Missouri 4282 2015-2026

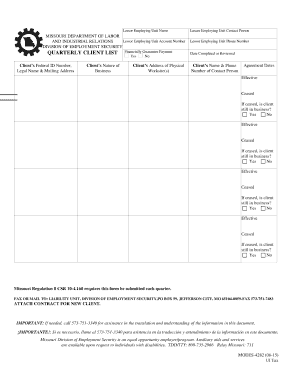

What is the Missouri 4282?

The Missouri 4282 is a form used by employers to report quarterly wages and calculate unemployment insurance contributions. This form is essential for businesses operating in Missouri, as it ensures compliance with state labor laws and helps maintain accurate records for unemployment benefits. Employers must accurately report the wages paid to employees during each quarter to avoid penalties and ensure that their employees receive the correct unemployment benefits if needed.

How to use the Missouri 4282

To use the Missouri 4282 effectively, employers must first gather all necessary payroll information for the reporting period. This includes total wages paid, the number of employees, and any applicable deductions. Once the information is compiled, employers can fill out the form either electronically or by hand. It is crucial to ensure that all data is accurate and complete, as errors can lead to delays in processing or potential fines. After completing the form, employers must submit it to the Missouri Department of Labor and Industrial Relations by the designated deadline.

Steps to complete the Missouri 4282

Completing the Missouri 4282 involves several key steps:

- Gather payroll records for the quarter, including total wages and employee counts.

- Access the Missouri 4282 form through the Missouri Department of Labor website or other official sources.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically via the UInteract portal or by mailing it to the appropriate state office.

Legal use of the Missouri 4282

The Missouri 4282 must be used in accordance with state laws governing unemployment insurance and labor reporting. Employers are legally obligated to file this form each quarter to report wages and contributions accurately. Failure to comply with these requirements can result in penalties, including fines and increased unemployment insurance rates. It is essential for employers to understand their obligations under Missouri law to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Missouri 4282 to ensure timely reporting. The deadlines are typically as follows:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

It is important for employers to mark these dates on their calendars to avoid late submissions and associated penalties.

Required Documents

When completing the Missouri 4282, employers should have the following documents ready:

- Payroll records for the quarter, including total wages and employee information.

- Previous Missouri 4282 forms for reference, if applicable.

- Any correspondence from the Missouri Department of Labor related to unemployment insurance.

Having these documents on hand can streamline the completion process and ensure accuracy in reporting.

Quick guide on how to complete quarterly client list

Simplify your HR procedures with Missouri 4282 Template

Every HR professional recognizes the importance of keeping employee information tidy and organized. With airSlate SignNow, you access an extensive collection of state-specific employment forms that signNowly enhance the location, management, and storage of all work-related documents in one single place. airSlate SignNow enables you to oversee Missouri 4282 management from start to finish, with robust editing and eSignature tools available whenever you require them. Increase your accuracy, document security, and eliminate minor manual errors in just a few clicks.

The ideal method to modify and eSign Missouri 4282:

- Choose the relevant state and search for the form you require.

- Open the form page and then click Get Form to begin working with it.

- Wait for Missouri 4282 to upload in the editor and follow the instructions that indicate required fields.

- Enter your information or add additional fillable fields to the document.

- Utilize our tools and features to customize your form as needed: annotate, obscure sensitive details, and create an eSignature.

- Review your form for errors before proceeding with its submission.

- Click Done to save changes and download your form.

- Alternatively, send your document directly to your recipients and gather signatures and information.

- Securely store completed documents within your airSlate SignNow account and access them anytime you wish.

Employing a flexible eSignature solution is essential when handling Missouri 4282. Make even the most intricate workflow as seamless as possible with airSlate SignNow. Begin your free trial today to discover what you can achieve with your department.

Create this form in 5 minutes or less

Find and fill out the correct quarterly client list

FAQs

-

How can we track our visitors conversion/drop off when the visitor actually fills out fields on a form page outside of our site domain (Visitor finds listing in SERPS, hits our site, jumps to client site to complete form)?

The short answer: You can't unless the client site allows you to do so. A typical way to accomplish measuring external conversions is to use a postback pixels. You can easily google how they work - in short you would require your client to send a http request to your tracking software on the form submit. A good way to do this in practice is to provide an embedable form to your clients that already includes this feature and sends along a clientID with the request, so that you can easily see which client generates how many filled out forms.

-

Many potential clients of ours are filling out a contact form. What is the risk of adding them to our mailing list without asking?

First, it’s illegal (CAN-SPAM Act) and spamming people isn’t a relationship builder which is what your goal should be. Instead, give people an incentive for opting-in and add valuable content in your emails regularly and an on going basis.signNow out to the people you have met and or inquired, understand that they may not have found what they were looking for at first but you can provide great information if they become part of your email list. Simply ask……. “I have an email that goes out once a week with valuable information and updated trends and tips to keep you on the cutting edge, would that be something you are interested in?Take a look at this from Dmitry Dragilev :How to Convert 97% of Visitors Who Do Not Fill Out The Contact FormRemember incentives!Include/offer Incentive(s) for Signing UpGive them a reason, what will they get out of it, tips or tricks; information that is valuable? Be precise on how your emails will help them now or in the future?Offer Something in Return, make it a WIN/WINGiveaways, eBooks, Tests, or something that will increase their desire to be apart of your email list.Always build on the relationship before you sell……..Don’t sell too early in the process.Check this idea out:“Redirecting Comments to a “thank you” page using a simple plugin. As soon as someone leaves a comment for the first time they’ll get redirected to a little page that thanks them for their interaction and shows them the mailing list and some other cool content. It converts at around 7%.” - Ramsay from - *Blog Tyrant*Good-Luck, Lee

-

How is it that when you fill out a form, "Asian" is somehow listed as one race?

It’s worse than that: on most forms that have only a few options (Joseph Boyle is right that the US Census now gets more specific), Asians-and-Pacific-Islanders is all one group. That means from the Maori through Indonesia and Polynesia, then Vietnam, straight up past Mongolia, and east out to Japan and west right out past India — all one “race”. Why?Because racism, that’s why.To be specific, because historically in the US the only racial difference that counted was white/black — that is, white and and not-white. For centuries that was how distinctions of race and (implied) class were made. There were quite a few court cases where light-skinned Japanese (etc) petitioned to be declared white — they usually weren’t — and where dark-skinned South Asians (etc) petitioned to be declared non-black — which sometimes worked. In fact, it worked so well that some American Blacks donned turbans and comic-opera inaccurate “Eastern” garb to perform more widely as an “Indian” musician than they’d ever be allowed to do in their original identity.So in the 1800s, there was white and Black. Period. Well, ok, and Native Americans, but to the people that mattered, they hardly counted (and were all dead, anyhow, right?). As colonialism and rising globalization brought more and more people who were neither white nor black to North America, there became an increasing dilemma about how to classify this cacophonous mob of confusing non-white people.Eventually the terms “Arab” and “Asian” came to be widely used, and some classifiers (see also Why is "Caucasian" a term used to label white people of European descent? ) also separated Pacific islander from the general morass of “Asian”. But in general, everyone from the Mysteeeeerious East was just called one thing, unless you felt you needed to specify a country.So, like I said: racism. And a racist tendency to dismiss as unimportant distinctions between different groups of “unimportant” people.

-

Is there a way to upload a publication list to LinkedIn without filling out the form for each publication?

Rather than asking us in an abstract way, if you could provide us a sample of a list and tell us the outcome you're seeking, perhaps we could come up with alternatives ... ("No" is so boring ... and could be wasteful if we're not sure of what outcome you're seeking...)

-

How do I create forms that clients can sign/fill out digitally?

Before you seek out a tool to design your form, consider your two goals inherent in your question: to fill out the form digitally and to sign it digitally. These goals are generally not accomplished through online web form builders because web forms are designed to work for web sites and not to represent paper-based forms.To have a client fill out a form that is e-signNow and resembles a paper-based form requires a solution that mimics the paper-based experience online.Here are two ways to accomplish this goal, assuming you’ve designed your form already (i.e. in Microsoft Word, Excel or some desktop publishing software like signNow Illustrator).My company (Quik! Enterprise Forms Automation Service) takes your original designed form, builds it (i.e. makes it fillable, secure and e-signNow) and converts it to an HTML-based form that can be filled out in any browser and e-signed with signNow.com, signNow.com or with our own Native Esign feature. Our forms can be delivered via a link or email to clients to fill out the form, with required fields, and routed to whomever needs to receive the final form.E-sign vendors like signNow can accomplish much of the same thing as we can, with a little more work on your part. With signNow you upload your document, drag-and-drop the fields onto the form (i.e. build the form to be fillable and signNow). Then you can send the document out for e-signature and to be filled out.To be fully transparent, Quik! is designed for businesses who have lots of forms. Our solution works just as well for a single form as it does for 1,000 forms. The more forms you have, the more cost-effective Quik! becomes.A product like signNow is also a great solution because it is not hard to use and will likely take you an hour or two to set up your form, depending on how complex your form is. The advantage to Quik! is that we build your form for you. The advantage to using an e-sign solution is that you can do it all yourself.

-

Is it necessary to fill out the admission form once again for the 2nd merit list?

Not needed to fill any more forms.You must have filled the form asking your choice of college in preference order. That should be enough. When you get admission in the first list according to the order your preference then take admission in that college.If you are not happy with the college still you must take admission and then opt for the second round of admission. Then again in the second list you may get a better choice of college as per your preference if the cut off drops. Withdraw from the first college and take in the second college.Not more than 2 choices are allowed.This I am writing to the best of my knowledge. You please confirm the process with other students too and read up website.

-

How can I learn mutual funds investment?

Its not that complex… Here, i have written everything you need to know about Mutual funds. Read this, you can start investing without anyone’s help.Mutual fund is like fixed deposit where we deposit our money and it will give us return.There are three types of mutual funds, they are debt fund, equity fund & balanced fund.Debt fund is similar to Bank. When we invest our money in debt fund, fund house will use our money to give loans to private companies or Indian government or State government.Debt fund - Risk is low. Return is around 8%. If you withdraw money within 3 years, you need to pay tax based on your income tax slab (like 10% or 20% or 30%). If you withdraw after 3 years, you need to pay 20% tax with indexation.Indexation: 20% tax with indexation means you will be discounting inflation while paying tax. So you will be paying less tax after discounting inflation (less than 15%)Inflation: Inflation is most important factor when comes to finance. It means decrease in purchasing power of money. To give you an example, before 10 years Rs.10 is a big amount. But now??? In 10 years from now Rs.10 will be nothing. Thats the inflation, every year value of money will get reduced. Government regularly release inflation details.There are many types of debt funds like gilt, income, short term, liquid, ultra short term.Gilt fund - your money will be loaned to government. Risk is very low since borrower is Government.Income fund - you will receive monthly income. Suitable for retired people.Liquid fund - you can withdraw your money anytime without any charges. It is like savings account.Short term or Ultra short term - if you like to invest only for some months.Let me warn you, debt funds are not risk free. They too carry some risk. Sometimes company default loans (Vijay Mallya, Nirav Modi). Then there is a risk of interest rate.If like to invest with minimal risk, then open the debt fund in valueresearchonline website. There you will find the below diagram (or chart?). Good low risk debt fund should have black box in red area. The meaning is, the fund is less sensitive to interest rate change and has good credit quality.Equity fund. As the name says, your money will get invested in Share market.Equity fund is riskier than debt fund. But it gives good return like 12% to 25%. If you withdraw withing an year you need to pay short term capital gain tax of 15%. If you withdraw after 1 year and if your return is more than 1 lakh, you need to pay capital gain tax of 10%.It is recommended to hold equity mutual funds at least 5 years to see decent return.Equity mutual funds comes in many types like large cap, mid cap, small cap, sector.Large cap or Bluechip fund - your money will get invested in big companies. Risk is low and return is around 10% - 13%.Mid cap fund - your money will get invested in medium size companies. Return is more than 13%. Medium risk.Small cap fund - your money will get invested in small companies. Very risky but good return, more than 20%.Sector fund - your money will get invested in companies in specific sector. For example, Equity Infra fund means, your money will get invested in Infrastructure companies. Return varies based on sector, but it will be more than 15%.Index fund - Return is around 10%. Medium risk.What is index fund? There are many indices in India like Nifty, Sensex, Bank nifty, etc., Each index comprise of many companies with different weightage. For example, Nifty comprise of top 50 companies in NSE. If you invest your money in Nifty index fund, it is like investing in top 50 companies in NSE.ELSS - It is tax saving mutual fund. You can save tax under Section 80C. It is getting popular now. Lock in period is 3 years. Return is around 12%.Arbitrage fund - It is very very low risk equity fund. Arbitrage fund won’t get affected by markets up and down. Return is 8%. Taxing is same as equity mutual funds.Balanced or Hybrid fund. It is mix of Equity and Debt fund. (65% equity and 35% debt). Low risk. Return around 12%. Taxation is similar to equity fund.First, choose fund type based on your risk potential (like debt or equity or balanced).If you are retired person or if you don’t want to take any risks then choose Debt funds.If you like to take only small amount of risk, choose balanced fund.If you earn average income, then choose balanced fund or large cap or both.If you fall under huge income category, then mix large cap, mid cap and small cap.To choose fund, visit Funds - Value Research Online. Here are the list of things to note while choosing fund…See the fund’s performance from inception. See yearly, 3 year, 5 year and overall return.See the expense ratio. Expense ratio is the amount you are going to pay as commission. Less than 1% is better.See exit load. This is amount you need to pay when you withdraw.Value research online gives star rating for all funds. Choose funds with atleast 4 Stars.IMPORTANT NOTE: All funds comes in two plans Regular & Direct plan. Regular means you invest via Broker or Agent. Direct means you invest directly. Broker or Agents charge commission. Their commission will be around 1% per year. IT IS LOT OF MONEY. So never go with Broker or Agents.If you are new to mutual fund, you need to register KYC first. It is one time process and it is centralized. Once you get registered, you can invest in any mutual funds just by giving your PAN number. To register KYC, first select fund house (example, SBI Mutual fund or HDFC mutual fund). Find their office in your city and go and register KYC. You can also register e-KYC online, but it has some limitations. So i suggest you to visit office and do it in person.Once KYC is done, you can invest in any mutual funds. If you do KYC in SBI mutual fund, you can also invest in HDFC or ICICI mutual funds. KYC is centralized.Once KYC is done, visit mutual fund company website (like SBI mutual fund site or LT mutual fund site). Register there. Start investing. You can either invest as Lump sum. Or as SIP. SIP means you can invest small amount monthly. Money will be automatically deducted from your account.FAQ:When should i invest?If you are planning to invest via SIP you can start anytime. But if you are planning to invest as Lumpsum, there is a completely different approach. If you like to invest lumpsum in debt fund. You can invest anytime, no issues.But if you like to invest lumpsum in equity mutual fund, you need to follow different approach, since investing lumpsum in equity mutual fund is very risky. First invest your lump amount in liquid fund or ultra short term debt fund [Lets call Fund A]. These funds don’t have exit load (or withdrawing fee), so there is no charges when money gets transferred. Now, set up STP (Systematic Transfer Plan) to transfer a fixed amount monthly to an equity fund [Fund B]. For example, if you have 1 lakh lump amount, set a monthly amount to Rs.5,000. Every month, Rs.5,000 from Fund A will get transferred to Fund B. Fully automatic.Note: Never invest lump amount directly in equity mutual funds.Is there any service which helps me to invest in Mutual funds easily?There are so many apps these days which help you to invest money in mutual funds via direct plan. Like, Zerodha Coins [Not a promotion, you can try any app you want]. These apps are not free, they charge small amount monthly. You can easily set up investments from the app and also you can track the fund performance. I personally find such apps useful.I heard mutual fund is risky.Every investment is risky, whether it is real estate, gold or FD.Gold. What if someone stole or you lose is somewhere? Think how many times you heard from your friends or relatives (or happened to you) that they lost Jewels?FD. FD return is very low. If you are a tax payer and if you invest in FD, then you are LOSING MONEY because of tax and inflation. You will be losing 1% or more per year if you invest in FD. And also, what happens if bank goes bankrupt? FD is insured for Rs.1 lakh. If you have 10 lakhs in FD and bank goes bankrupt, you receive Rs.1 lakh.Real estate. Many factors affect real estate like current government, policies, economy, water issue, etc., And there is liquidity problem . You can’t buy or sell real estate fast.Like these mutual funds also carry risk. If you plan properly you can reduce the risk by investing GILT fund or Arbitrage fund. Remember, mutual fund house invest your money in companies like ICICI bank, TCS, ITC, Tata motors, etc., It is very unlikely that these companies shut down their business.Is it true that debt fund carry Zero Risk?No. As i said earlier Risk is everywhere. When compared with equity, debt fund carry low risk. Still there is some risk. Companies default their loan (remember Kingfisher?). Companies goes bankrupt.What funds are you investing?I am investing in…Aditya Birla SL Balanced '95 Direct-G (Balanced fund)IDFC Focused Equity Direct-G (Large and mid cap)L&T Emerging Businesses Direct-G (Small cap)What should i choose? Growth or Dividend or Dividend reinvestment?Growth - To unleash the power of compound interest choose Growth. It will give you massive return in long term. (Recommended)Dividend - If you want regular income from your investment, then choose Dividend. This option is recommended for retired people.Dividend reinvestment - Companies release dividend regularly. If you choose this option then fund house will buy new units of the fund with dividend money.If I choose dividend fund, do I need to pay income tax for dividend income?No, there is no income tax for dividend income.What is the minimum age required to invest in mutual fund?There is no minimum age. You can start at any age. If you are below 18, you need to provide birth certificate.What is the minimum amount needed to invest in mutual fund?You can start with as low as Rs.500.I am already investing via Regular plan. How to switch to direct plan?Visit fund company website. Register yourself and login. There will be option to Switch. While switching select Direct plan. Simple.How do I know whether I am investing in Regular plan or Direct plan?Login to your account or check your statement. See the fund name. If the name ends with Direct, it is direct plan. Or if it ends with regular it is regular plan.What should i do after investing?It takes atleast 5 years to see decent return from equity mutual funds. Bookmark the website value research online. It is popular site about mutual funds. They give star rating for all mutual funds. Good fund should have atleast 4 stars. Every once in a while check number of stars for your fund. If it goes below 3 stars, i suggest you to switch fund.I am investing in equity mutual fund. I got negative returns. Now i have less money than what i invest. What should i do?Market fluctuates. It is normal. As i said earlier, you need to wait atleast 5 years to see decent return from equity mutual funds.How to withdraw money?Login to your account. Choose redeem option. Money will be withdrawn to your bank account.How to terminate mutual fund?First redeem your money. Then you need to send post (physical, no email) to mutual fund company asking them to terminate. But it is not necessary. Just withdraw money and done with that.What happens if I fail to pay monthly instalment for SIP because of no funds in my savings account?Nothing will happen. Don't worry.How to switch funds?Case 1: Switch funds from same fund house. For example, LT Fund A to LT Fund B. Login to fund house website. Choose switch option. It is simple.Case 2: Switch funds of different fund house. For example, LT Fund A to SBI Fund A. There is no direct option for this. First you need to withdraw money from fund A and invest freshly in Fund B.How to track my mutual funds investments?If you are investing via apps like Zerodha coin, you can easily track form those apps.What are open ended and close ended mutual funds?When comes to mutual funds always go with open ended funds. Open ended fund gives better return than close ended. And also you can enter and exit open ended funds anytime.———————————————————————————————————Hope, i explained everything here. Please don’t contact me with questions which i already explained here. I won’t respond. Spend some time to read. If i missed anything, do comment here.Invest with your own risk. Market fluctuates, sometimes market crashes, companies default their loans. Anything can happen. I am just sharing knowledge.Happy investing.Ashok Ramesh.

Create this form in 5 minutes!

How to create an eSignature for the quarterly client list

How to create an eSignature for the Quarterly Client List online

How to create an electronic signature for your Quarterly Client List in Chrome

How to generate an electronic signature for signing the Quarterly Client List in Gmail

How to generate an eSignature for the Quarterly Client List from your smartphone

How to make an electronic signature for the Quarterly Client List on iOS

How to create an electronic signature for the Quarterly Client List on Android OS

People also ask

-

What is Missouri 4282 in relation to airSlate SignNow?

Missouri 4282 refers to a specific regulation or standard that affects eSignature solutions in the state of Missouri. airSlate SignNow complies with these regulations, ensuring that your electronic signatures are legally binding and secure. By using airSlate SignNow, you can confidently manage your documents while adhering to Missouri 4282 guidelines.

-

How does airSlate SignNow support Missouri 4282 compliance?

airSlate SignNow is designed to meet the requirements of Missouri 4282 by providing a secure platform for electronic signatures. Our solution includes features like secure storage, audit trails, and user authentication, which are essential for compliance with the Missouri regulations. This ensures that your documents signed through airSlate SignNow are valid and reliable.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those operating under Missouri 4282. Our competitive pricing ensures that you get the best value for a robust eSignature solution without exceeding your budget. You can choose from monthly or annual subscriptions based on your needs.

-

What features does airSlate SignNow provide for users in Missouri?

airSlate SignNow offers a variety of features that are beneficial for users in Missouri, including customizable templates, mobile access, and real-time tracking of document status. These features streamline the signing process and enhance productivity, making it easier for businesses to comply with Missouri 4282 while managing their documents efficiently.

-

Can airSlate SignNow integrate with other tools I use?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, allowing you to enhance your workflow while ensuring compliance with Missouri 4282. Whether you need integration with CRM systems, cloud storage, or project management tools, airSlate SignNow can connect with your existing software to improve efficiency.

-

What benefits does airSlate SignNow offer for businesses in Missouri?

Businesses in Missouri can benefit from using airSlate SignNow by streamlining their document signing process and reducing turnaround times. With features designed for compliance with Missouri 4282, airSlate SignNow ensures that your electronic signatures are both secure and legally recognized. This leads to increased productivity and better customer satisfaction.

-

Is airSlate SignNow suitable for small businesses in Missouri?

Absolutely! airSlate SignNow is an ideal solution for small businesses in Missouri looking for a cost-effective way to manage their document signing needs. The platform is user-friendly and designed to scale with your business, providing all the necessary features to ensure compliance with Missouri 4282 without overwhelming your resources.

Get more for Missouri 4282

- Joint petition for termination of child support form

- Antrag auf erstattung einer aufwandspauschale gem 1835a bgb form

- Raymonds run form

- Contract to enter into a lease of real property form

- Chicago city stationary engineer license form

- El dorado county fire safe councildefensible space form

- Furniture sale contract template form

- Gam esports contract template form

Find out other Missouri 4282

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template