- Approval times can vary, but typically range from a few days to several weeks, depending on the lender and the complexity of your application.

Key Elements of the MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15

Several key elements characterize the MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15:

- The lenders listed are officially recognized by the SBA, ensuring they adhere to federal guidelines.

- Each lender may offer different loan products, terms, and interest rates, providing options for diverse business needs.

- The list is updated regularly to reflect current participating lenders, ensuring accuracy and reliability for applicants.

Legal Considerations for Using SBA Loans

When utilizing SBA loans through participating lenders, it is essential to understand the legal implications:

- Borrowers must comply with all terms and conditions set forth in the loan agreement.

- Failure to adhere to repayment schedules can result in penalties, including the potential loss of collateral.

- Understanding the legal obligations associated with SBA loans can help businesses avoid pitfalls and ensure compliance.

Quick guide on how to complete minnesota sba participating lenders as of june 15 sba

Effortlessly Manage [SKS] on Any Device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications, and enhance any document-centric workflow today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize critical sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota sba participating lenders as of june 15 sba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba?

MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba are financial institutions that have been approved by the Small Business Administration to offer SBA loans. These lenders provide essential funding options for small businesses looking to grow or sustain their operations. By working with these lenders, businesses can access favorable loan terms and conditions.

-

How can I find MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba?

You can find MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba by visiting the official SBA website or contacting your local SBA office. Additionally, many financial institutions list their participation in SBA programs on their websites. This makes it easier for businesses to identify potential lenders.

-

What are the benefits of working with MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba?

Working with MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba offers several benefits, including lower down payments, longer repayment terms, and competitive interest rates. These lenders are experienced in helping small businesses navigate the loan process, ensuring a smoother experience. This support can be crucial for businesses seeking funding.

-

What types of loans do MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba offer?

MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba typically offer various loan types, including 7(a) loans, 504 loans, and microloans. Each loan type serves different business needs, from purchasing equipment to real estate financing. Understanding these options can help businesses choose the right loan for their specific situation.

-

What is the application process for loans from MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba?

The application process for loans from MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba generally involves submitting a loan application, providing financial documentation, and demonstrating the ability to repay the loan. Each lender may have specific requirements, so it's essential to check with them directly. Preparing your documents in advance can streamline the process.

-

Are there any fees associated with loans from MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba?

Yes, there may be fees associated with loans from MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba, including application fees, closing costs, and guarantee fees. These fees can vary by lender and loan type, so it's important to inquire about them upfront. Understanding these costs can help businesses budget effectively.

-

How can airSlate SignNow assist businesses in working with MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba?

airSlate SignNow can assist businesses by providing a seamless platform for sending and eSigning documents required for loan applications with MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba. This easy-to-use solution helps streamline the documentation process, ensuring that businesses can focus on securing their funding. Additionally, it enhances efficiency and reduces turnaround times.

Get more for MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba

- Form mvu 25 affidavit in support of a claim for massgov mass

- Used bike tire and battery license form

- Uhm form

- Gender bias in tax systems the example of ghana form

- Los angeles property tax relief for military personnel on active duty form

- Medical shipment application form

- Application certificate relief form

- Application for property tax relief catawbacountync form

Find out other MINNESOTA SBA PARTICIPATING LENDERS AS OF JUNE 15, Sba

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT