Nys Form Rp 467 Instructions 2009

What is the NYS Form RP-467 Instructions

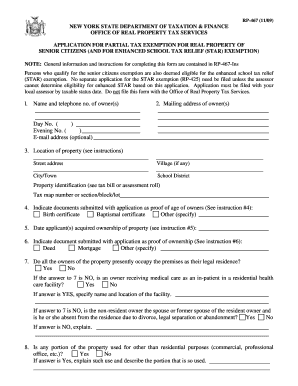

The NYS Form RP-467 is a critical document used in New York State for property tax exemption purposes. Specifically, it is designed for the application of the Enhanced STAR exemption, which provides tax relief to eligible homeowners aged sixty-five or older. The instructions for this form guide applicants through the necessary steps to complete the application accurately, ensuring they meet all eligibility criteria to receive the exemption.

Steps to Complete the NYS Form RP-467 Instructions

Completing the NYS Form RP-467 involves several key steps:

- Gather necessary documentation, including proof of age and income.

- Fill out the personal information section, ensuring all details are accurate.

- Provide information about the property, including the address and tax identification number.

- Complete the income section, detailing all sources of income for the applicant and spouse.

- Sign and date the form, certifying that all information provided is true and complete.

Legal Use of the NYS Form RP-467 Instructions

The NYS Form RP-467 is legally binding when completed correctly and submitted to the appropriate local tax authority. To ensure its legal validity, applicants must adhere to the guidelines set forth in the instructions, including providing accurate information and meeting the eligibility requirements. Failure to comply with these regulations may result in denial of the exemption or potential penalties.

How to Obtain the NYS Form RP-467 Instructions

The NYS Form RP-467 instructions can be obtained through various channels. They are available for download online from the New York State Department of Taxation and Finance website. Additionally, local tax offices may provide physical copies of the form and its instructions. It is essential to ensure that the most current version of the instructions is used to avoid any discrepancies during the application process.

Required Documents for NYS Form RP-467

To successfully complete the NYS Form RP-467, applicants must provide several required documents:

- Proof of age, such as a birth certificate or driver's license.

- Income documentation, including tax returns or Social Security statements.

- Property tax bill or assessment information.

Filing Deadlines for NYS Form RP-467

It is crucial for applicants to be aware of the filing deadlines associated with the NYS Form RP-467. Typically, the application must be submitted by March first of the tax year for which the exemption is sought. Late applications may not be considered, so timely submission is essential to ensure eligibility for the Enhanced STAR exemption.

Quick guide on how to complete nys form rp 467 instructions

Complete Nys Form Rp 467 Instructions effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Nys Form Rp 467 Instructions on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Nys Form Rp 467 Instructions with ease

- Obtain Nys Form Rp 467 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

No more lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nys Form Rp 467 Instructions and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys form rp 467 instructions

Create this form in 5 minutes!

How to create an eSignature for the nys form rp 467 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the rp 467 instructions for using airSlate SignNow?

The rp 467 instructions detail the step-by-step process for effectively utilizing airSlate SignNow. This includes how to create, send, and manage electronic signatures for documents. Following these instructions will help you streamline your document workflows and improve overall efficiency.

-

Are there any costs associated with the rp 467 instructions?

The rp 467 instructions themselves are free to access as part of the airSlate SignNow service. However, users should be aware that certain features may require a subscription or additional fees depending on their chosen plan. It's recommended to review the pricing page for specific details.

-

What features are covered in the rp 467 instructions?

The rp 467 instructions cover a variety of essential features, including document templates, custom branding options, and advanced security settings. These features allow users to personalize their document signing experiences while ensuring compliance and protection. Understanding these features can enhance your overall use of airSlate SignNow.

-

How can I benefit from following the rp 467 instructions?

By following the rp 467 instructions, you can maximize the benefits of airSlate SignNow, including saving time and reducing paperwork. Effective usage of the platform can lead to faster transactions and improved collaboration. This results in a more streamlined workflow for your business.

-

Do I need any special software to follow the rp 467 instructions?

No special software is required to follow the rp 467 instructions as airSlate SignNow is a cloud-based service. You can access it through any standard web browser on your device. Just ensure you have a stable internet connection to facilitate seamless access to the platform.

-

Can I integrate other tools with airSlate SignNow as per the rp 467 instructions?

Yes, the rp 467 instructions include guidance on integrating airSlate SignNow with various third-party applications. This allows users to connect tools such as CRM systems, cloud storage, and project management software for a more cohesive workflow. Integration enhances productivity and simplifies document management.

-

Is there customer support available while following the rp 467 instructions?

Absolutely! airSlate SignNow offers robust customer support for users who need assistance while following the rp 467 instructions. You can signNow out via chat, email, or phone for any queries. This support ensures that users can effectively utilize the platform's features without obstacles.

Get more for Nys Form Rp 467 Instructions

Find out other Nys Form Rp 467 Instructions

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later