Old Age Security Return of Income OASRI 2023-2026

What is the Old Age Security Return of Income OASRI

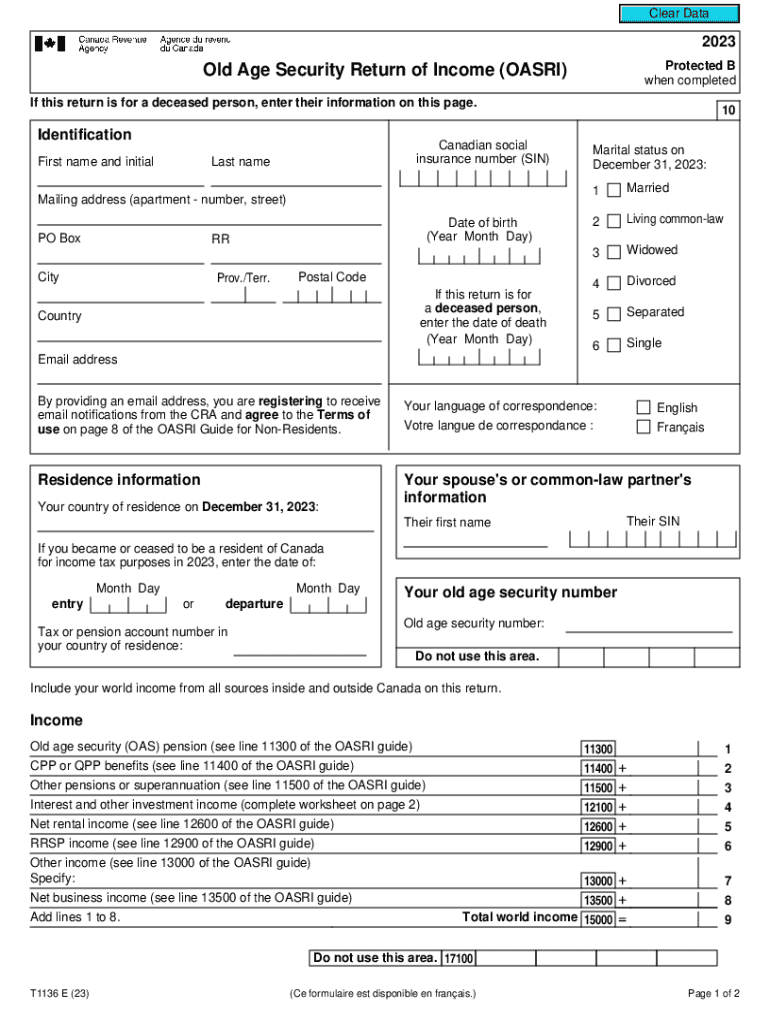

The Old Age Security Return of Income (OASRI) is a crucial form for individuals receiving Old Age Security (OAS) benefits in Canada. This form is used to report income to ensure that the correct amount of OAS is paid. It is essential for maintaining eligibility and determining the benefit amount based on the individual's income level. The OASRI is particularly important for seniors, as it directly impacts their financial support during retirement.

Steps to Complete the Old Age Security Return of Income OASRI

Completing the OASRI involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and tax returns. Next, carefully fill out the form, providing accurate information about your income sources. It is important to report all income, including pensions, investments, and any other earnings. After completing the form, review it for errors before submission. Finally, submit the OASRI by the specified deadline to avoid penalties.

How to Obtain the Old Age Security Return of Income OASRI

The OASRI can be obtained through various channels. Individuals can download the form directly from the official government website or request a paper copy to be mailed to them. Additionally, many community organizations and senior centers provide assistance in obtaining and completing the form. It is advisable to ensure that you have the most current version of the OASRI to avoid any issues during the filing process.

Required Documents for the Old Age Security Return of Income OASRI

To successfully complete the OASRI, several documents are typically required. These include:

- Income tax return from the previous year

- Statements of pension income

- Records of any other income sources, such as rental or investment income

- Social Insurance Number (SIN)

Having these documents on hand will facilitate the completion of the form and ensure that all income is accurately reported.

Filing Deadlines / Important Dates for the OASRI

It is essential to be aware of the filing deadlines for the OASRI to avoid penalties. The form is typically due on April 30 of the year following the tax year being reported. For example, the OASRI for the 2023 tax year must be submitted by April 30, 2024. Late submissions may result in delays in benefit payments or potential penalties, making timely filing crucial for all recipients.

Penalties for Non-Compliance with the OASRI

Failure to file the OASRI or inaccuracies in reporting income can lead to significant penalties. Individuals may face reductions in their OAS benefits, or in severe cases, they may be required to repay benefits received. Additionally, there may be financial penalties imposed by tax authorities for late submissions or failure to comply with reporting requirements. It is important to complete and submit the OASRI accurately and on time to avoid these consequences.

Quick guide on how to complete old age security return of income oasri

Complete Old Age Security Return Of Income OASRI effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Old Age Security Return Of Income OASRI on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Old Age Security Return Of Income OASRI with ease

- Find Old Age Security Return Of Income OASRI and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Old Age Security Return Of Income OASRI to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct old age security return of income oasri

Create this form in 5 minutes!

How to create an eSignature for the old age security return of income oasri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada old age return income?

The Canada old age return income refers to the income received by seniors from the Old Age Security (OAS) program. This income is crucial for retirees as it provides financial support during their retirement years. Understanding this income can help seniors manage their finances effectively.

-

How can airSlate SignNow help with managing Canada old age return income documents?

airSlate SignNow offers a seamless way to send and eSign documents related to Canada old age return income. With our platform, you can easily manage your financial documents, ensuring they are signed and stored securely. This simplifies the process of handling important income-related paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides various pricing plans to cater to different needs, including options for individuals and businesses. Our cost-effective solutions ensure that you can manage your Canada old age return income documents without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage. These features are designed to streamline the management of documents related to Canada old age return income. Our user-friendly interface makes it easy for anyone to navigate and utilize these tools.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow. This includes popular tools that can help you manage your Canada old age return income documents more efficiently. Our integrations ensure that you can work seamlessly across different platforms.

-

Is airSlate SignNow secure for handling sensitive income documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. This is especially important when dealing with sensitive information like Canada old age return income. You can trust us to keep your data safe and secure.

-

How does airSlate SignNow improve the efficiency of document signing?

airSlate SignNow signNowly improves the efficiency of document signing by allowing users to eSign documents from anywhere, at any time. This is particularly beneficial for managing Canada old age return income documents, as it eliminates the need for physical signatures and speeds up the process. Our platform is designed for convenience and efficiency.

Get more for Old Age Security Return Of Income OASRI

Find out other Old Age Security Return Of Income OASRI

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure