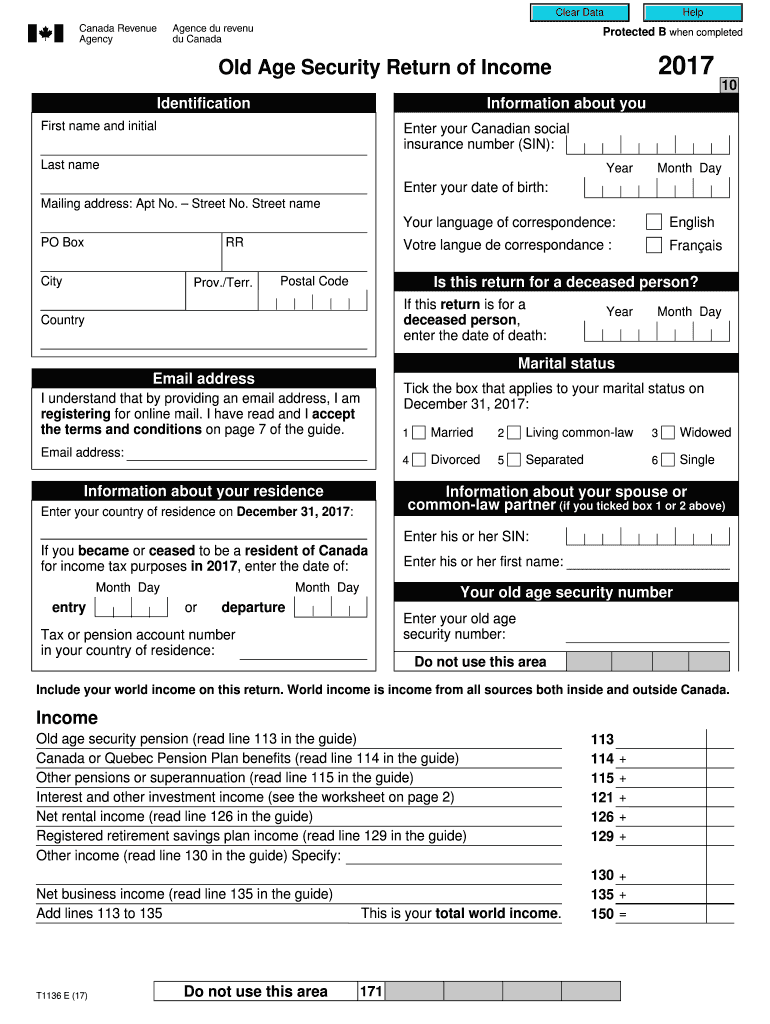

Old Age Security Return of Income Form 2017

What is the Old Age Security Return of Income Form

The Old Age Security Return of Income Form is a crucial document for individuals receiving Old Age Security (OAS) benefits in the United States. This form is used to report income to ensure that recipients receive the correct amount of benefits. It helps the government assess eligibility and determine if any adjustments to benefits are necessary based on the individual's income level. Understanding this form is essential for maintaining compliance with federal regulations and ensuring the accurate distribution of benefits.

How to Use the Old Age Security Return of Income Form

Using the Old Age Security Return of Income Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and tax returns. Next, carefully fill out the form, providing detailed information about your income sources. It is important to review the form for accuracy before submission. After completing the form, you can submit it through the designated channels, ensuring that you meet any deadlines to avoid penalties.

Steps to Complete the Old Age Security Return of Income Form

Completing the Old Age Security Return of Income Form requires attention to detail. Follow these steps:

- Collect all relevant income documentation, such as W-2s or 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include any taxable benefits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Required Documents

To successfully complete the Old Age Security Return of Income Form, you will need several documents. These typically include:

- Previous year’s tax return for reference.

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Any other documentation related to income, such as pension statements or social security benefit letters.

Form Submission Methods

The Old Age Security Return of Income Form can be submitted in various ways. Individuals have the option to submit the form online, which is often the fastest method. Alternatively, you can mail the completed form to the appropriate government office. In some cases, in-person submission may be available, depending on local regulations and office hours. It is essential to choose the method that best suits your needs while ensuring compliance with submission deadlines.

Eligibility Criteria

To qualify for benefits associated with the Old Age Security Return of Income Form, individuals must meet specific eligibility criteria. Generally, applicants should be of retirement age and have a certain level of income. The income thresholds can vary, so it is important to refer to the latest guidelines provided by the government. Additionally, residency requirements may apply, meaning that individuals must be legal residents of the United States to be eligible for OAS benefits.

Quick guide on how to complete old age security return of income form 442036955

Complete Old Age Security Return Of Income Form effortlessly on any device

Managing documents online has gained signNow traction among organizations and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Old Age Security Return Of Income Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Old Age Security Return Of Income Form with ease

- Find Old Age Security Return Of Income Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Old Age Security Return Of Income Form and maintain outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct old age security return of income form 442036955

Create this form in 5 minutes!

How to create an eSignature for the old age security return of income form 442036955

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the old age security return of income form?

The old age security return of income form is a document that individuals must complete to report their income for the Old Age Security (OAS) program in Canada. This form helps determine eligibility and the amount of benefits received. It's essential for ensuring that you receive the correct OAS payments based on your income.

-

How can airSlate SignNow help with the old age security return of income form?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the old age security return of income form. Our solution streamlines the document management process, making it simple to complete and submit your forms securely. This ensures that you can focus on your retirement without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the old age security return of income form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features for managing the old age security return of income form. Our plans are designed to be cost-effective, providing excellent value for businesses and individuals alike. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the old age security return of income form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the old age security return of income form. These features enhance the efficiency of completing and managing your forms. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other applications for the old age security return of income form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline the process of managing the old age security return of income form. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the old age security return of income form?

Using airSlate SignNow for the old age security return of income form provides numerous benefits, including time savings and increased accuracy. Our platform minimizes the risk of errors and ensures that your forms are completed correctly. Additionally, the ease of eSigning allows for faster processing and submission.

-

Is airSlate SignNow secure for handling the old age security return of income form?

Yes, airSlate SignNow prioritizes security and compliance when handling the old age security return of income form. We use advanced encryption and secure servers to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for Old Age Security Return Of Income Form

Find out other Old Age Security Return Of Income Form

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement