New T2054 Capital Dividend Account Election Formfollow Up 2022-2026

Understanding the T2054 Capital Dividend Account Election Form

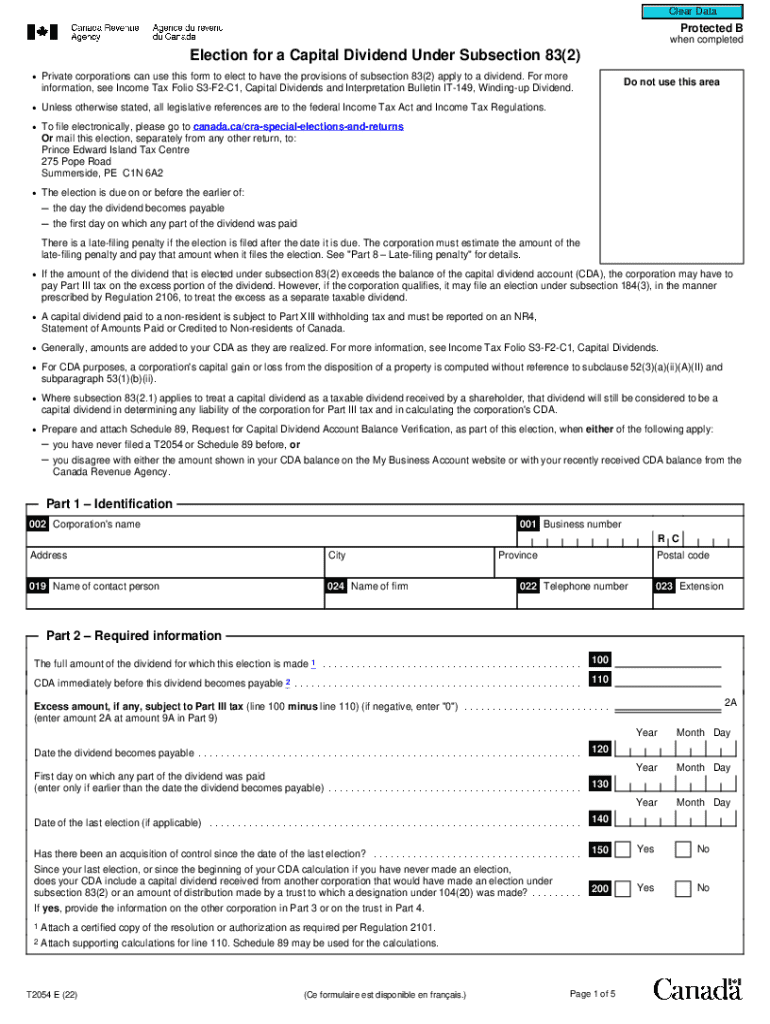

The T2054 form is essential for Canadian corporations that wish to elect to pay capital dividends to their shareholders. This form allows companies to utilize their capital dividend account (CDA), which is a tax-free source of funds for distributing dividends. The CDA typically includes tax-free amounts received from the sale of capital assets, capital gains, and certain life insurance proceeds. Understanding the nuances of this form is crucial for compliance and effective financial management.

Steps to Complete the T2054 Form

Completing the T2054 form involves several critical steps. First, ensure that your corporation qualifies to use the CDA by verifying the balance in the account. Next, accurately fill out the required sections of the form, including the election details and the amount to be paid as a capital dividend. It is important to provide all necessary information to avoid delays or penalties. After completing the form, review it for accuracy before submission to ensure compliance with the regulations set by the Canada Revenue Agency.

Obtaining the T2054 Form

The T2054 form can be obtained directly from the Canada Revenue Agency’s website or through authorized tax professionals. It is advisable to download the most recent version to ensure compliance with current regulations. For U.S.-based corporations with Canadian operations, consulting with a tax advisor familiar with cross-border taxation can provide additional insights into obtaining and completing the form correctly.

Legal Use of the T2054 Form

The T2054 form must be used in accordance with Canadian tax laws. This includes ensuring that the capital dividend account is accurately calculated and that the election is made within the specified time frame. Misuse of the form or incorrect information can lead to penalties, including the requirement to pay taxes on the amount distributed as a capital dividend. Understanding the legal implications of this form is crucial for corporate governance and financial planning.

Filing Deadlines for the T2054 Form

Timely filing of the T2054 form is essential to avoid penalties. The form must be filed within a specific period following the declaration of the capital dividend. Typically, this deadline is within a specified number of days after the dividend is declared. Corporations should keep track of these deadlines to ensure compliance and maintain the tax-free status of the dividends distributed from the CDA.

Eligibility Criteria for Using the T2054 Form

To be eligible to use the T2054 form, a corporation must have a positive balance in its capital dividend account. Additionally, the corporation must be a Canadian-controlled private corporation (CCPC) or meet specific criteria set by the Canada Revenue Agency. Understanding these eligibility requirements is vital for corporations looking to leverage their capital dividend accounts effectively.

Quick guide on how to complete new t2054 capital dividend account election formfollow up

Effortlessly prepare New T2054 Capital Dividend Account Election Formfollow Up on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without any holdups. Manage New T2054 Capital Dividend Account Election Formfollow Up on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign New T2054 Capital Dividend Account Election Formfollow Up without hassle

- Obtain New T2054 Capital Dividend Account Election Formfollow Up and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign New T2054 Capital Dividend Account Election Formfollow Up to ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new t2054 capital dividend account election formfollow up

Create this form in 5 minutes!

How to create an eSignature for the new t2054 capital dividend account election formfollow up

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada T2054 form?

The Canada T2054 form is a tax document used by businesses to report certain income and expenses. Understanding how to properly fill out the Canada T2054 can help ensure compliance with Canadian tax regulations. Using airSlate SignNow can simplify the process of sending and eSigning this important document.

-

How can airSlate SignNow help with the Canada T2054?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the Canada T2054 form. With its intuitive interface, you can quickly prepare your documents, ensuring that all necessary fields are completed accurately. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to essential features for managing documents like the Canada T2054. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow efficiency. You can connect it with popular tools like Google Drive and Dropbox, making it easier to manage documents such as the Canada T2054. These integrations help streamline your document management process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features are particularly useful for managing important documents like the Canada T2054. With airSlate SignNow, you can ensure that your documents are organized and easily accessible.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including the Canada T2054, are protected. The platform uses advanced encryption and secure access controls to safeguard your information. You can trust airSlate SignNow to handle your sensitive documents with care.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage documents like the Canada T2054 on the go. The mobile app provides the same features as the desktop version, ensuring you can send and eSign documents anytime, anywhere. This flexibility enhances your productivity.

Get more for New T2054 Capital Dividend Account Election Formfollow Up

Find out other New T2054 Capital Dividend Account Election Formfollow Up

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation