the Blunt Bean Counter Capital Dividends a Tax 2020

What is the Blunt Bean Counter Capital Dividends A Tax

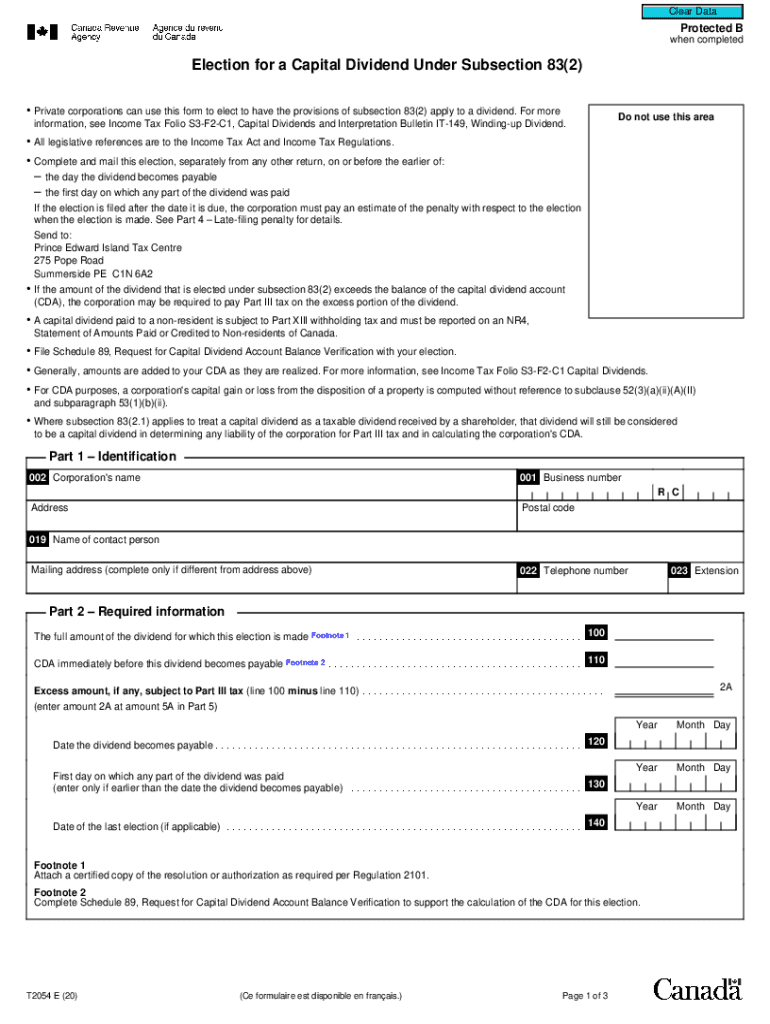

The Blunt Bean Counter Capital Dividends A Tax refers to a specific tax consideration for individuals and businesses receiving capital dividends. These dividends are typically derived from the profits of investments and can significantly impact an individual's or entity's tax obligations. Understanding this tax is crucial for effective financial planning and compliance with IRS regulations.

Steps to complete the Blunt Bean Counter Capital Dividends A Tax

Completing the Blunt Bean Counter Capital Dividends A Tax involves several steps to ensure accuracy and compliance. First, gather all relevant financial documents, including dividend statements and prior tax returns. Next, determine the total amount of capital dividends received during the tax year. Then, accurately report these amounts on the appropriate tax forms, ensuring all calculations are correct. Finally, review your submission for completeness before filing it with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the taxation of capital dividends. These guidelines outline how to report dividends, the applicable tax rates, and any deductions or credits that may apply. It is essential to refer to the latest IRS publications or consult a tax professional to ensure compliance with current tax laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Blunt Bean Counter Capital Dividends A Tax typically align with the standard tax filing dates. For most taxpayers, the deadline is April 15 of the following year. However, if you are self-employed or have other specific circumstances, different deadlines may apply. It is important to stay informed about these dates to avoid penalties.

Required Documents

To complete the Blunt Bean Counter Capital Dividends A Tax, certain documents are necessary. These include dividend statements from financial institutions, previous tax returns, and any additional documentation that supports your income claims. Having these documents ready will streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the Blunt Bean Counter Capital Dividends A Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the IRS. Understanding the importance of timely and accurate reporting is essential to avoid these consequences.

Eligibility Criteria

Eligibility for the Blunt Bean Counter Capital Dividends A Tax typically depends on the nature of the dividends received. Individuals and businesses must meet specific criteria, including the source of the dividends and their overall income level. It is advisable to review these criteria carefully to determine your eligibility and ensure proper tax treatment.

Quick guide on how to complete the blunt bean counter capital dividends a tax

Effortlessly Prepare The Blunt Bean Counter Capital Dividends A Tax on Any Device

Online document management has gained popularity among both businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage The Blunt Bean Counter Capital Dividends A Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign The Blunt Bean Counter Capital Dividends A Tax

- Locate The Blunt Bean Counter Capital Dividends A Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for such tasks.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign The Blunt Bean Counter Capital Dividends A Tax and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the blunt bean counter capital dividends a tax

Create this form in 5 minutes!

How to create an eSignature for the the blunt bean counter capital dividends a tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are The Blunt Bean Counter Capital Dividends A Tax?

The Blunt Bean Counter Capital Dividends A Tax refers to the taxation on capital dividends received by shareholders. Understanding this tax is crucial for effective financial planning and compliance. It helps individuals and businesses navigate their tax obligations related to capital dividends.

-

How can airSlate SignNow help with managing The Blunt Bean Counter Capital Dividends A Tax?

airSlate SignNow provides a streamlined solution for managing documents related to The Blunt Bean Counter Capital Dividends A Tax. With its eSigning capabilities, you can easily send and sign tax-related documents, ensuring compliance and efficiency. This helps you focus on your financial strategies without getting bogged down by paperwork.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing The Blunt Bean Counter Capital Dividends A Tax. These features enhance your workflow, making it easier to handle tax documents efficiently. Additionally, the platform ensures that all your documents are stored securely and are easily accessible.

-

Is airSlate SignNow cost-effective for small businesses dealing with The Blunt Bean Counter Capital Dividends A Tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing The Blunt Bean Counter Capital Dividends A Tax. With flexible pricing plans, it allows businesses to choose a package that fits their budget while still accessing essential features. This affordability helps small businesses streamline their tax processes without overspending.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage The Blunt Bean Counter Capital Dividends A Tax. This integration allows for efficient data transfer and document management, ensuring that all your financial records are up-to-date and compliant. You can enhance your overall workflow by connecting your tools.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those concerning The Blunt Bean Counter Capital Dividends A Tax, offers numerous benefits. It simplifies the signing process, reduces turnaround time, and enhances document security. Additionally, the platform's user-friendly interface makes it accessible for all users, regardless of their tech-savviness.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to The Blunt Bean Counter Capital Dividends A Tax. The platform employs advanced encryption and secure cloud storage to protect sensitive information. This commitment to security ensures that your documents remain confidential and are only accessible to authorized users.

Get more for The Blunt Bean Counter Capital Dividends A Tax

Find out other The Blunt Bean Counter Capital Dividends A Tax

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later