FL Certificate of Authority FLORIDA DEPARTMENT of Form

Understanding the FL Certificate of Authority

The FL Certificate of Authority is a crucial document for any foreign corporation wishing to operate in Florida. This certificate allows a corporation formed in another state or country to legally conduct business within Florida. It is essential for compliance with state laws, ensuring that the corporation is recognized as a legitimate entity in the state. Without this certificate, a foreign corporation may face penalties and be unable to enforce contracts in Florida courts.

Steps to Obtain the FL Certificate of Authority

To obtain the FL Certificate of Authority, a foreign corporation must follow a series of steps:

- Gather necessary documents, including a certificate of good standing from the home state.

- Complete the application form, which requires details about the corporation and its officers.

- Submit the application along with the required fee to the Florida Department of State.

- Wait for processing, which typically takes a few weeks.

Once approved, the corporation will receive the Certificate of Authority, allowing it to operate legally in Florida.

Key Elements of the FL Certificate of Authority

The FL Certificate of Authority includes several key elements that are important for compliance and operational purposes:

- Corporation Name: The name must match the one registered in the home state.

- Principal Office Address: A physical address where the corporation conducts business.

- Registered Agent: An individual or business designated to receive legal documents on behalf of the corporation.

- Duration: The period for which the corporation intends to operate in Florida.

These elements ensure that the corporation is properly identified and can be held accountable under Florida law.

Legal Use of the FL Certificate of Authority

The FL Certificate of Authority is legally binding and allows corporations to engage in business activities such as entering contracts, hiring employees, and opening bank accounts in Florida. It also provides the corporation access to Florida courts for legal matters. However, failure to obtain this certificate may result in fines and the inability to enforce contracts, highlighting its importance for legal compliance.

Required Documents for the FL Certificate of Authority

When applying for the FL Certificate of Authority, certain documents are required to validate the application:

- Certificate of Good Standing: Issued by the home state, confirming the corporation is in good standing.

- Application Form: Completed with accurate information about the corporation.

- Payment: The appropriate fee for processing the application.

Having these documents ready can streamline the application process and reduce delays.

Penalties for Non-Compliance

Operating in Florida without a valid FL Certificate of Authority can lead to significant penalties. These may include fines, back taxes, and the inability to bring lawsuits in Florida courts. Additionally, the corporation may face challenges in securing contracts and conducting business operations effectively. It is crucial for foreign corporations to comply with this requirement to avoid legal and financial repercussions.

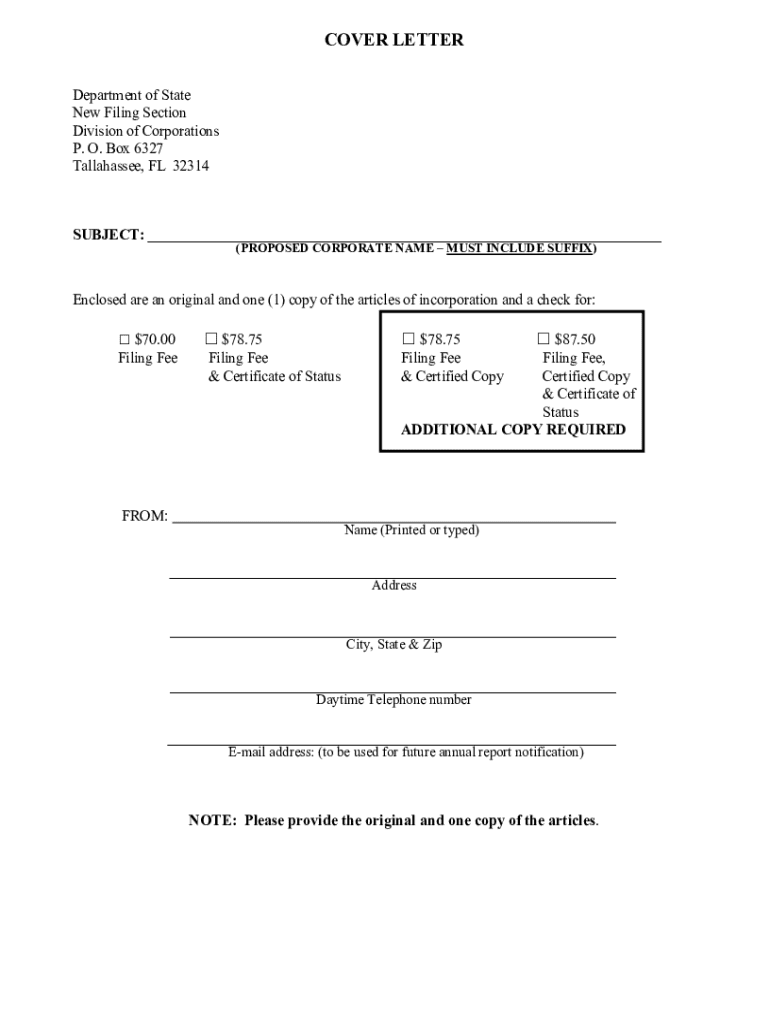

Quick guide on how to complete fl certificate of authority florida department of

Effortlessly Prepare FL Certificate Of Authority FLORIDA DEPARTMENT OF on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent sustainable alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely maintain it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Handle FL Certificate Of Authority FLORIDA DEPARTMENT OF on any device with the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The Easiest Way to Modify and eSign FL Certificate Of Authority FLORIDA DEPARTMENT OF with Ease

- Obtain FL Certificate Of Authority FLORIDA DEPARTMENT OF and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in a few clicks from any device you prefer. Modify and eSign FL Certificate Of Authority FLORIDA DEPARTMENT OF to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fl certificate of authority florida department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Florida profit corporation?

A Florida profit corporation is a type of business entity that is formed to generate profit for its shareholders. It is governed by the Florida Business Corporation Act and offers limited liability protection to its owners. This structure is ideal for businesses looking to raise capital and limit personal liability.

-

How do I form a Florida profit corporation?

To form a Florida profit corporation, you need to file Articles of Incorporation with the Florida Division of Corporations. This process includes choosing a unique name, designating a registered agent, and paying the required filing fee. Once approved, your corporation will be legally recognized in Florida.

-

What are the benefits of a Florida profit corporation?

A Florida profit corporation provides several benefits, including limited liability protection for shareholders, the ability to raise capital through stock sales, and perpetual existence. Additionally, it allows for easier transfer of ownership and can enhance credibility with customers and investors.

-

What are the costs associated with establishing a Florida profit corporation?

The costs of establishing a Florida profit corporation include the filing fee for the Articles of Incorporation, which is typically around $70, and any additional fees for obtaining necessary licenses or permits. Ongoing costs may include annual report fees and potential franchise taxes, depending on your corporation's revenue.

-

Can I use airSlate SignNow for my Florida profit corporation?

Yes, airSlate SignNow is an excellent tool for your Florida profit corporation. It allows you to easily send and eSign documents, streamlining your business processes. With its user-friendly interface and cost-effective pricing, it can help you manage your corporate paperwork efficiently.

-

What features does airSlate SignNow offer for Florida profit corporations?

airSlate SignNow offers features such as document templates, customizable workflows, and secure eSigning capabilities. These tools are designed to simplify the document management process for Florida profit corporations, ensuring compliance and enhancing productivity. Additionally, it integrates seamlessly with various business applications.

-

How does airSlate SignNow ensure the security of my Florida profit corporation's documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. This ensures that sensitive information related to your Florida profit corporation is protected from unauthorized access. Regular security audits and compliance with industry standards further enhance document safety.

Get more for FL Certificate Of Authority FLORIDA DEPARTMENT OF

- Special sale contract form

- Ucc 1 8 form

- Ex c behavior treatment plan review form macomb county mccmh

- The iep form filled in

- Request judicial intervention addendum form

- Greater binghamton association of realtors inc and broome county form

- Purchase agreement offer receipt and lake realty ohio form

- Money agreement oregon form

Find out other FL Certificate Of Authority FLORIDA DEPARTMENT OF

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter